, etc.

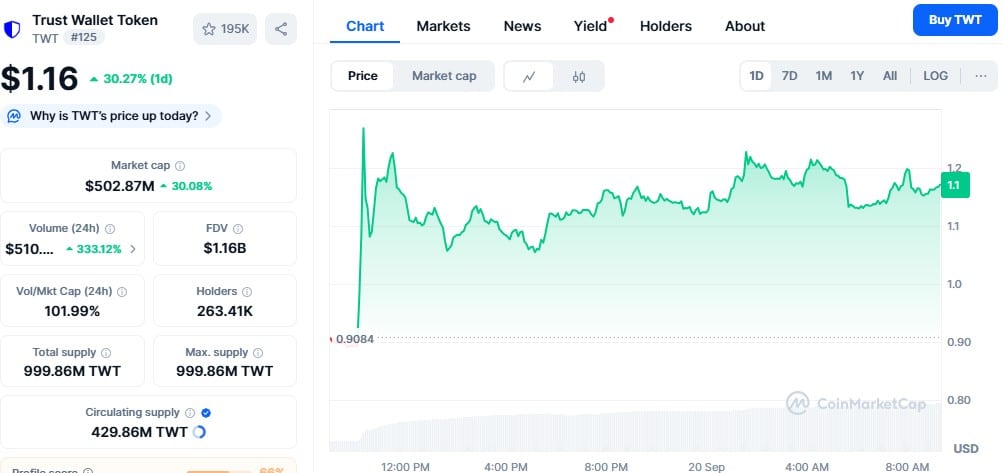

The Trust Wallet Token, that most enigmatic of digital creatures, has once again proven its ability to leap like a startled hare, surging 30% to a lofty $1.26 before retreating to the more modest $1.16. A spectacle of volatility, it is! 🧠

On the 2-day chart, TWT had been forming an inverse head-and-shoulders pattern, a classic bullish setup. Once the breakout triggered, prices rushed again toward the projected target of $1.17. CZ’s quote X helped accelerate the push, but once the target was met, traders quickly booked profits. 🕵️♂️

CZ wrote on X, “TWT token started as an experiment. The FDV got too high quickly. They burned 99% of the supply, but didn’t have too many use cases for it. Now that’s expanding.” His post fueled attention, but the breakout was already primed technically. 🧱

Profit-Taking Wave Signals Caution

After the spike, profit-taking hit hard. Exchange net flows flipped from 177,980 TWT on September 17 to +2.84 million just two days later, a massive 1,600% jump. This shows holders rushed to send tokens onto exchanges to lock in gains. 💸

Whales too participated in the sell-off. Wallets holding 10 million-100 million TWT trimmed their holdings by over $8 million in September, adding to selling pressure. 🐋

Can TWT Hold $1.00?

Despite the short-term excitement there, the long-term indicators are wary. Since late 2024, TWT has shown hidden bearish divergence, suggesting momentum isn’t strong enough to break its broader downtrend. 🧠

Key support sits at $1.00, then $0.84 and $0.71. On the upside, only a daily close above $1.42 and ideally $1.63 could shift sentiment bullish again. For now, the rally looks like a breakout target achieved and followed by heavy profit-taking, not yet a sustainable trend. 🚀

Read More

- Gold Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Silver Rate Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-09-20 07:23