Ah, the fickle dance of digital fortunes! On a Wednesday as grey as a Moscow winter, Bitcoin ETFs bid adieu to $133 million, while Ether funds, not to be outdone, shed $42 million. Solana, that sprightly upstart, sipped modestly from the cup of investor favor, leaving XRP to nurse its modest wounds.

Crypto ETFs Waltz to the Tune of Redemptions: Bitcoin and Ether Take a Bow

The risk appetite, once a ravenous bear, now nibbles cautiously at the edges of the crypto ETF feast. On February 18th, a day as unremarkable as a third act in a Chekhov play, capital fled Bitcoin and Ether like guests from a dull party. Only Solana remained, a lone violinist in an emptying ballroom.

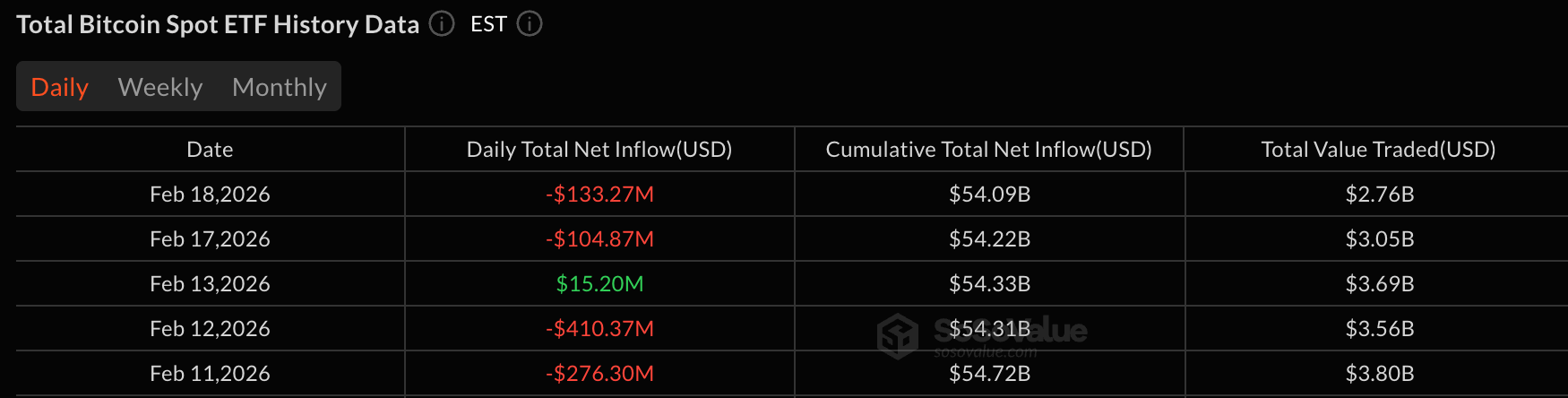

Spot Bitcoin ETFs, those grand dames of the digital age, wept $133.27 million in net outflows. Blackrock’s IBIT, once the belle of the ball, lost $84.19 million, while Fidelity’s FBTC followed suit with $49.07 million. No hero emerged to stem the tide; the total trading volume swelled to $2.76 billion, yet aggregate net assets shrank to a mere $83.63 billion-a fortune, yes, but one that feels suddenly fragile.

Ether ETFs, too, felt the chill. A modest $41.83 million slipped through their fingers, with Blackrock’s ETHA leading the retreat at $29.93 million. Fidelity’s FETH and Invesco’s QETH followed, their losses a quiet lament. Trading volume held firm at $892.43 million, but net assets dwindled to $11.12 billion-a fortune, yet one that feels suddenly uncertain.

Even XRP ETFs joined the exodus, shedding $2.21 million, primarily from Grayscale’s GXRP. Total value traded? A mere $9.23 million. Net assets? $1.02 billion, a number that hangs in the air like an unanswered question.

But ah, Solana! That bright-eyed optimist attracted $2.4 million in inflows, led by Bitwise’s BSOL with $1.51 million. Fidelity’s FSOL and Invesco’s QSOL chipped in, their contributions a small but welcome warmth. Trading volume reached $20.26 million, and net assets closed at $697.13 million-a modest sum, yet one that feels like a ray of sunlight in a gloomy room.

In the end, Wednesday’s flows were a study in caution, a collective shrug from investors who, like characters in a Chekhov play, seem to wonder if the game is worth the candle. Bitcoin and Ether were trimmed, XRP was nudged aside, and Solana was given a tentative nod. Volumes remained lively, but the mood? Oh, the mood was as defensive as a man clutching his last kopeck.

FAQ📉

- Why did Bitcoin ETFs record $133 million in outflows?

Because even digital gold can lose its luster, and Blackrock’s IBIT and Fidelity’s FBTC found themselves the chosen ones for this particular exodus-a tale as old as time, or at least as old as the stock market. - How did Ether ETFs perform compared to Bitcoin ETFs?

Like a younger sibling following in its elder’s footsteps, Ether ETFs shed $41.83 million, their losses spread across Blackrock, Fidelity, and Invesco. A family affair, if ever there was one. - Which crypto ETF category saw inflows on February 18?

Solana, that sprightly upstart, attracted $2.4 million-a small victory in a sea of redemptions. - What were the total assets under management after the session?

Bitcoin ETFs: $83.63 billion. Ether ETFs: $11.12 billion. XRP ETFs: $1.02 billion. Solana ETFs: $697.13 million. A fortune, yes, but one that feels suddenly precarious, like a house built on sand.

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-19 19:07