Oh, look at that! Crypto’s doing its thing, trying to recover from whatever it was doing last week. On September 8, the market decided it wasn’t done yet. It bounced up by 1.33%, hitting a market cap of $3.88 trillion, according to CoinMarketCap (who else, right?). And-surprise, surprise-the daily trading volume soared like it had something to prove: up by 44.19% to $119.89 billion. Who’s buying? Who’s selling? It’s all a mystery, folks. 🙄

Now, hold onto your hats: Bitcoin’s hanging in there at $112,226 with a 24-hour trading volume of $33.73 billion. It managed a modest 0.92% bump yesterday. You know, like when you try to make a salad and end up adding too much dressing. Ethereum’s doing its thing too, creeping up by 0.74%, bringing it to $4,334.15 with $26.30 billion in volume. So yeah, it’s like a family reunion where everyone’s just… showing up. 🙃

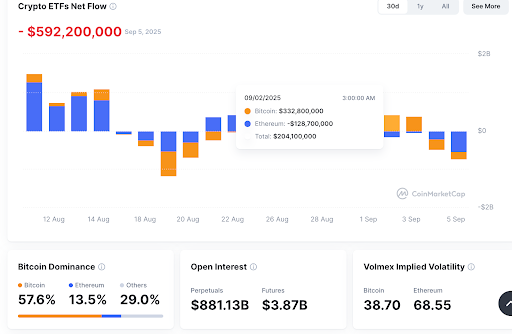

Bitcoin is still the boss, holding a market dominance of 57.6%, while Ethereum is chilling at 13.5%. No big deal, right? 😏

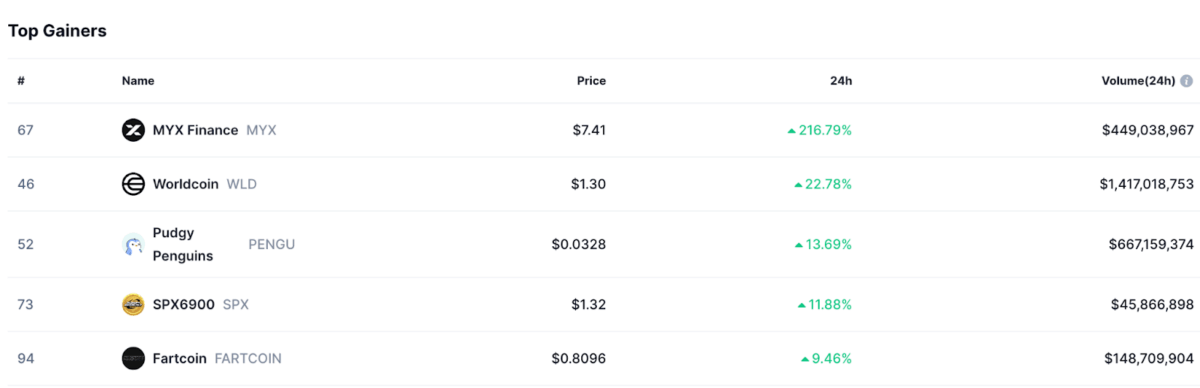

Top Gainers and Decliners

Let’s talk about the stars of the show, the real winners of the day. MYX Finance (MYX) had a 216.79% jump. You heard that right. It hit $7.41 with a trading volume of $449.03 million. Worldcoin (WLD) also didn’t disappoint, climbing 22.78% to $1.30 with a solid $1.41 billion in volume. It’s like everyone suddenly realized they *might* be onto something. 🙌

And who could forget Pudgy Penguins (PENGU)? They waddled up 13.69% to $0.0328. Yes, those penguins are still a thing. SPX6900 (SPX), whatever that is, rose 11.88%, reaching $1.32, while Fartcoin (FARTCOIN) made a very *smelly* 9.46% increase, priced now at $0.8096. You can’t make this stuff up. 🐧💨

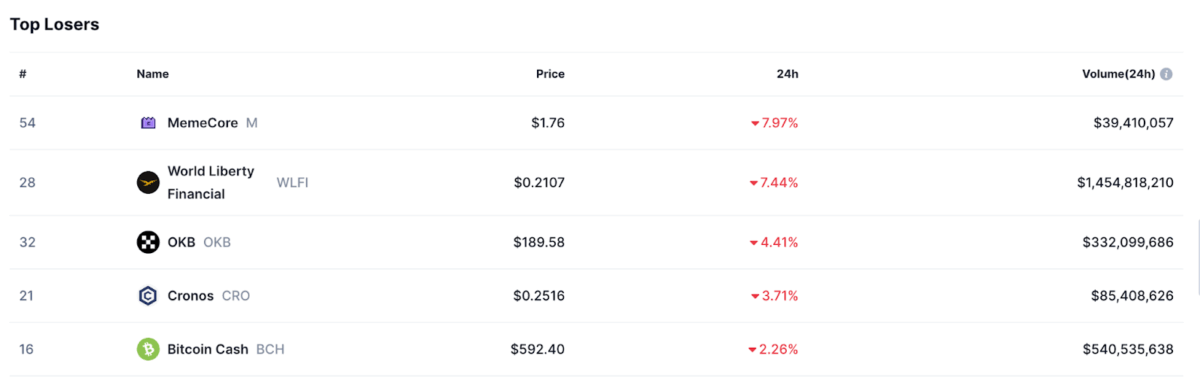

On the other hand, some coins decided to take a nap. MemeCore (M) dropped 7.97%, landing at $1.76. And World Liberty Financial (WLFI), with all its bells and whistles, fell 7.44% to $0.2107 despite pulling in $1.45 billion in volume. They tried, didn’t they? 😬

OKB slipped 4.41%, like that one guy who’s always the last to leave the party, now at $189.58. Cronos (CRO) fell by 3.71%, resting at $0.2516, and Bitcoin Cash (BCH) saw a smaller dip of 2.26%, now at $592.40. They’re all just trying to get by. 😑

ETFs and Market Sentiment

So, what’s the mood? The Fear and Greed Index is sitting at 42, which is basically crypto’s version of a “meh” emoji. People are feeling… neutral. Bitcoin’s still playing the game, leaving altcoins in its dust-Altcoin Season Index is at 51. It’s like the cool kid at school and the rest of us are just… there. 😎

But hold on! Things got a little tense with ETFs. On September 2, Bitcoin ETFs managed to pull in $332.8 million, while Ethereum ETFs saw $128.7 million leave, like a bad breakup. The net result? A $204.1 million inflow. But things took a turn on September 5-outflows surged to $592.2 million. Oh boy, here we go again. 😬

Bitcoin’s implied volatility stands at 38.70-so yeah, expect some ups and downs. Ethereum, however, is playing it more dramatic with 68.55, suggesting a few more nail-biting moments. Open interest? It’s hanging out at $881.13 billion for perpetual contracts and $3.87 billion for futures. It’s the Wild West out here. 🏜️

In short, with rising trading volumes and ETF outflows, we’re in a volatile phase where optimism is trying to fight off the cautious selling. It’s like watching a slow-motion train wreck. Grab your popcorn. 🍿

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Whale of a Time! BTC Bags Billions!

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

2025-09-08 20:45