After gracing the hallowed halls of Binance Alpha, a project, darling, has recorded growth so impressive, it’s almost vulgar. Its market value, you see, has surpassed $200 million. One might say it’s a bit much, like wearing too much jewelry to breakfast. 💎

From being embraced by World Liberty Financial (WLFI) – a name that sounds suspiciously like a Dickensian villain – to cavorting with smart money and being listed on Binance Alpha, BUILDon has become, dare I say, a “notable” name in cryptocurrency. Whether it’s notable for the right reasons, well, that’s a question for the ages. 🤔

What, pray tell, is Driving BUILDon’s Growth?

BUILDon (B), a project nestled within the BNB Chain ecosystem, has been causing quite a stir. It’s garnered attention like a scandalous rumor at a garden party, all thanks to its “strategic moves” and “impressive performance.” One wonders if they’re employing a particularly persuasive fortune teller. 🔮

First, World Liberty Financial (WLFI) – yes, those charming chaps again – announced the purchase of a “certain amount” of B tokens to support BUILDon, like a nouveau riche throwing money at a problem to make it go away. They expressed their endorsement of the project’s choice of USD1 as its base trading pair, claiming USD1 could help accelerate BUILDon’s development. One can only hope it doesn’t accelerate it right off a cliff. 🪨

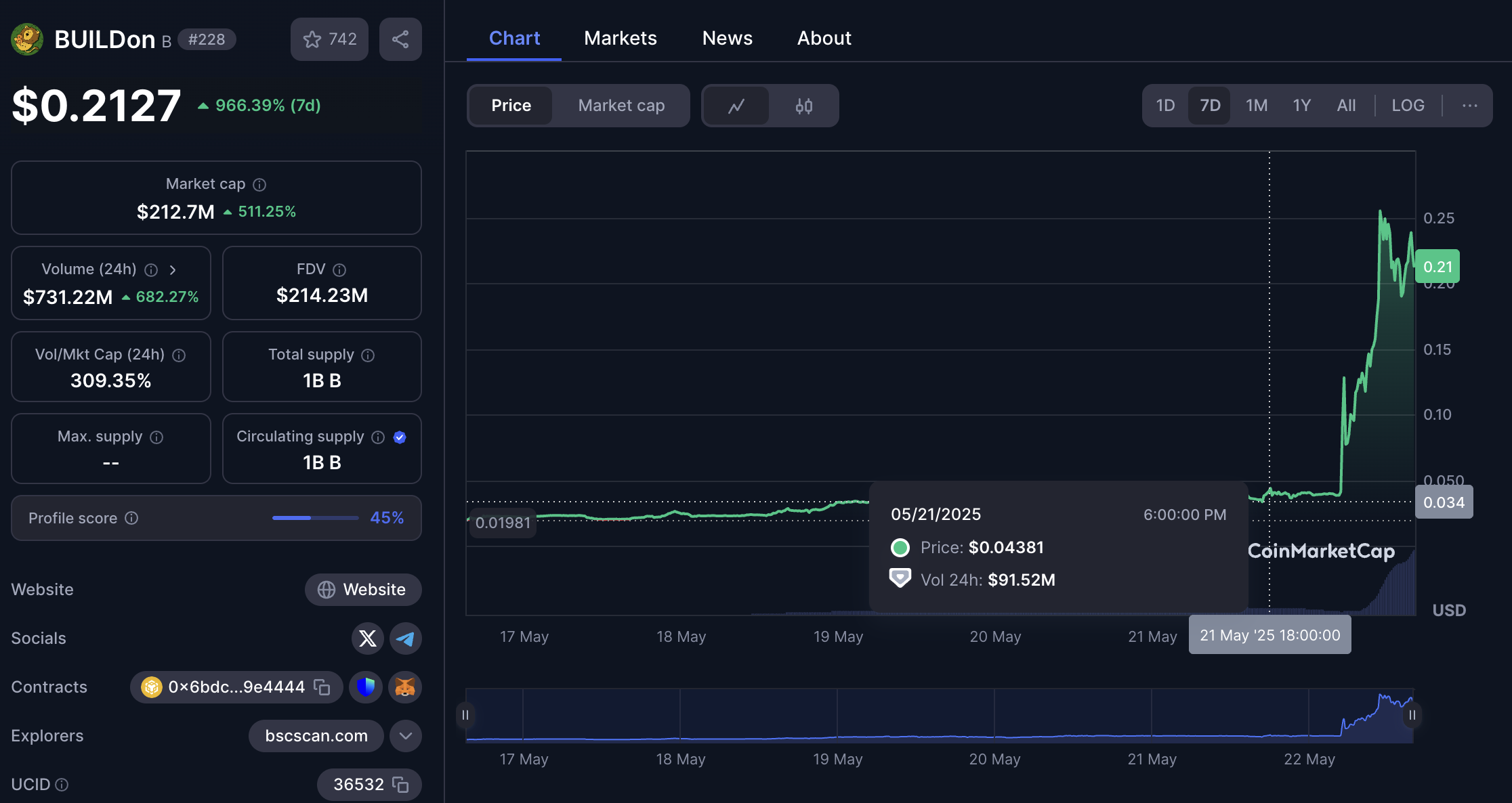

This move, you see, provided financial backing and enhanced BUILDon’s credibility in the eyes of the community. It contributed to a sharp increase in the price of the B token and propelled the project’s market value beyond the $212 million mark in a mere blink. Such vulgar displays of wealth are enough to make one blush. 😳

However, many users are, quite rightly, skeptical about WLFI’s rather perplexing investment decision, which bears an uncanny resemblance to its previous dalliance with EOS. It’s as if they’re determined to repeat history, like a bad habit one simply can’t shake. 🤷

“First of all, when I saw this project, I already thought that you created it. Secondly, let’s say it’s not like that. How did you come to the conclusion that they were not scammers and invested?” An X user questioned, with the sort of skepticism that would make Voltaire proud. 🧐

Following WLFI’s announcement, several major investors also perked up their ears, further fueling BUILDon’s growth momentum. A smart money wallet – a term that sounds far too self-important – purchased 3.32 million B tokens, achieving a return rate of 117%. One might call it luck, but I wouldn’t dare. 🍀

This, apparently, demonstrates strong confidence from experienced investors in BUILDon’s potential, especially as Binance Alpha—a platform supporting new projects by Binance—also announced its support. Being listed on Binance Alpha boosts liquidity and allows BUILDon to reach a vast global user base, creating momentum for continued market value growth. One can only hope they don’t trip over their own feet in the process. 🏃♀️

Potential and Risks

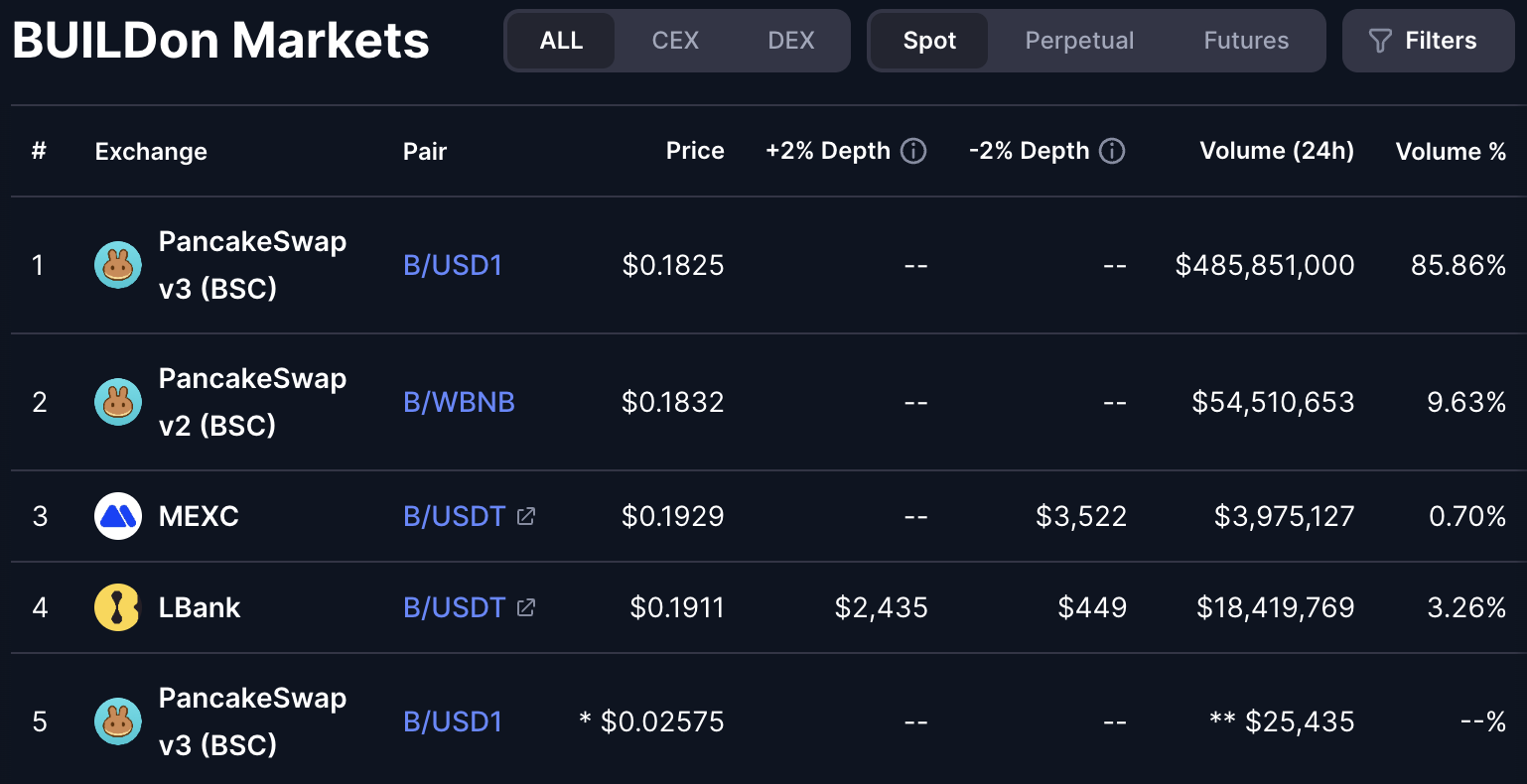

On-chain data on CoinMarketCap shows that meme coin B’s trading volume surged nearly 682% in the past 24 hours, reaching over $731 million. Of course, almost 95% of the volume comes from DEXs. The price of the B token peaked and reached an ATH at $0.285 before correcting and stabilizing around $0.212 at the current moment. A rollercoaster ride, indeed. 🎢

Even so, the current price reflects a nearly 1,020% increase compared to five days ago ($0.019). Compared to the price of B meme coin at the time Binance Alpha announced the listing ($0.043), at the current price, B meme coin has increased by about 500%. One might say it’s a bit like winning the lottery, but without the taxman breathing down your neck. Yet. 🤑

This growth reflects BUILDon’s appeal within the BNB Chain ecosystem, which is renowned for its low transaction fees and fast processing speeds, attracting DeFi projects and developers. It’s like a cheap holiday destination for digital currencies, darling. ✈️

However, BUILDon also faces numerous challenges. The cryptocurrency market is inherently volatile, and competition within the BNB Chain ecosystem is intensifying with many emerging projects. And as BeInCrypto reported, many projects saw large price drops following the previous Binance Alpha listing announcement. A rather sobering thought, isn’t it? 🍸

On-chain data reveals that the most recent trading volume comes from the B/USD1 pair. Relying on USD1 as a trading pair could pose risks, especially since it remains a relatively new stablecoin with a market cap of just over $2 billion. It could lead to negative consequences if this stablecoin encounters liquidity or regulatory issues. It’s like building a house on sand, darling. 🏖️

Nevertheless, with support from major organizations like WLFI and the involvement of Binance Alpha, BUILDon has a solid foundation for growth. If it can maintain its momentum and continue expanding its ecosystem, BUILDon has the potential to become a leading project in the DeFi space by 2025. One can only hope they don’t become too frightfully successful. After all, what would we have to gossip about then? 🗣️

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Crypto Riches or Fool’s Gold? 🤑

- KTA’s Rise: A Tale of 30% Gains & $1.20 Ambitions 📈

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

2025-05-22 15:05