In the grand theatre of commerce, where the ticker-tape twirls like a couture wig and fortunes flicker like candlelight, Bitcoin and Ethereum prepare a last act most dramatic: the expiry of their options. Nearly 2.4 billion dollars of cheeky contracts stand to vanish into the ledger’s pocket, and the audience holds its breath with the certainty of a sparrow at a masque ball.

Two Billion Bitcoin Options Expire Today

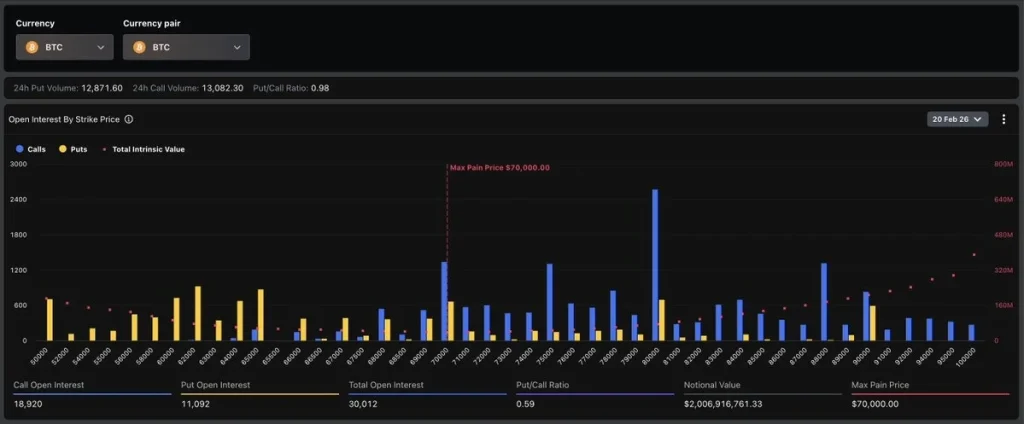

According to the venerable Derbit chronicle, around 30,012 Bitcoin contracts shall expire today, of which 18,920 are calls and 11,092 are puts, amounting to a total notional value of $2.00 billion. A theatre of numbers, where every contract wears a mask and every wager eyes the curtain.

The put/call ratio stands at 0.59, thus more traders are placing their bets on a rising Bitcoin than on its drastic fall, as if the coin itself were a boastful suitor.

The most crucial lever to watch is Bitcoin’s max pain price at $70,000. The current price hovers near $67,772, a whisker below the max pain, as if the market teases the audience with a cruel joke.

If Bitcoin, with the grace of a capricious dancer, moves toward $70,000, payouts to option holders may dwindle and the marketplace might find a steadier tempo. Yet, should it fall further from that mark, bearish momentum could swell like a storm at a tea party.

$404 Million Ethereum Options Expiry Today

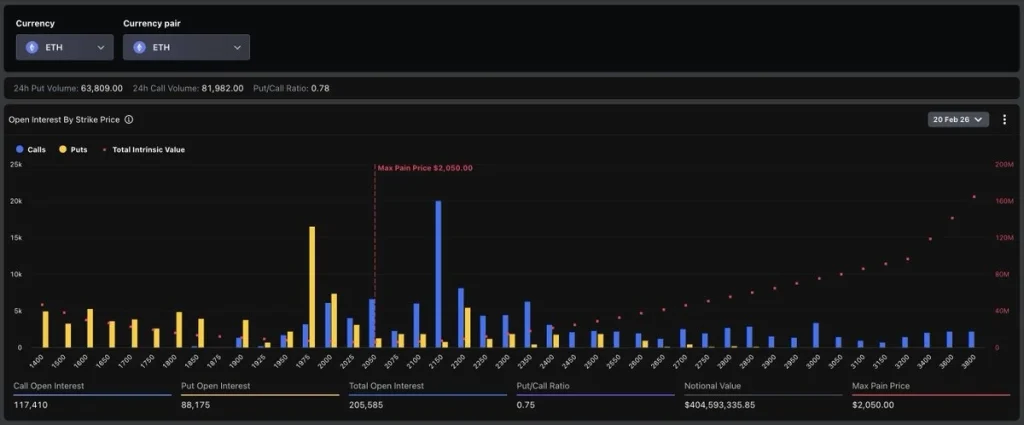

Alongside Bitcoin, Ethereum makes a grand entrance: 205,585 contracts worth approximately $404.5 million expire today. The put/call ratio is 0.75, hinting at a sentiment that leans slightly toward the bulls, as if the ether would rather flirt with the sun than sulk in the shade.

Ethereum’s max pain price stands at $2,050, while the current price flirts around $1,955. This suggests upward pressure toward the $2,050 mark as expiry approaches, a lure perhaps, or merely a well-timed nudge from Fortune herself.

Ethereum options expiry data shows 117,410 call contracts and 88,175 put contracts, a chorus proclaiming that most traders expect strength in the price, or at least wish it so with a bow.

How Options Expiry Could Impact the Crypto Market Today

These expiry events are little comedies of volatility: traders adjust their positions before settlement, and the market waltzes with heightened tremors. Looking back at last week’s expiry on February 13, 2026, over $3 billion worth of Bitcoin and Ethereum contracts expired, a veritable carnival of digits.

After that spectacle, Bitcoin rose nearly 4% to $69,395, and Ethereum climbed about 5.4% to near $2,060-proof, if proof be needed, that these expiries can jog the price as a nimble dancer shuffles on a stage.

Compared to last week, this week’s $2.4 billion expiry is smaller in size. The air carries less dramatic pressure, and the volatility is more a playful gust than a hurricane-though a gust can still flip the fan upside down.

Yet, if market sentiment remains robust, Bitcoin and Ethereum could still enjoy a short-term rebound after expiry, as if the curtain rises again for a brief encore.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

What is Bitcoin and Ethereum options expiry?

Bitcoin and Ethereum options expiry is when crypto options contracts settle on a set date, often causing short-term price swings with a dash of theatrical flair.

What happens when Bitcoin and Ethereum options expire?

Options expiry can trigger short-term volatility as traders close or roll positions, often tugging prices toward the infamous “max pain” levels, like a stubborn chorus insisting on a certain tempo.

Can Bitcoin options expiry affect the crypto market price?

Yes. Large expiry events can cause short-term volatility and price swings as traders buy or sell assets to close or roll over their positions before settlement, like a hurried cast changing costumes backstage.

Does a $2.4B options expiry guarantee a market rally or crash?

No. Expiry increases volatility, but the direction depends on sentiment, liquidity, and broader market conditions, a reminder that even the best plans may meet a mischievous Fate.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Silver Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-20 11:03