In the latest escapade chronicled by CoinGecko’s 2025 Q1 Report, the cryptocurrency realm—led by the ever-regal Bitcoin—has embarked on a most curious exercise in self-sabotage, shedding almost one-fifth of its value as if proving that fortune, like fashion, is terribly fickle.

The total market value took a nosedive from a robust $6.6 trillion to a somewhat humbler $2.8 trillion, a decline of 18.6% which could only be described as a spectacular vanishing act worthy of the finest magicians—or perhaps the latest reality star’s investment portfolio. Trading volume followed suit, shriveling by 27% to a modest $146 billion per day, presumably reflecting a collective decision to take a nap on the money pit.

Bitcoin’s Grand Monologue While Chorus Lines Fail Miserably

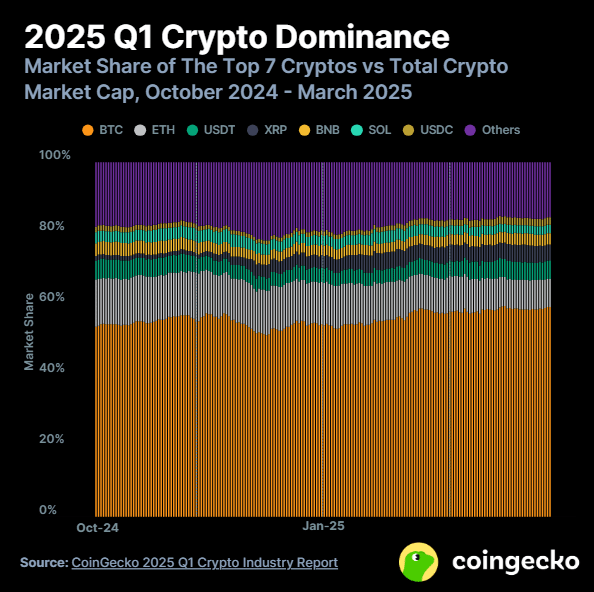

Bitcoin, displaying the stubborn resilience of a cat refusing a bath, held its throne intact. Its market share flirted with an aristocratic 60%, a level unseen in four years—quite the comeback for a digital coin that likes to act like the King rather than the jester. It hit a dizzying peak of $106,182 in January, only to take a leisurely 12% tumble to $82,514 by quarter’s end, as if reminding us all that pride goes before a crash.

In comparison, traditional safe harbors like gold and US Treasury bonds waltzed gently along, delivering less excitement but slightly less hemorrhaging of wealth, proving that old-school boredom has its merits.

Ethereum, poor Ethereum, performed rather like a tragic hero in a Victorian drama—falling 45% and wiping out all the theatrical gains of 2024. Its market share diminished to a mere 8%, sinking lower than a playwright’s hopes after a hostile premiere. The rise of “Layer 2” side networks only added insult to injury, as Ethereum’s main stage dimmed in the shifting spotlight.

Meme Coins: From Memeing to Screaming 😱💸

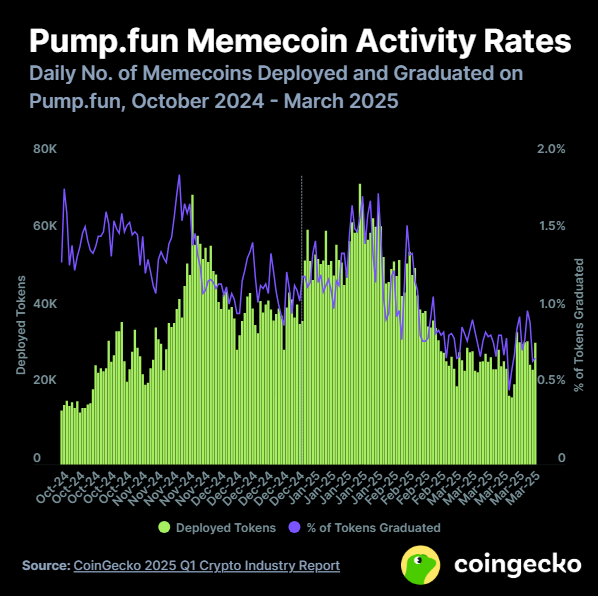

Ah, the meme coins—brief bright flashes of folly that dazzled before descending into chaos. The Trump-themed token boom crashed dramatically as Argentina’s President Javier Milei’s so-called Libra token revealed itself to be nothing more than a well-executed confidence trick, proving yet again that in crypto, the joke often ends with empty pockets.

Developers vanished with investor funds faster than you can say “pump and dump,” leaving the meme coin market gasping for breath. New token launches on platform Pump.fun plummeted by over 50% by March’s end—perhaps investors wisely deciding that investing in Paul Bunyan trading lumber was a safer option.

The DeFi Drama: More Tears Than Cheers

Even the decentralized finance utopia was not spared the grim reaper’s touch—wallets holding DeFi treasures shrunk by 27%, trembling down to a mere $48 billion. Ethereum’s dominance in this realm slid to 56%, a polite way of saying “not quite the belle of the blockchain ball anymore.”

Yet not all is doom and gloom. Stablecoins like Tether (USDT) and USD Coin (USDC) quietly padded their cushions, gaining favor among those with a penchant for the dull but dependable. Solana, riding the tailwind of meme coin mania, held a 39.6% share of decentralized exchange trading, though even its reign showed signs of fatigue as the party atmosphere dwindled.

So here we are: after the dazzling fireworks of 2024, the crypto carnival has been rained upon, with nearly a trillion dollars evaporating into the digital ether in just three months. One might say the only thing certain about crypto is its delightful capacity to keep us perpetually entertained, if not exactly wealthy.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Brent Oil Forecast

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

2025-04-18 02:12