So, it turns out that retail investors are feeling a bit like a deflated balloon in the crypto market this June 2025, with their bullish vibes hitting rock bottom since early April. Who knew?

Of course, this delightful drop comes courtesy of some economic and geopolitical shenanigans. But fear not! Experts are waving their magic wands, claiming it might just be the spark we need for a market rebound. 🪄✨

Why Weak Sentiment Could Be a Bullish Signal

According to the ever-so-reliable Santiment (because who doesn’t love a good analytics platform?), the ratio of bullish to bearish comments on social media has plummeted to a staggering 1.03 bullish comments for every bearish one. Wow, talk about a party!

This is the lowest level since April, when everyone was panicking over tariffs like it was the end of the world. 😱

Apparently, traders are losing their patience faster than I lose my keys, and bearish sentiment is creeping in like an unwanted guest at a party. But wait! Santiment analyst Brianq thinks this could actually mean a market recovery is on the horizon. Who knew pessimism could be so optimistic?

“This is typically a bullish sign. Markets historically move the opposite direction of retail’s expectations. A prime example was the optimal buy time during the early April fear from other traders,” Brianq commented. Sounds like a plot twist! 📈

Meanwhile, EllioTrades, the founder of SuperVerse, describes the current crypto scene as a rare “asymmetric” phase. I mean, who doesn’t love a good asymmetry in their life?

He revealed that many crypto enthusiasts have completely burned out. They’ve stopped trading, stopped watching the market, and his YouTube channel subscribers have plummeted to 2019 levels. Ouch! Talk about a social media crisis! 📉

“Socially, we’re in the depths of a bear market in many ways.

And yet: Bitcoin is over $100K. Stablecoins just got legalized. DeFi is next. Institutions are FOMOing.

This is one of the most incredible and asymmetric moments in the history of crypto,” EllioTrades said. Well, that’s a silver lining! 🌈

This contrast is as striking as my morning coffee. While the community seems to be at the “bottom” of a bear market, the market’s fundamentals are flexing their muscles, showing strong growth potential. 💪

Echoing Brianq’s sentiments, EllioTrades encourages those still in the game to stay committed and not throw in the towel. Because who doesn’t love a good underdog story?

Retail Investors Are Being Sidelined in the 2025 Market

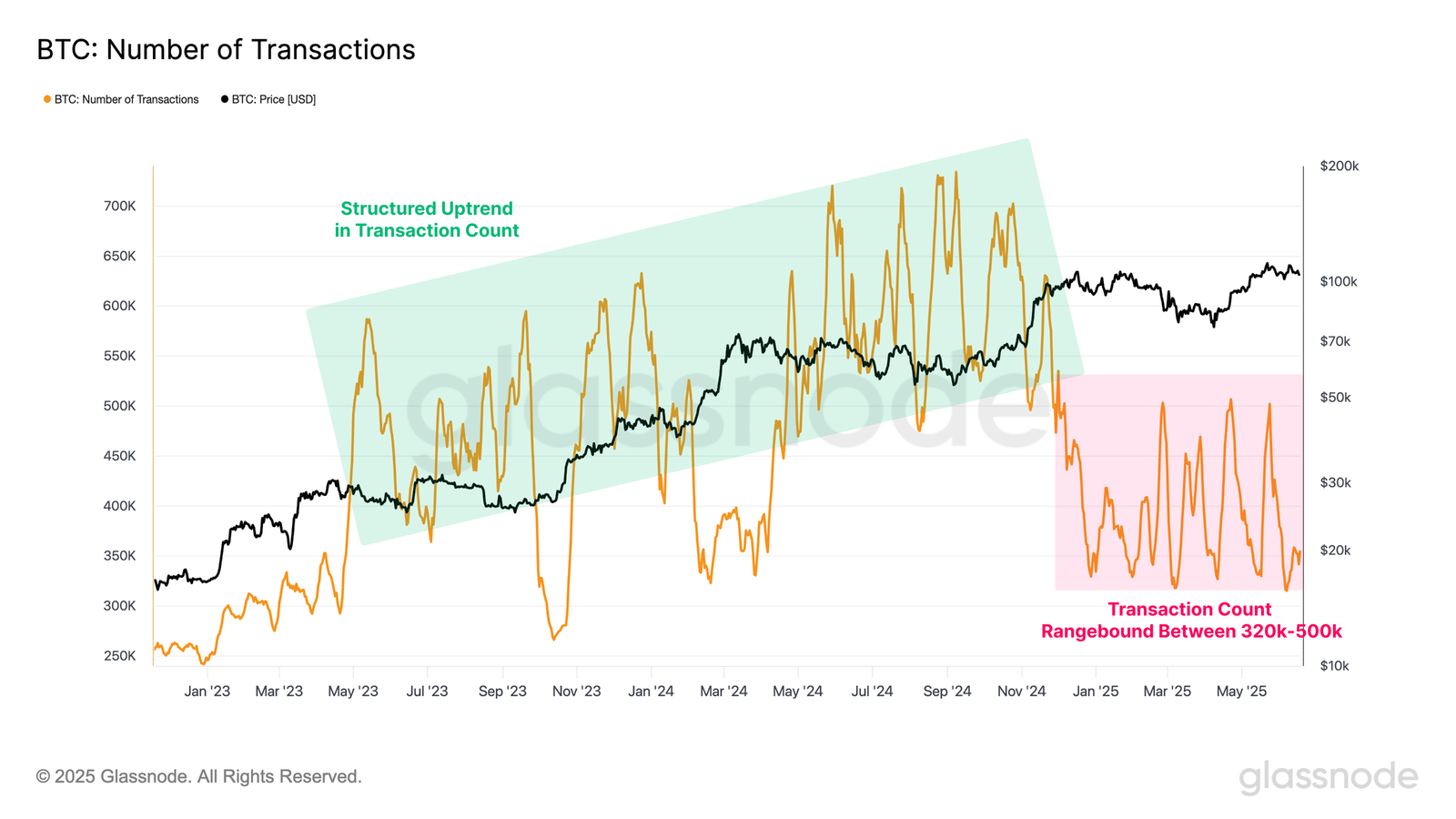

A recent report by Glassnode offers deeper insight into the current market conditions. Despite Bitcoin prices hovering near all-time highs, on-chain transaction volume has dropped by nearly half. It’s like a party with no guests! 🎉

Interestingly, while the number of transactions has decreased, the average value per transaction remains high at around $36,200. This suggests that institutions or high-net-worth individuals are dominating on-chain activity. Because, of course, they can afford to throw money around like confetti! 🎊

“Transactions exceeding $100,000 have shown a clear structural rise in dominance, accounting for 66% of network volume in November 2022, and increasing to 89% today. This trend reinforces the view that high-value participants are becoming increasingly dominant within on-chain activity,” the Glassnode report stated. Sounds like a VIP club! 🕶️

The lack of retail investors on-chain aligns with broader current events. For instance, rising tensions between Israel and Iran — including recent retaliatory attacks — have triggered concerns about geopolitical instability, affecting investor sentiment. Because nothing says “let’s invest” like global chaos! 🌍

Additionally, the US Federal Reserve’s shift in tone regarding interest rate policy has added to investor anxiety. The Fed has delayed rate cuts amid heightened global tensions. And let’s not forget the massive leak of 16 billion passwords. Because who doesn’t love a good data breach to spice things up? 🔒

As risks mount, retail investors have more reasons to hesitate before deploying capital into the market. It’s like trying to jump into a pool when you’re not sure if there’s water in it. 🏊♀️

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Brent Oil Forecast

- SHIB PREDICTION. SHIB cryptocurrency

- ETH Does What Now?! 😱

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- ETC PREDICTION. ETC cryptocurrency

2025-06-20 17:37