There it is again: the Federal Reserve, that self-appointed captain of the economic Titanic, is holding its final 2025 meeting like some corporate version of a reality TV show. On Tuesday, Dec. 9, they kicked things off with all the suspense of a middle school talent show, and by Wednesday afternoon, they’ll presumably drop their monetary policy verdict like a cryptic tweet from a disgruntled teenager.

- The Fed is expected to announce a 0.25% rate cut, its third awkward attempt at economic CPR this year. Because nothing says “confidence” like cutting rates while the economy coughs up glitter.

- Bitcoin, that digital equivalent of a caffeinated squirrel, historically goes on a joyride after rate cuts. Who knew? Lower interest rates = less appeal for boring savings accounts. Priorities, humans!

- Despite the crypto market’s usual flair for the dramatic (read: volatility), Bitcoin and Ethereum are currently trading like they’ve just been handed a participation trophy. 🚀

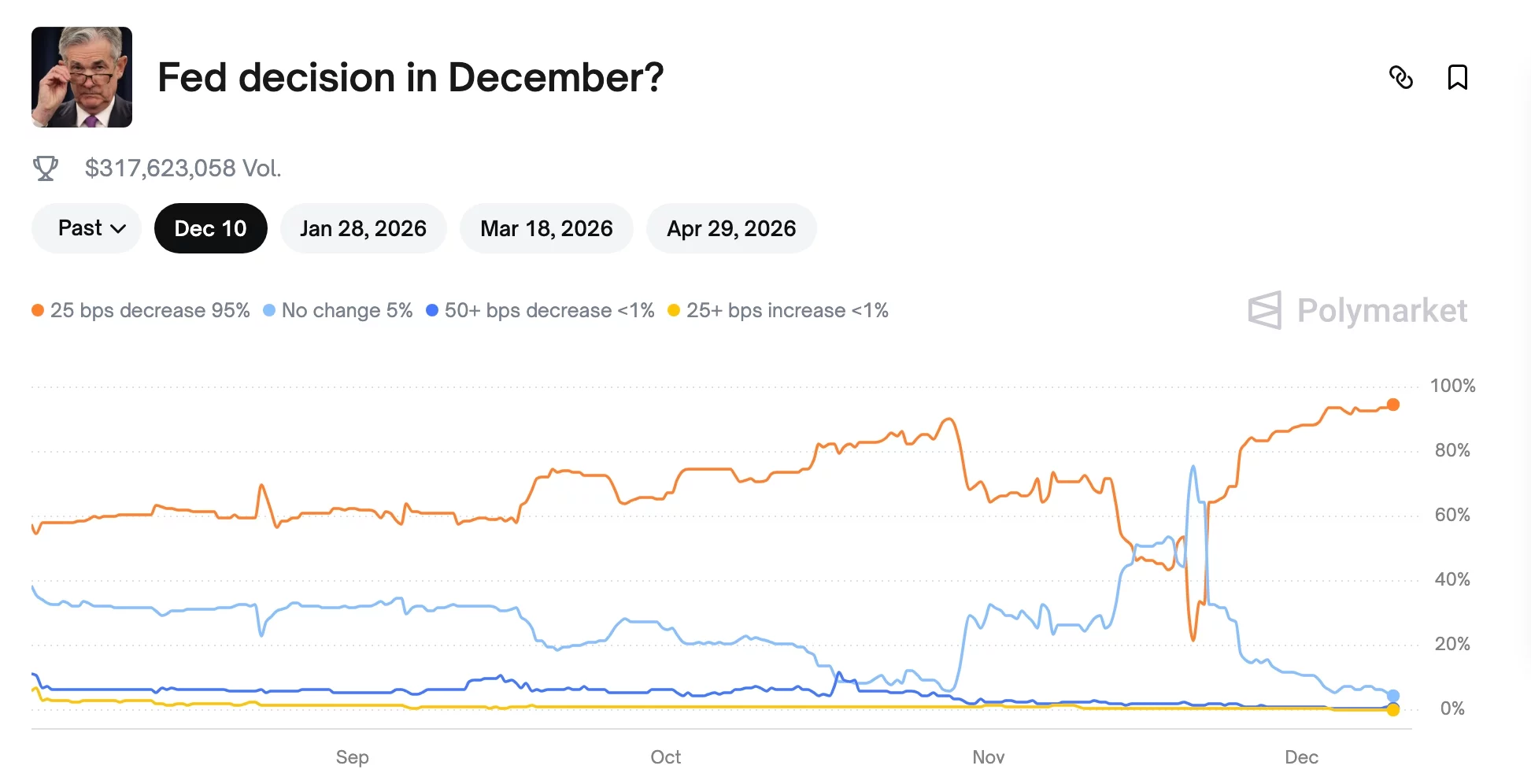

Investors are betting on a 0.25% rate cut with the enthusiasm of a group of pigeons eyeing a breadcrumb. CME Group data says there’s a 90% chance of this happening, which is about the same odds as my neighbor finally fixing his lawn gnomes. Polymarket gamblers are also throwing their weight behind the cut, probably because they’ve run out of other hobbies. 🎲

Bitcoin’s love affair with rate cuts is well-documented, like a tragic rom-com. Lower rates make it easier to ignore the fact that cryptocurrency pays zero interest-how rebellious! But lately, the market has been acting like it’s dating someone who only texts in emojis. Mixed signals, folks. Rate cuts? Yawn. Powell’s facial expressions? Panic button. 😂

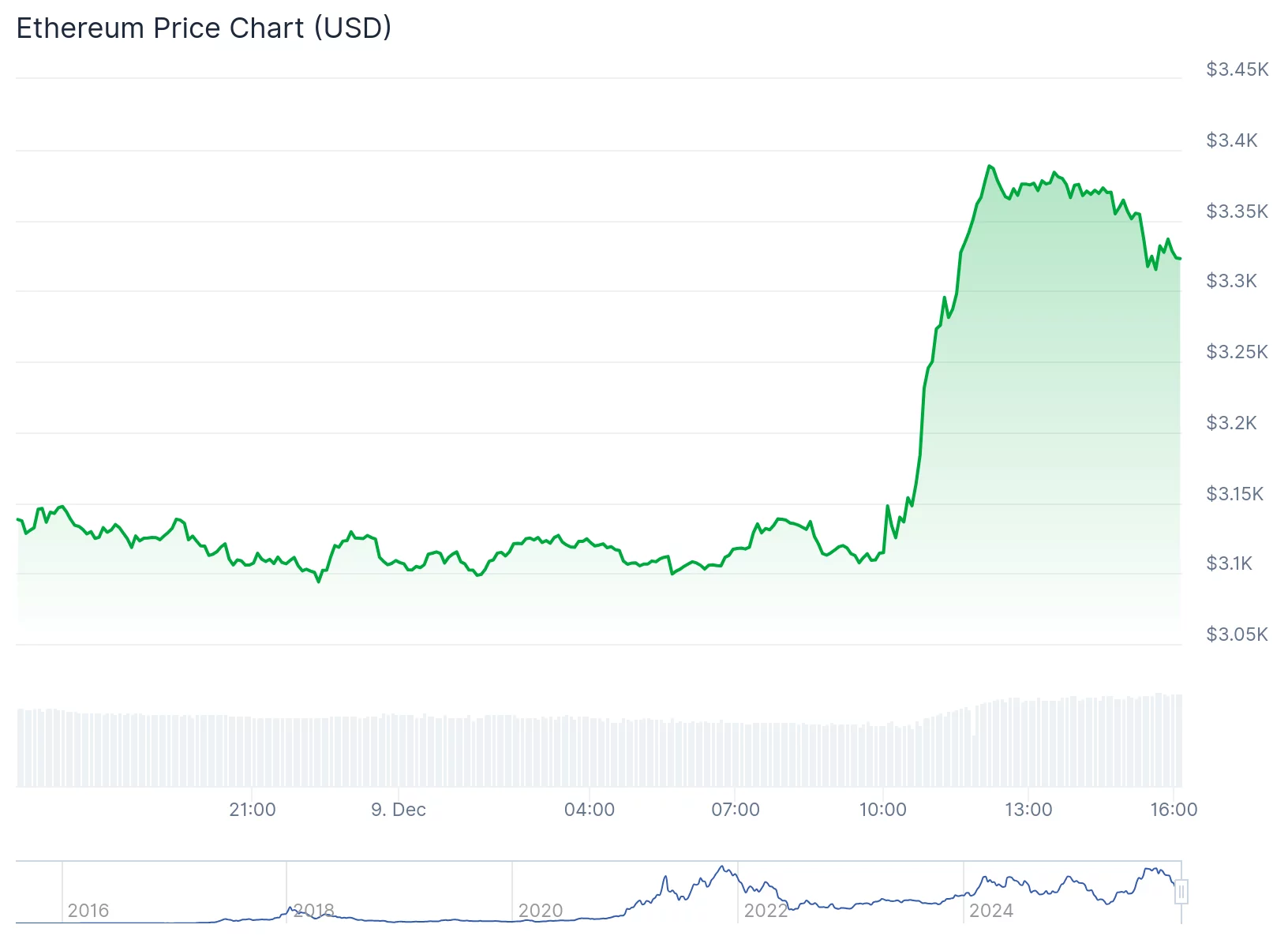

At last check, Bitcoin was up 2.6% and Ethereum 6%, which is either a miracle or the market’s way of saying, “We’re pretending this isn’t a dumpster fire.” Altcoins, meanwhile, were down like a toddler’s confidence after being told Santa isn’t real. 🐢

Stablecoin Outflows: The Great Exodus

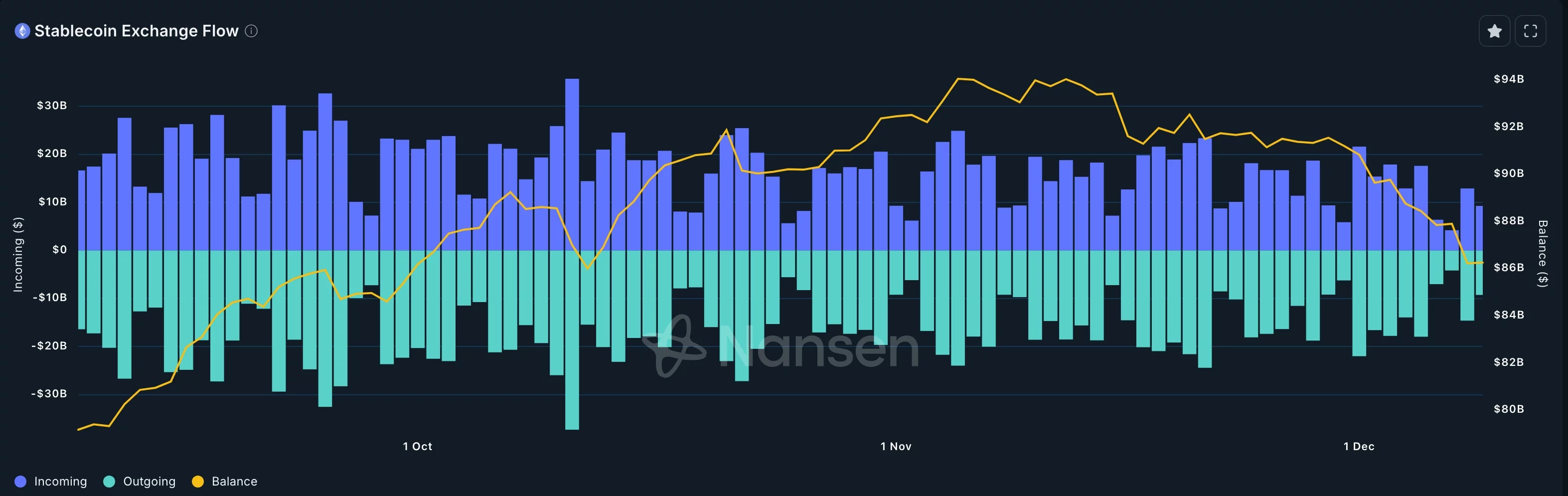

Nansen’s data reveals that stablecoins on exchanges have plummeted to $86 billion, the crypto world’s version of spring cleaning. Investors are clearly embracing risk-off behavior, which is just a fancy way of saying, “I’m hiding under the bed.” 🛏️

CoinGlass reports that futures open interest has dropped to $130 billion, and funding rates are flatter than a pancake at a gluten-free café. If you weren’t paying attention, this means the futures market is currently about as exciting as watching grass grow… in slow motion. 🌾

Fed’s Interest Rate Decision: A Three-Act Tragedy

Here’s why Bitcoin might take a nosedive post-announcement:

- 1. The rate cut is already baked into the cake. Investors will sell the news like it’s stale bread. 🍞

- 2. The Fed might deliver a “hawkish” cut, which is code for, “We’re not done being terrible at this yet.”

- 3. A rate cut could accidentally trigger inflation, prompting the Fed to panic and hike rates in 2026. Because nothing says “economic stability” like a rollercoaster with no seatbelts. 🎢

The crypto market’s recent pullback confirms what we’ve all suspected: this rally is a dead-cat bounce. Like a cat that’s both dead and allergic to balloons. 🐱💥

Read More

- Silver Rate Forecast

- EUR UAH PREDICTION

- Gold Rate Forecast

- USD RUB PREDICTION

- USD TRY PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- BTC’s Ballet: A Symphony in Satoshis 🎻💰

- The Cryptic Summer of 2026: Drama and Bitcoin!

- Brent Oil Forecast

- GBP JPY PREDICTION

2025-12-10 00:17