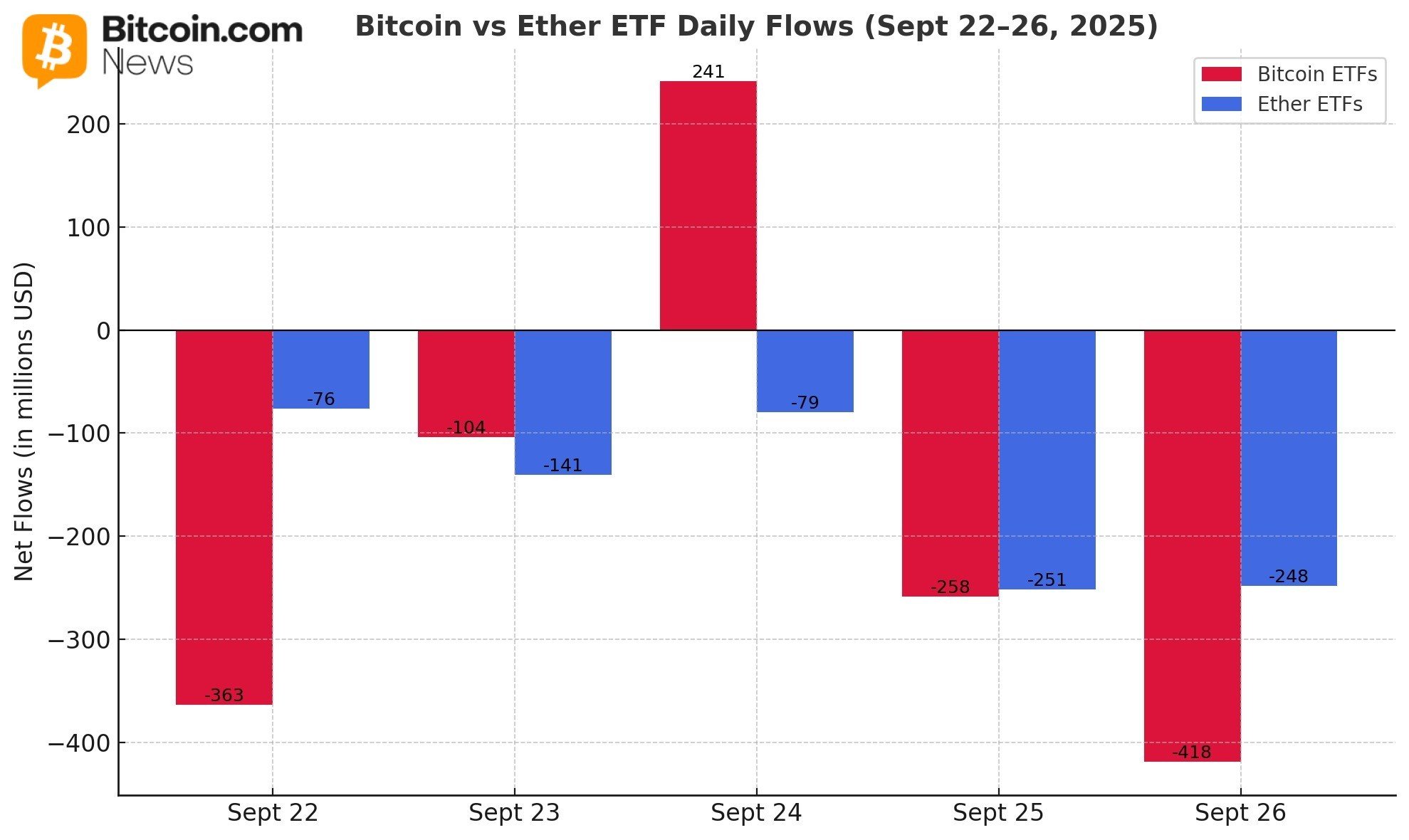

Oh, the horror! The Bitcoin ETFs spewed $903 million into the ether (not the crypto kind), while Ether ETFs coughed up $796 million like a kid who ate too many Wonka bars. Fidelity and Blackrock? More like Fiddle-dee-dee and Blockhead. The biggest cash slide since summer!

When Grown-Ups Panic: Bitcoin & Ether ETFs Turn Into Vampire Funds 🧛♂️

It was a week so brutal, even Willy Wonka would’ve called it quits. Crypto ETFs? More like “Eeek, Flee the Tornado!” funds. Four days of losses, five days of tears. A grand total of $1.69 billion vanished faster than Charlie’s golden ticket. Sosovalue says investors are now dumber than Augustus Gloop in a chocolate river.

Bitcoin ETFs? They’re the kid who brought a peanut butter sandwich to a Nutella fight. Fidelity’s FBTC lost $737.76 million-enough to buy every child in the world a lollipop and still have change for a rocketship. Ark 21Shares’ ARKB? -$123.28 million. Bitwise’s BITB? -$92.38 million. Grayscale’s GBTC? -$84.69 million. Looks like someone’s getting coal for Christmas!

Grayscale’s Mini Trust? -$14.51 million. Vaneck’s HODL? -$22.48 million. Franklin’s EZBC? -$6.34 million. Valkyrie’s BRRR? -$4.96 million. Wait, EZBC and BRRR? Sounds like a sneeze and a yawn. No wonder they’re bleeding cash!

But wait! Blackrock’s IBIT sucked up $173.88 million like a golden goose. Invesco’s BTCO? $10.02 million. Congrats! You’re the only ones not crying into your cocoa. Though net assets still plunged to $143.56 billion. Oopsie.

Ether ETFs: The Great Red Ink Splatter 🖌️🔴

Ether ETFs? They’re the kid who fell into a vat of red paint. Fidelity’s FETH bled $362.25 million-enough to buy a small island (and a very confused parrot). Blackrock’s ETHA? -$241.41 million. Grayscale’s Ether Mini Trust? -$67.96 million. ETHE? -$38.37 million. Bitwise’s ETHW? -$78.26 million. Vaneck’s ETHV? -$1.44 million. Franklin’s EZET? -$2.98 million. Invesco’s QETH? -$2.34 million. 21Shares’ TETH? -$550K. Not a single inflow. It’s like a party where everyone left early.

Trading volume hit $10.01 billion, but net assets? Down to $26.01 billion. Sounds like someone’s math teacher needs a refresher course.

The Verdict: Capital’s Taking a Vacation 🏖️

Remember Bitcoin’s seven-day inflow streak? Feels like a dream now. Ether’s five-day outflow streak? More like a nightmare. Investors are pulling cash like a rug from under a dancing bear. Will the tide turn? Or will next week be “Curse You, Red Baron!” levels of bad luck? 🎩💸

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- The Pi Network Price Surge You Didn’t Know You Needed

2025-09-29 15:13