Ah, the world of spot bitcoin and ethereum exchange-traded funds, where a staggering $270.37 million flowed in on a seemingly ordinary Friday, as if the universe itself conspired to keep institutional investors engaged with these whimsical crypto-backed funds.

Spot Bitcoin ETFs Now Total $44.5B in Inflows

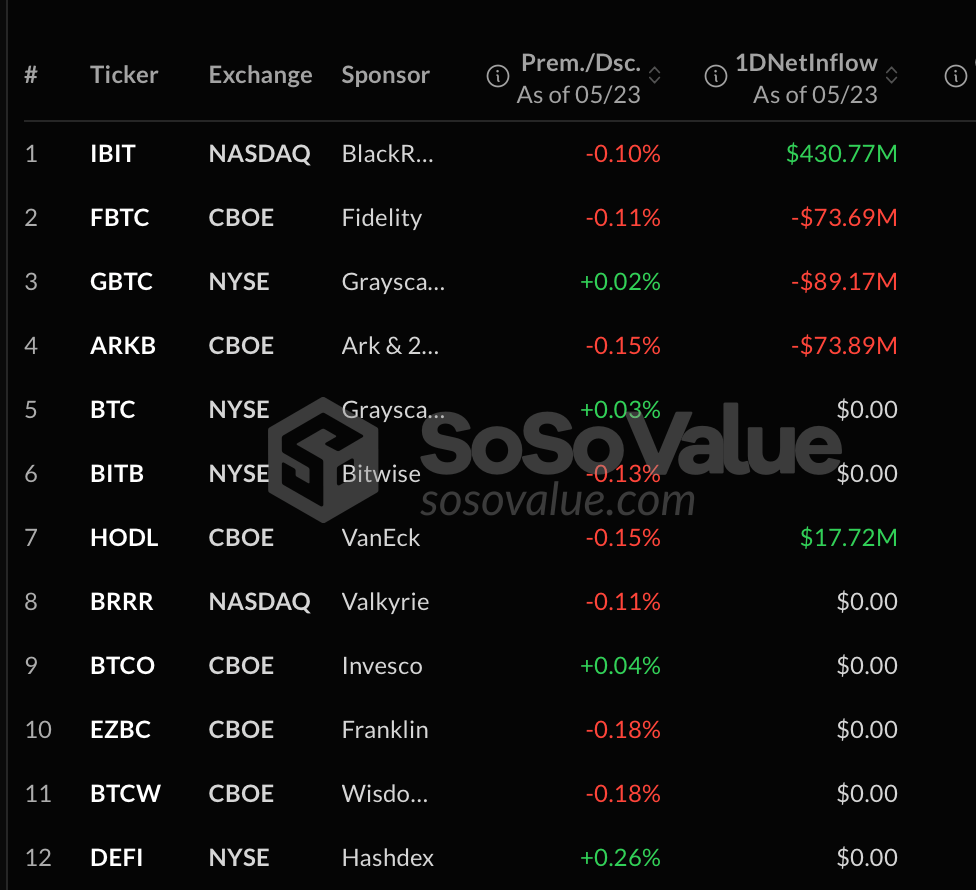

According to the ever-reliable Sosovalue.com, our dear spot bitcoin ETFs managed to attract a delightful $211.74 million during the trading session of May 23, pushing the cumulative inflows to a jaw-dropping $44.53 billion since their grand debut on January 11. The star of the show? Blackrock’s IBIT, which, like a glutton at a buffet, pulled in a whopping $430.77 million.

Meanwhile, Vaneck’s HODL, in a fit of modesty, saw gains of just $17.72 million. But not all was rosy in the garden of funds; Grayscale’s GBTC shed a lamentable $89.17 million, while Fidelity’s FBTC lost $73.69 million, and Ark Invest’s ARKB saw $73.89 million exit stage left.

Some funds, like Grayscale’s Mini Bitcoin fund, Bitwise’s BITB, and Valkyrie’s BRRR, were as flat as a pancake, showing no net inflow or outflow activity. The U.S. bitcoin ETFs now collectively hold a staggering $131.39 billion in BTC, which is around 6.11% of BTC’s market cap. Quite the hefty sum, wouldn’t you agree?

ETHA Tops Ethereum ETF Inflows with $52.8M

On the other side of the crypto coin, the ethereum ETFs brought in a combined $58.63 million, lifting total net inflows to a respectable $2.76 billion since their inception on July 23, 2024. Blackrock’s ETHA led the charge with $52.84 million in fresh capital, as if it were the only contestant in a race of tortoises.

Grayscale’s Mini Ethereum fund added a modest $5.79 million, while its ETHE product remained as neutral as a cat in a room full of rocking chairs. All other funds, including those from Fidelity, Bitwise, Vaneck, and 21shares, posted no inflows or outflows, leaving us to ponder the mysteries of investor behavior.

The stark contrast between high net contributions and the neutrality of others highlights the ongoing selectivity of investors in both the bitcoin and ethereum ETF markets. Inflows suggest that institutional appetite remains steady—and it seems to be tilting decidedly in bitcoin’s favor, like a well-balanced scale in a courtroom drama.

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

- Polygon’s Rise: A Most Curious Affair! 🧐

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Bitcoin’s Wild Ride: $2B Down the Drain and Counting! 🚀💸

- HBAR’s Perilous Plunge: Upgrade to the Rescue or Ruin?

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

2025-05-24 23:59