Oh, what a delightful day for the crypto markets! Today, a staggering $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to take their final bow! 🎭

Traders, like anxious theater-goers, are glued to their seats, eager to see how the plot thickens! The expiration of these contracts has the power to sway the short-term trends, much like a well-placed slapstick routine. Examine the put-to-call ratios and maximum pain points; they might just unveil the mysteries of traders’ expectations and potential market paths! 🤔

Bitcoin and Ethereum Options on the Stage 🎬

Behold! The notional value of the swan song for today’s expiring BTC options is a round $2.23 billion. With 27,657 Bitcoin options poised for departure, we find a put-to-call ratio of 0.86—a fanciful hint to the balance of purchases over sales, like a soirée more favoring revelers than wallflowers! 🎉

And pray tell, what is the dreaded maximum pain point? A staggering $81,000! Ah, in the cruel world of crypto options, this represents the price at which most contracts meet their untimely demise—a tragedy for many holders! 🎭🎭

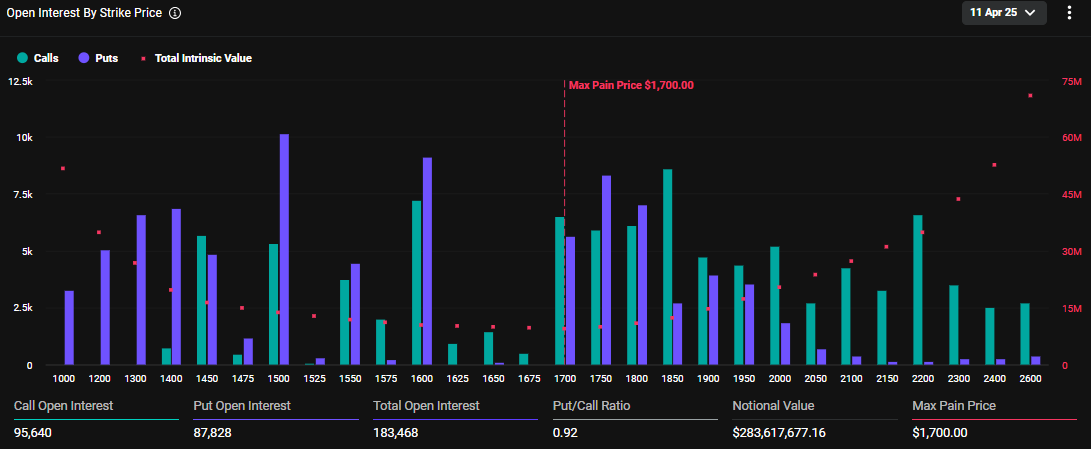

But lo! The excitement doesn’t end with Bitcoin! A whopping 183,468 Ethereum contracts are also preparing for expiration, with a notional value of $283.6 million! Their put-to-call ratio is somewhat similar at 0.92, and their dramatic maximum pain point? A mere $1,700. What a cliffhanger! 🥴

As of now, our protagonists—the Bitcoin and Ethereum prices—dare to tread below their maximum pain points, with BTC at $80,622, whilst ETH wanders at $1,543. Can our heroes reclaim their momentum? 🎭

“With recent market volatility rattling our very foundations, what do you suppose these expiries shall do to our beloved price action?” Deribit muses, keen to provoke thought. 💭

In a delightful twist, we learn that Deribit is a card dealer in the world of crypto options and futures. Yet, chaos reigns supreme as the crypto markets tremble under the uncertainties of trade war follies, all while Charles Hoskinson, that savvy Cardano maestro, bellows that tariffs might just be missing the mark on crypto! 😂

He claims the damages of future tariffs are already priced in; a curious outlook indeed, and perhaps just a touch optimistic!

Traders Brace for Extended Weakness: It’s Like Watching Paint Dry! 🎨

In other news fit for an afternoon delight, analysts at Deribit observe a mild twist in the tale of crypto options. It appears dips have not deterred put demand, as traders seem all too eager to brace for an extended downturn—like waiting for a pizza that takes an eternity to arrive! 🍕

“You’ll find yourself peering all the way to September before the calls regain any funny business. Traders might be preparing for a long winter’s nap,” they noted rather dramatically. 🥱

This paints a curious picture of traders’ sentiments waning, as they fret over a fading call premium. It mirrors an air of caution, where the implied volatility of calls descends while puts flourish, much like a comedy where only the punchlines land. 🤷♂️

Moreover, a negative volatility skew—a term that sounds rather fancy, doesn’t it?—reveals that risk-averse investors are trembling at the mere thought of plummeting prices. A heavy heart indeed, as BTC’s implied volatility slips to almost 50%, while ETH maintains a brisk pace at 80%—a savvy move for those considering short-term trades! 💥

As the world braces under global economic shivers, the crypto community grapples with its own inherent volatility, which seems to echo the chaos unfolding across borders.

“This week was a veritable panic-fest, with Trump’s tariff gambits making our markets shudder like a leaf in a storm,” say the wise analysts at Greeks.live. 😱

These Greeks live, in thought, align with Deribit’s forecasts of extended weaknesses, though they paint a darker picture full of uncertainty that could last many moons. For our dear traders, this suggests a necessity—a veritable call to arms—for protective strategies to hedge against wild whims! 💣

“Cryptocurrencies, now faced with a distinct lack of fresh funds and thrilling narratives, are teetering on the edge! In this mad dash between bulls and bears, we might well see a black swan; thus, deep vanilla puts might just be your best bet,” Greeks.live wisely concluded. 🦢💸

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-04-11 10:07