Well, well, well! 🚨 It seems Ethereum is stepping into the limelight, just as Bank of America decides to take a break from their usual routine of, you know, banking, to drop their new weekly report, “On Chain.” Apparently, it’s all about how Ethereum is set to attract a steady stream of interested investors… sort of like that one ex who keeps texting you after you swore you were done! 📱💔

With over 50% of all dollar-pegged coins chilling on its network, it’s no wonder big banks and asset managers have suddenly gazed at Ethereum with googly eyes. I mean, who wouldn’t want to cuddle up to the home of the stablecoin family?💕

Stablecoin Legislation: A Whole Soap Opera

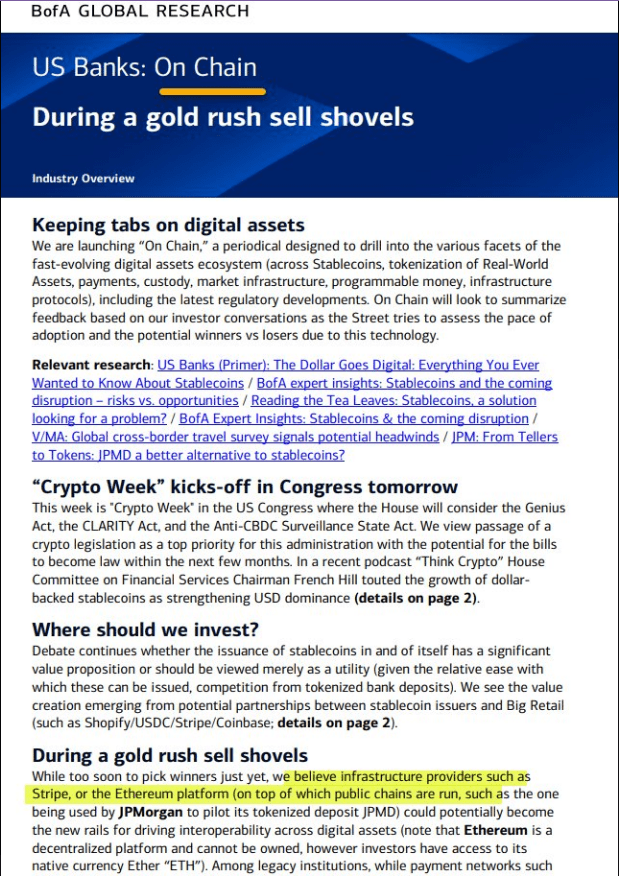

And just when we thought politics couldn’t get any messier, this week in Congress, lawmakers are getting all hot and bothered over three major bills: the GENIUS Act (seriously, do they even come up with these names?), the CLARITY Act, and the Anti-CBDC Surveillance bill. Sounds like a blockbuster film just waiting to happen! 🎬✨

House Financial Services Chair French Hill, probably wearing a superhero cape, says dollar-backed coins might just give the US dollar that extra shimmer on the global stage. If Congress can manage to play nice and establish some rules, we could see fresh capital looking to jump aboard the Ethereum express train! All aboard! 🚂💨

BofA launches new weekly periodical ‘On Chain,’ like the newest Netflix series nobody asked for but is now addicted to.

First call: Bullish ETH 💪

— matthew sigel, recovering CFA (@matthew_sigel) July 14, 2025

The Rails for a Bumpy Future

Bank of America, in a rare moment of wisdom, points to infrastructure providers like Stripe and our dear friend Ethereum as the go-to options for stablecoin exposure. It’s not just about buying tokens; it’s like ordering a fancy three-course meal when all you wanted was a cheeseburger—wallets, apps, and payment tools galore! 🍔

Investors who snap up Ether now could be in for a wild ride as stablecoin chatter ramps up. Kind of like scooping up tickets to a sold-out concert before they skyrocket in price. 🎤💸

The report lets us in on a little secret: Treasury Secretary Scott Bessent thinks the dollar-pegged stablecoin market could balloon to a staggering $2 trillion in the next five years. No pressure, huh? Fund managers are staring at their charts with wide, hopeful eyes. 📈😳

Then there’s Thomas Lee, Fundstart’s CIO, who decided to dub stablecoins the “ChatGPT of crypto.” No, I don’t know what that means, but it sounds clever, so let’s roll with it. Much like his firm, which is now hoarding Ether like my friend hoards cat memes. 🐱💾

As if we needed more excitement, BlackRock CEO Larry Fink claims tokenization could expand 4,000 times. Meanwhile, some folks are whispering about XRP and Ether being the go-to tokens. But let’s face it, Ethereum’s basically like that popular kid who already has a leg up on the competition. 🚀

It’s not all rainbows and unicorns, though. Regulation is like a mysterious fog that can either clear things up or leave us completely lost. With new networks popping up like Trenta-sized lattes at Starbucks, Ethereum has to keep its game face on to maintain its lead. ☕️

For now, all eyes are glued to Congress and on-chain data, hoping for a glittery future. If US lawmakers can get their act together and set stablecoin rules without turning it into a circus, maybe Ethereum will continue to wear its crown. Investors will certainly be mulling over those Ether flows like it’s the latest gossip in town. The coming weeks could write a whole new chapter for this digital diva! 📖✨

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Crypto Dinner: Where Politics Meets Meme Coins and Laughter! 😂🍽️

2025-07-15 18:43