If you thought the markets were a steady boat, think again. Bitcoin took a nosedive, dropping 5% faster than a greased pig at the county fair, sinking to around $100,372—thanks to macro headwinds, leveraged traders getting whipped out like yard sale clutter, and Elon Musk’s Twitter feud with Trump adding a tad more spice. Traders are now holding their breath, waiting for the upcoming crypto options expiry and the nonfarm payrolls report on Friday—because nothing says “fun” like market chaos.

Meanwhile, the other kids on the blockchain playground—ETH, XRP, SOL, DOGE, ADA, HYPE, and SUI—decided to join in the tumble, falling over 10% from their glory days. But leave it to Bitcoin to bounce back a little, creeping above $102,400, probably to give traders a false sense of hope while they buy the dip like desperate eBay bidders.

Crypto Liquidation Crosses $1 Billion in Headlines

According to CoinGlass, the crypto market just set a record—over a billion dollars lost in liquidations overnight, turning over 227,000 traders into digital ghosts. Yep, more than $900 million blew away longs, and a sad $100 million shorted into oblivion—as Bitcoin couldn’t hold support but decided to kiss the ground instead. The biggest sucker punch? A $10 million XBTUSD order on BitMEX—because who doesn’t like big numbers to startle the system?

CoinGlass declared this the largest long liquidation since February 25—probably the day everyone realized they’d bet their lunch money on a rollercoaster. James Wynn, a high-leverage trader, got liquidated for 155.38 BTC, worth over $16 million. Looks like his dreams of crypto riches turned into a digital yard sale, and he closed all his longs—better luck next time, buddy.

Options Expiry: The Market’s Tinder Date

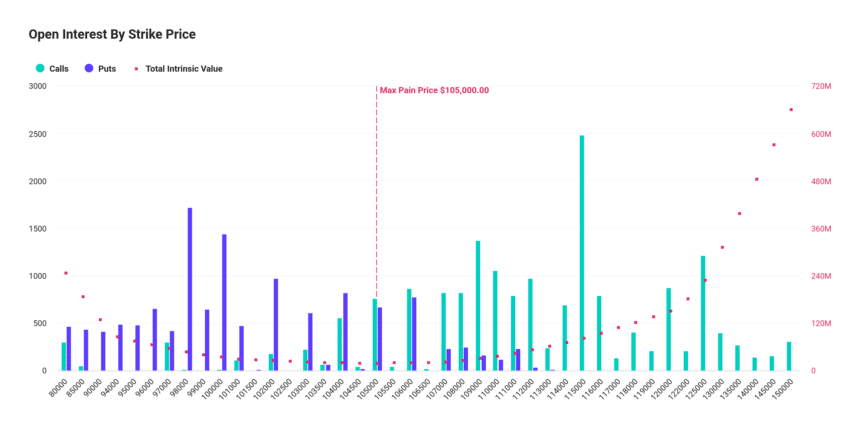

Now, everyone is glued to the upcoming crypto options expiry—$3.8 billion worth of Bitcoin and Ethereum contracts set to vanish at 8:00 UTC on Deribit. With 30,000 BTC options and a notional value of $3.21 billion about to expire, traders are nervous—especially since the maximum pain point sits above the current BTC price, making some of them wish they’d stayed in bed. The put-call ratio stands at 0.70—like a teetering seesaw of despair.

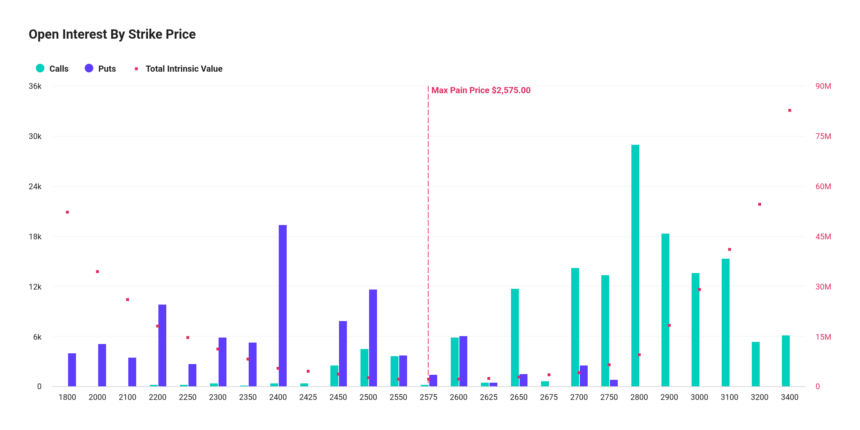

On the Ethereum front, 242,584 options worth $588 million are also about to fade away, with a max pain at $2,575—probably the number traders are dreaming of, not the one they get.

Luckily, the futures market seems to have shrugged off the chaos. Total BTC and ETH futures open interest inched up by 0.80% and 1.74% in just four hours, proving that maybe, just maybe, traders are trying to hold it together amidst the financial circus.

US Jobs Data and Market Fears: The Real Circus

Across the pond, the US 10-year Treasury yield is lounging around 4.39%, while the US Dollar Index sits at about 98.8, waiting for the next act—namely, the May jobs report. President Trump keeps hollering about interest rate cuts, but the Fed remains cautious, playing it cool with elevated trade worries, kind of like a cat eyeing a fish.

The Bureau of Labor Statistics is about to release the payrolls data—expected to add a modest 130,000 jobs, which is small potatoes in the grand scheme, and the unemployment rate will probably stay at 4.2%. If the report surprises with higher unemployment, the Fed might just cut rates earlier—meaning the market might breathe a sigh of relief or panic harder, depending on your perspective.

So, sit back, grab some popcorn, and watch the market rollercoaster, because nobody really knows if it’s going up, down, or just spinning in circles—just like life, but with more digital zeros. 🎢😂

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- USD PHP PREDICTION

- OM PREDICTION. OM cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- ILV PREDICTION. ILV cryptocurrency

- USD KRW PREDICTION

2025-06-06 08:05