- Crypto mining stocks have lost a staggering $12 billion, despite Bitcoin’s serene stability

- The curious decoupling between mining stocks and Bitcoin may herald a tempest of volatility

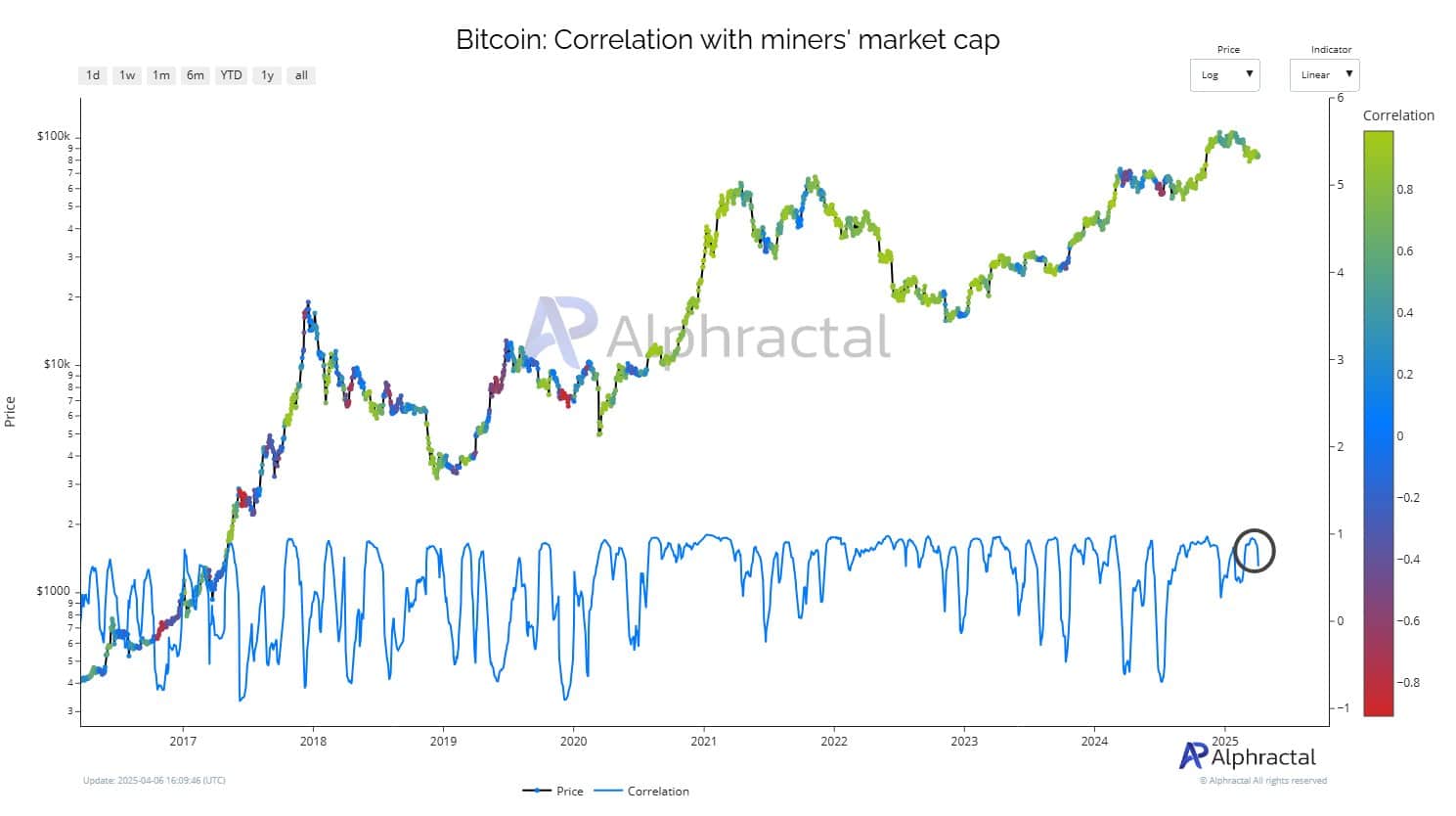

Ah, the tragicomedy of crypto mining stocks! They have plummeted, shedding a jaw-dropping $12 billion in market value, retreating to the nostalgic embrace of early 2024 levels. What a delightful irony! The timing of this descent is particularly rich, occurring while Bitcoin, that ever-stoic digital deity, maintains its relative price stability. This curious decoupling between the miners and the mighty BTC raises eyebrows and perhaps a few heart rates. Could it be a harbinger of market turbulence? 🌀

Is this a sign that the crypto sector is about to navigate some choppy waters? Or are we merely witnessing a dramatic performance in the theater of finance?

The $12 billion retreat

Since February, Bitcoin mining stocks have experienced a theatrical nosedive, losing over $12 billion in market value, plummeting from a lofty $36 billion to a mere $24 billion. All gains made in the euphoric early days of 2024 have been obliterated! Key miners, those brave souls, have seen their fortunes evaporate in sharp double-digit declines. How poetic! 🎭

What’s particularly amusing is that this plunge occurs while Bitcoin’s price remains as stable as a well-trained circus elephant. 🐘

Decoupling from BTC – A red flag?

Miners are breaking away from Bitcoin, and not in a harmonious dance. Despite BTC valiantly holding above its $65k support, miner equity valuations have taken a nosedive, triggering a steep decline in correlation. It’s as if they’ve decided to go their separate ways, like a couple in a sitcom who realize they’re better off apart.

Indeed, the data reveals a sharp dip in the correlation between Bitcoin’s price and the miners’ market cap, nearing negative territory for the first time since mid-2022. What a twist! 📉

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- USD PHP PREDICTION

- OM PREDICTION. OM cryptocurrency

- How Stabull Solves The Stablecoin Chaos (With a Wink and a Nudge) 💰✨

- INR RUB PREDICTION

- BXN PREDICTION. BXN cryptocurrency

- CAT PREDICTION. CAT cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

2025-04-08 05:14