In the sun-scorched valley of crypto, where dreams of quick riches once bloomed like wildflowers after rain, the bulls now trudge home with empty pockets and hangdog expressions. Bitcoin, that once-proud stallion, bucked below the $100,000 fence, settling at $96,600 like a man who’d lost his last dime at a poker game. The market’s latest party trick? Turning millionaires into mortals before breakfast.

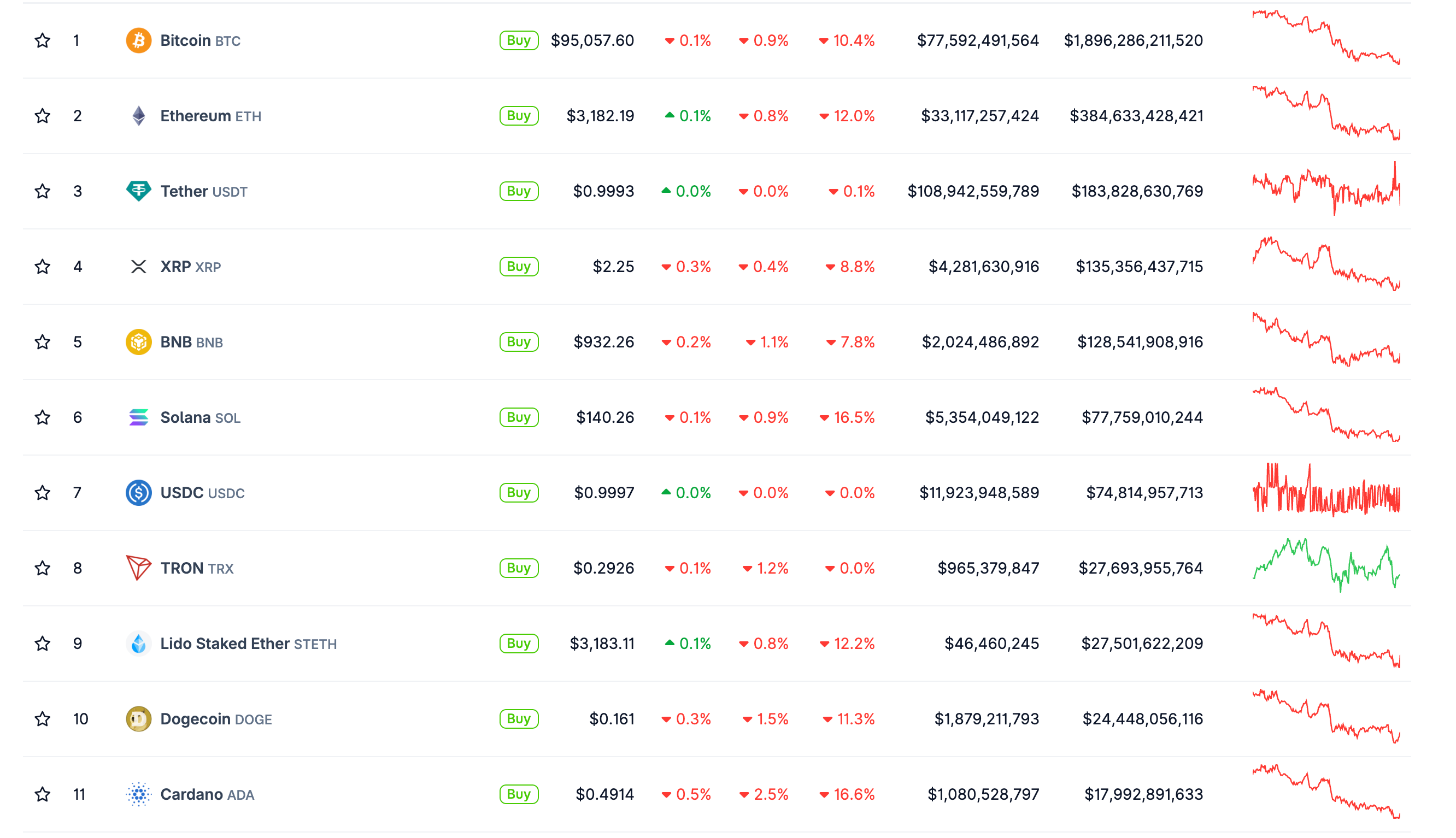

Ether, XRP, and Solana-crypto’s answer to the Three Musketeers-fared no better. Ether slumped to $3,182, a 12% weekly loss that’d make a sailor weep. XRP dangled at $2.25, while Solana crumpled like a house of cards in a hurricane. ADA and BNB? They clung to life like a cat on a windowsill, trembling but unyielding.

The air smells of burnt toast and bad decisions. ETF inflows have slowed to a trickle, long-term holders are selling like it’s Black Friday at the apocalypse, and retail investors? They’re watching from the sidelines, sipping lukewarm coffee and muttering about “the next big thing.”

Research firm 10x, with all the cheer of a funeral director, declared the market officially in bear phase. Structural support? Gone. Funds, corporates, and ETFs have all turned tail. It’s the crypto equivalent of a barn burning, and no one’s bringing a bucket.

Technical Breakdown (Because Hope Is a Technical Term)

Bitcoin’s slide below $100,266 was like watching a house of cards collapse. Support levels? A mirage. The next pitstop? $89,600, where the ghosts of HODLers past whisper warnings. Resistance? $100,200, a wall so high it makes the leaning tower of Pisa look modest.

Bitunix, a derivatives firm with all the optimism of a wet blanket, warned that a breakdown near $93,000 could send prices spiraling into the abyss. Meanwhile, Nick Ruck of LVRG Research is betting on the Fed’s next move like a gambler in a saloon-nervous, hopeful, and probably wrong.

Subdued Trading: The New Normal?

Jeff Mei of BTSE summed it up best: “The market’s bracing for a Fed pause like a man bracing for a punch.” Subdued trading? More like subdued souls, clinging to their coins like lifelines in a storm. Bitcoin’s 30% gain this year? Gone. The Oct. 6 peak? A memory as fleeting as a summer breeze.

All because Trump mentioned tariffs, and the market said, “Oops, never mind.” The bulls, once roars of optimism, now shuffle home with tails between legs, wondering if crypto’s next chapter is a tragedy… or a very expensive lesson in hubris. 🚀💸

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Web3 Wallet Vanishes $908K in a Phishing Fiasco – Don’t be the Next Victim! 💸🕵️♂️

2025-11-17 09:23