Welcome, dear reader, to the morning briefing of US Crypto News—your daily dose of the wild and wacky world of cryptocurrency.

Pour yourself a steaming cup of joe, for we are about to dive into the murky waters of Bitcoin (BTC) and its potential for the Emerald Isle, where the winds of global economic uncertainty howl like a banshee. Our unlikely hero, MMA star Conor McGregor, has taken it upon himself to champion the cause of Bitcoin, inspired by the audacious feats of El Salvador’s President Nayib Bukele.

Crypto News of the Day: Conor McGregor’s Bitcoin Blueprint for a Sovereign Ireland

In a recent publication from US Crypto News, it was reported that McGregor has a grand vision—a Bitcoin strategic reserve for Ireland! Yes, you heard that right. He wants the land of shamrocks to follow in the footsteps of El Salvador, adopting Bukele’s Bitcoin strategy like a dog chasing its tail.

McGregor believes this move could be the magic wand to wave away financial corruption and usher in a new era of stability. Who knew the octagon could lead to the blockchain?

“An Irish Bitcoin strategic reserve will give power to the people’s money,” McGregor proclaimed on X, as if he were declaring war on the status quo.

In a twist of fate, the Irish presidential hopeful has proposed a decentralized blueprint for Ireland’s sovereignty, using Bitcoin as the cornerstone. It’s like he’s trying to build a castle out of digital gold!

I want to build on the amazing feats president @nayibbukele has achieved in El Salvador.

Germany dropped the ball – Ireland will not.

Using crypto, I plan on establishing a decentralised blueprint for sovereignty.

One that others can also adopt to reclaim their nations.

I…

— Conor McGregor (@TheNotoriousMMA) May 29, 2025

The former UFC champion has showered Bukele with praise for his transformative achievements, particularly the audacious move to adopt Bitcoin as legal tender. McGregor aims to replicate this success, slashing crime and corruption rates like a hot knife through butter. He’s on a mission to empower the Irish people and reclaim their national autonomy—one Bitcoin at a time!

But hold your horses! McGregor’s casual use of “crypto” instead of “Bitcoin” has drawn the ire of his supporters on X (Twitter). It’s like calling a fine whiskey “just a drink.”

Meanwhile, as McGregor dreams of Bitcoin in Ireland, across the ocean, Panama and El Salvador are rallying for Bitcoin adoption in Latin America. It’s a crypto fiesta!

At the Bitcoin Conference, Panama City’s mayor, Mayer Mizrachi, called for a Panama-El Salvador alliance to lead the charge for global financial freedom using Bitcoin. Because why not throw a party while the world is on fire?

“Panama and El Salvador are pushing Bitcoin adoption in Latin America,” Mizrachi shared on X, probably while sipping a piña colada.

US Bank Earnings Tick Up, But FDIC Warns of CRE Weakness—What It Means for Bitcoin

In other news, the FDIC (Federal Deposit Insurance Corporation) has reported a modest earnings rebound in the US banking sector for Q1 2025. They’re up to a net income of $70.6 billion, which sounds impressive until you realize it’s just a drop in the bucket compared to the ocean of debt out there.

However, lurking beneath the surface, stress in commercial real estate (CRE) portfolios has caught the attention of regulators and crypto investors alike. It’s like a ticking time bomb waiting to go off!

The FDIC’s Quarterly Banking Profile has flagged continued weakness in non-owner-occupied CRE loans. Past-due and nonaccrual (PDNA) rates are climbing faster than a cat up a tree.

Large banks with over $250 billion in assets reported a CRE PDNA rate of 4.65%, far above the pre-pandemic average of 0.59%. It’s a wild ride, folks!

While these banks are less exposed to CRE than their total assets, mid-sized institutions with higher CRE concentrations are increasingly vulnerable. It’s like watching a tightrope walker without a safety net.

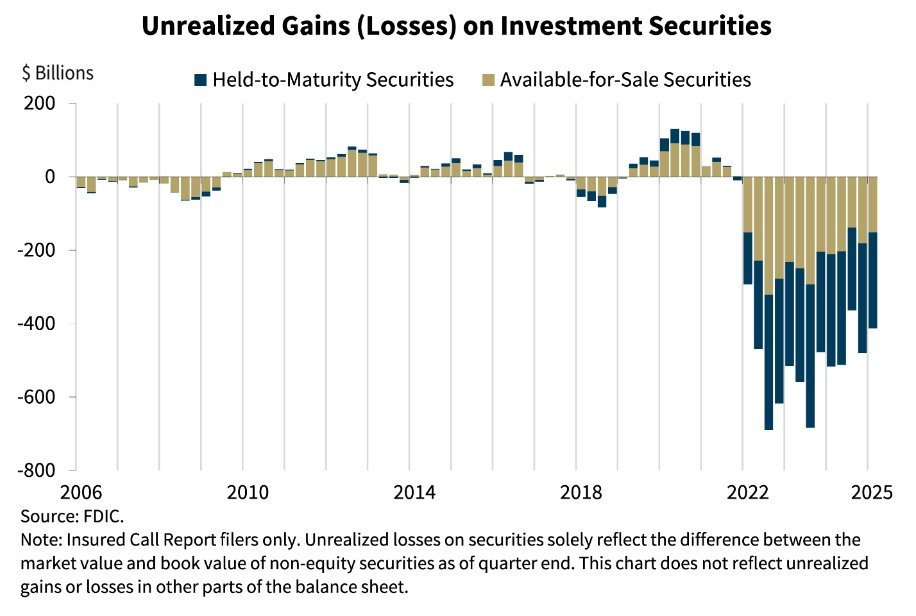

This structural pressure comes amid tight credit conditions, high interest rates, and elevated unrealized losses on securities portfolios. If broader economic stress escalates, these factors risk constraining lending and liquidity. Buckle up!

Implications for Crypto

CRE stress may signal both risk and opportunity for Bitcoin and digital assets. Should CRE-linked defaults ripple through mid-sized banks, investor confidence in the traditional financial (TradFi) system could weaken. It’s like a game of Jenga, and the tower is wobbling!

//lh7-rt.googleusercontent.com/docsz/AD_4nXdAsZmW6cxc8f0KXpUl82DRtzQwAgoK3JJztrsZwtM3mRRnR_PzBgGpaI-ijf9q3KSCMwa0Hmq67Wlkmje9bXrHo6gmgpC6UO1vfJgmQoBTRkz-1PGtr7SbtU98ixFf1HAKUmx58Q?key=FAz6wPciWx8Cuss-mHyjkw”/>

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of May 29 | Pre-Market Overview |

| Strategy (MSTR) | $370.63 | $368.46 (-0.59%) |

| Coinbase Global (COIN) | $248.84 | $247.25 (-0.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $27.05 | $26.79 (-0.95%) |

| MARA Holdings (MARA) | $14.61 | $14.47 (-0.96%) |

| Riot Platforms (RIOT) | $8.18 | $8.13 (-0.61%) |

| Core Scientific (CORZ) | $10.69 | $10.71 (+0.19%) |

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- STETH GBP PREDICTION. STETH cryptocurrency

- Cardano’s ADA: $60M Whale Shopping Spree! Is $1 in Sight? 🐋💰

- ETH’s Grand Gesture: A Love Letter to Bulls or a Joke on Bears?

2025-05-30 16:27