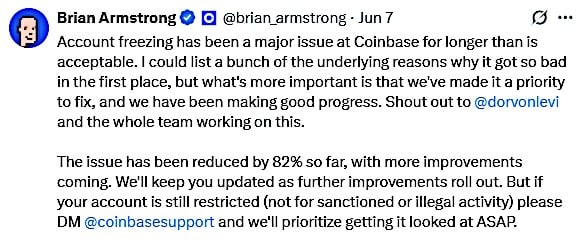

This week, Brian Armstrong, CEO of Coinbase, openly acknowledged in the public domain that account freezing has been a significant problem for an extended period, more than what’s tolerable. This statement wasn’t merely a damage control measure; it was an acceptance of a crisis that has left countless users unable to access millions worth of cryptocurrency assets.

Coinbase CEO Brian Armstrong on X.

The Unsettling Reality Behind Coinbase’s “Fraud Prevention”

The statistics paint an alarming picture. Instead of locking users out due to questionable behavior, it appears they are being penalized for acting in a manner that aligns with authentic crypto investors’ practices.

Consider this: A longtime user of Coinbase named @v1nm4n had their entire account frozen for a week when they tried to send just $10 worth of cryptocurrency. It wasn’t $10,000 – it was ten dollars! The restriction didn’t only affect that single transaction; it blocked all their assets. Similarly, Eric Conner, co-founder of EthHub, had his account frozen due to using a VPN to access it. In December 2024, his public complaint sparked an outpouring of similar stories from users who had been locked out for months or even years. The trend is evident: Coinbase’s automated “fraud prevention” system has been labeling regular crypto activities as suspicious behavior.

The VPN Trap: How Privacy Protection Became a Red Flag

Here’s where it can be challenging for privacy-focused cryptocurrency users: Coinbase’s risk detection mechanisms often flag the use of VPNs, even though using Virtual Private Networks (VPNs) is a common security measure among many crypto investors. Scott Shapiro, Coinbase’s product director, defended this policy in December by stating that VPNs are always used by “miscreants.” This statement indicates a lack of understanding about legitimate cryptocurrency security practices and suggests that the exchange may view user privacy with suspicion. As Coinbase aims to expand globally, it will need to recognize that numerous individuals in various countries rely on VPNs to access any site related to cryptocurrencies.

For individuals who prioritize confidentiality and safety when dealing with cryptocurrencies, a challenging predicament arises: either relinquish privacy or face the potential of having their accounts perpetually locked. This dilemma was highlighted by Michael Chen, who expressed his frustration over an endless series of emails requesting him to disclose highly sensitive personal information. Chen’s sentiment is significant, considering Coinbase’s recent data breach incident where its customer service personnel reportedly sold private customer details to criminal organizations.

Why Long-Term HODLers Are Particularly Vulnerable

The information shows that having an account for a long time doesn’t shield you from unexpected limitations. Surprisingly, long-term users might even face greater risk during busy periods. There is actually an instance where a user’s daily ACH limits were boosted from $250 to $5,000, but their account was then frozen under the pretext of “fraud prevention” shortly after they utilized the increased limits. It’s hard to comprehend this situation: If raising limits leads to freezing an account, why raise them in the first place? This pattern seems to indicate that Coinbase’s systems are not well-coordinated, with different sections imposing conflicting regulations that ensnare users in logical conundrums.

An Attempted Fix

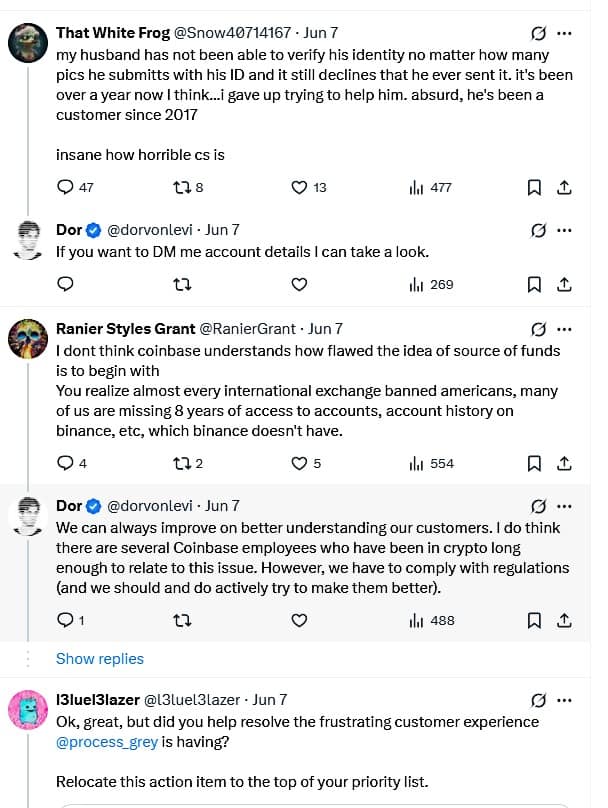

Over the past couple of months, I’ve encountered some troubles with my frozen account on Coinbase. Recently, they appointed Dorvon Levi as their “Frozen Account Czar.” After nine weeks in this role, he admitted that there’s still a lot more work to be done to reach an optimal state. He shared that the frequency of account locks has decreased by approximately 82% so far, with additional changes currently being implemented for further reductions. However, it seems that many users, including myself, are still experiencing this issue, as evident in Levi’s X thread on the platform.

Coinbase Frozen Account Czar Brian Dorvon Levi on X

What This Means for Your Crypto Investment Strategy

The Coinbase account freeze incident highlights underlying issues with the priority given by centralized exchanges towards adhering to legal requirements over protecting user privileges. Yet, it underscores three essential aspects to bear in mind when making investments:

1. Regulatory Compliance: Understanding and complying with relevant laws and regulations is crucial for any investment.

2. Customer Rights Protection: Ensuring that the rights of investors are safeguarded and respected by the exchange is equally important.

3. Risk Assessment: Carefully evaluating and managing risks associated with investments can help minimize potential losses or issues.

Maintaining all your cryptocurrency assets in a single exchange, regardless if it’s the biggest one in the U.S., can lead to unintentional risks due to potential single points of failure. The adage “not your keys, not your crypto” isn’t just theoretical; it’s about sensible risk handling by taking control of your own digital wallets.

2. Thorough Research on Exchange Policies: Prior to picking an exchange, it’s essential to delve into their policies regarding account restrictions, customer service response durations, and data security history. It’s worth noting that issues such as those experienced with Coinbase aren’t exclusive (similar problems were encountered with Nexo), but the magnitude of these incidents makes them noteworthy for concern.

3. The Unseen Expenses of “Ease”: Centralized platforms provide ease, but this ease can hide potential issues like sudden account actions that could prevent access to your assets when they are crucial, especially during turbulent market periods. Opt for self-custody instead. While it demands more technical expertise, self-custody removes the risk of arbitrary account limitations.

The Bigger Picture: Regulatory Compliance vs. User Rights

The challenges experienced by Coinbase echo wider conflicts in the cryptocurrency market, as there’s a constant struggle between ensuring regulatory compliance and providing seamless user experiences. Cryptocurrency exchanges are under immense scrutiny from regulators who demand robust anti-money laundering (AML) and identity verification measures (KYC). The troubles at Coinbase are shared across the industry, serving as an example of how excessive fear of regulatory action can sometimes result in overly restrictive algorithms that unintentionally impact legitimate users.

The Investment Verdict

If accurate, Coinbase’s 82% decrease in unwarranted account restrictions is commendable, yet it addresses an issue that perhaps should not have been so prevalent to such an extent. For cryptocurrency investors, the real question isn’t about Coinbase improving, but rather whether they feel secure entrusting their assets to a platform with a known history of such issues. Prudent crypto investors will assess exchanges not only based on fees and features, but also by considering their past behavior in upholding user rights and providing reliable customer service.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Bitcoin Investors Are Making Bank and Changing Their Minds. What’s Going on? 🤔

- Ukraine’s Bitcoin Myth: The 46,000 BTC Mirage! 🚀🤡

2025-06-11 10:02