In a tale of financial intrigue rivaling the most absurd of operas, James Chanos, the modern-day Icarus of short-selling, has gracefully exited his wager against Strategy-a company so enamored with Bitcoin it might as well mint its own cryptocurrency-themed perfume. 🌋

Chanos Cashes In on Strategy’s Bitcoin Meltdown: A Tragicomedy in 1.23x mNAV

James Chanos, the Cassandra of Wall Street (minus the tragic flair and plus a Bloomberg terminal), has long warned that Strategy’s obsession with bitcoin would end in tears-or at least a margin call. 🕵️♂️💸

Under CEO Michael Saylor, a man whose faith in Bitcoin rivals Don Quixote’s devotion to windmills, the company amassed 641,000 BTC via debt so aggressive it could make a Victorian novelist blush. 📉 Their stock? A leveraged bitcoin proxy, or as Chanos called it, “a speculative fever dream with a ticker symbol.” 🎭

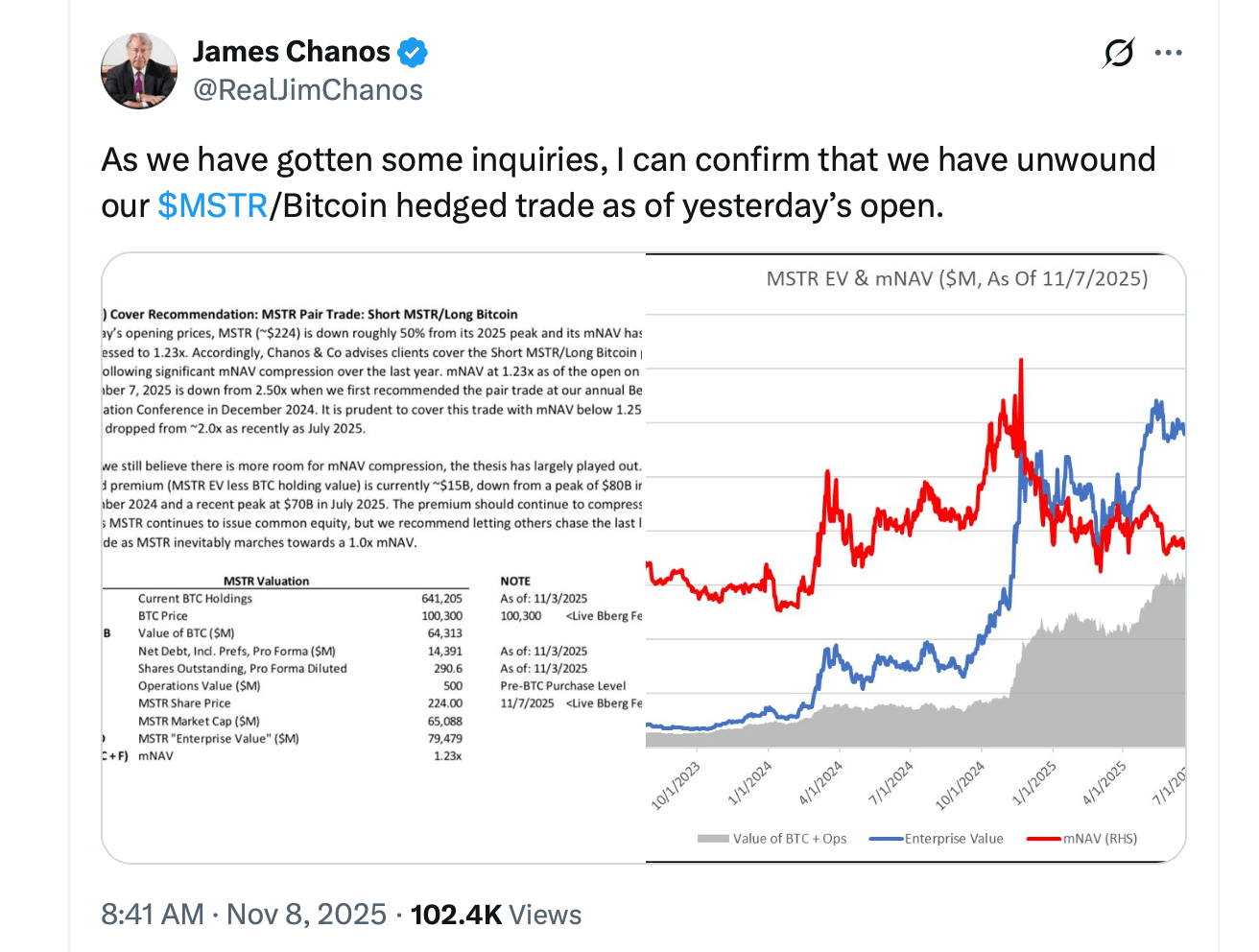

In May 2025, Chanos bet the farm-or rather, shorted the stock while buying bitcoin. His logic? Strategy’s price-to-mNAV ratio of 2.5x was less “genius” and more “financial performance art.” 🎭 He awaited the inevitable collapse like a kid waiting for a piñata to burst. 🥸

By Nov. 7, 2025, the curtain fell. Strategy’s mNAV multiple plummeted to 1.23x, its stock price halved, and the $80 billion bitcoin premium evaporated faster than a vampire at sunrise. 🧛♂️ Chanos closed the trade, pocketing gains while muttering, “Gravity always wins.” 🌍

The move was pure Chanos: spot a bubble, bet on reality, and exit before the clowns take the stage again. 🤡 His playbook? Older than a Soviet ration card: “Buy low, sell high, and never trust a CEO who tweets in all caps.” 📊

Strategy’s defenders? They’ll call this a “correction,” not a catastrophe. But let’s face it: betting your company on one volatile asset is like building a house on a glacier. 🧊 Eventually, you’re either swimming or bankrupt. Or both. 🏊♂️

“₿uy Now”

Saylor’s recent tweet, a rallying cry so optimistic it could fund a moon colony. 🌕 Whether this is visionary zeal or financial cosplay remains unclear. For Chanos, though, the math is as clear as a vodka hangover: “The numbers don’t lie. The CEOs do.” 📉

FAQ ❓ (Because Even Absurdism Needs Clarity)

- What did James Chanos short?

Strategy’s stock, while quietly buying bitcoin like a kid hoarding candy before a dentist visit. 🍬 - Why target Strategy?

Their overvaluation was so blatant, even Gogol would’ve called it “a satire in spreadsheet form.” 📊 - When did Chanos exit?

Nov. 7, 2025-the day Strategy’s premium deflated like a sad parade balloon. 🎈 - How much BTC does Strategy own?

641,000 coins, bought with debt so creative it belongs in a Dostoevsky novel. 📚

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- This Blockchain Bridge Will Make You Say ‘Crypto, Seriously?’ 🚀

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Pudgy Penguins: The Meme Coin That Dares to Be Different 🐧✨

2025-11-08 22:24