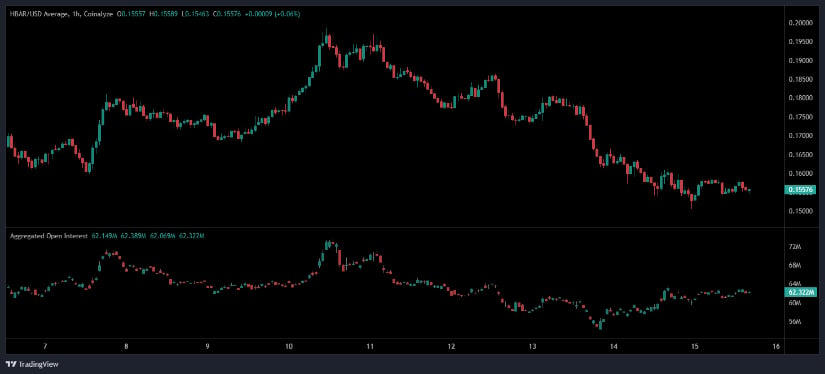

Crash Caprice! Molière Unmasks Why Coins Fall📉

Les poids-lourds ne sont point épargnés, car même le maître souverain Bitcoin à 95,381 pièces

et la fière Éthereum à 3,154 font des émeutes pour savoir s’ils trouveront un souffle. Bien que

je puisse décrire les journées passées qui se méfient, la retrouvaille holistique d’une victoire

quelconque n’en traduit point. Si d’exemple volaient la scène – ah, l’altcoin! Un spectacle

bien démoli parmi Rutfab -, l’on entend nos chers taureaux patauger à pareille faiblesse. Voyez

XRP à 2.21, BNB a 933, Solana près 139, et aucun, hélas, n’a armé de croissance fulgurante, à moins

l’on y trouvât un petit tour de force indispensable.