The Bitcoin Rollercoaster: Is $130,000 in the Cards or Just a Joke?

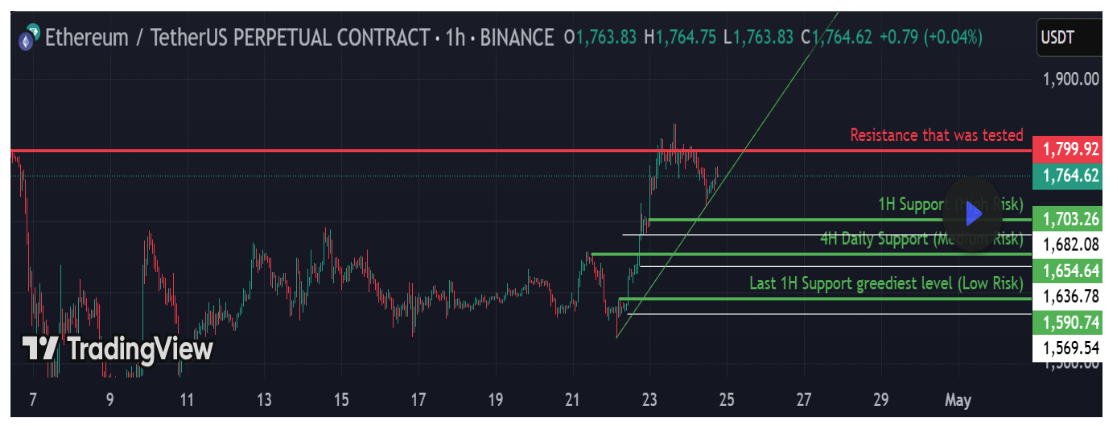

Now, here’s where things get spicy. Bitcoin might be working on what they call a “five-wave move” from the April low. If this is true, then we’re all about to get rich—well, at least if you bought in early enough to avoid crying into your coffee every morning. But, if it turns out to be a “three-wave structure” instead, then congratulations, you’re stuck in a bear market, and that recent uptick? Just a little blip before the crash. Welcome to the party!