Solana: The Crypto Comedy Climbing the Charts—Will $170 be Its Grand Finale? 🎭💰

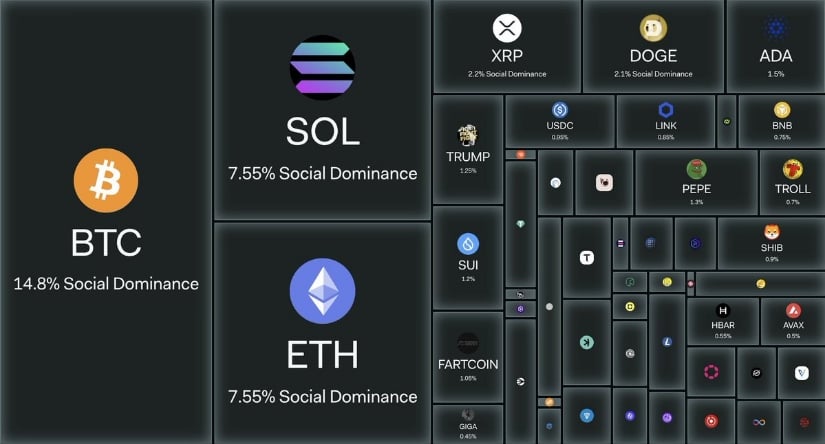

Lo and hark! Our gallant Solana ascends to the lofty second rank in the great theatre of crypto chatter. According to the auguries of the wise LunarCrush, $SOL now bestrides the social stage just behind the kingly Bitcoin himself. A triumph most worthy for a project jousting amidst tempestuous markets and rival knights.