Crypto Hits $3 Trillion Because Bond Vigilantes Wreck Trump’s Tariff Circus

Basically, they sell bonds like it’s Black Friday, driving yields up so borrowing becomes as pricey as a NYC apartment. The government? They hate it, obviously.

Basically, they sell bonds like it’s Black Friday, driving yields up so borrowing becomes as pricey as a NYC apartment. The government? They hate it, obviously.

For the past four days, XRP has been banging its head against the daily simple moving average (SMA) 50 at $2.18 like it’s a locked door at a trendy nightclub. It’s been flirting with a breakout, but no one’s letting it past the velvet rope just yet.

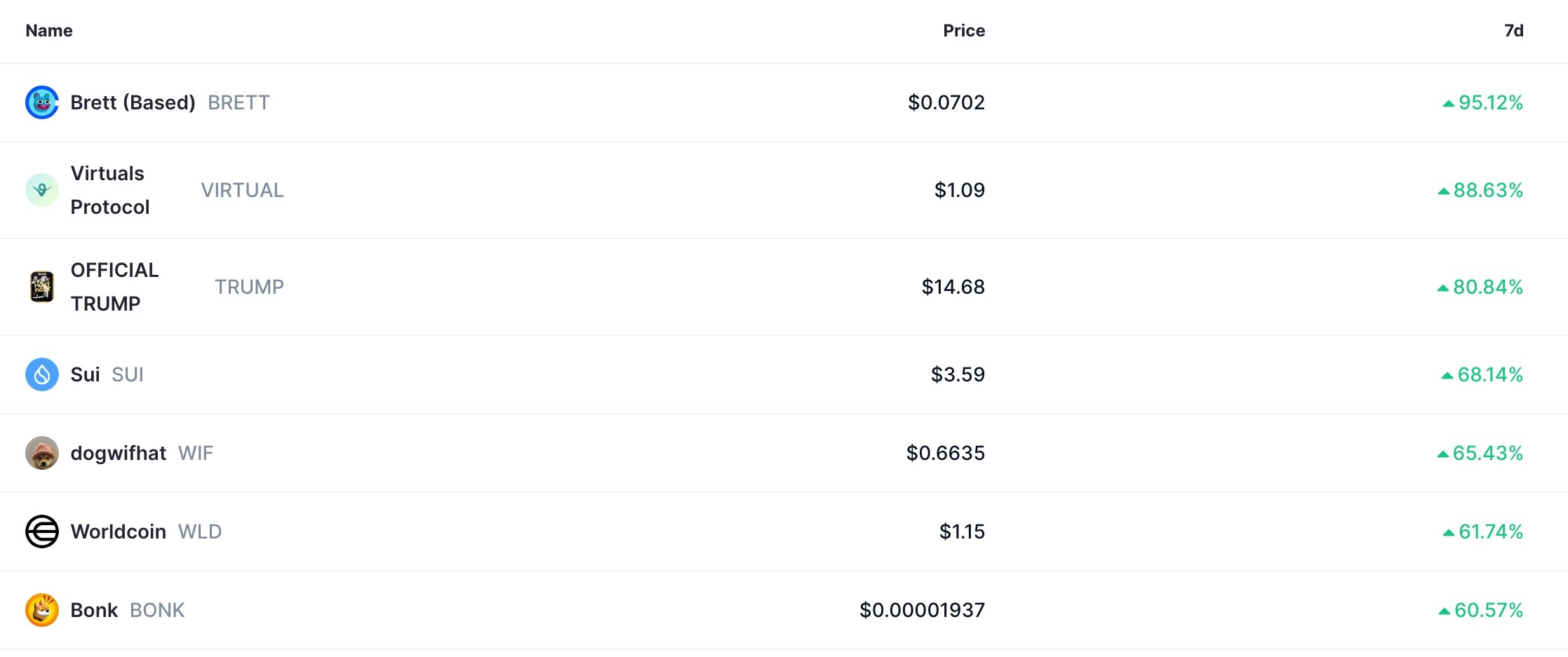

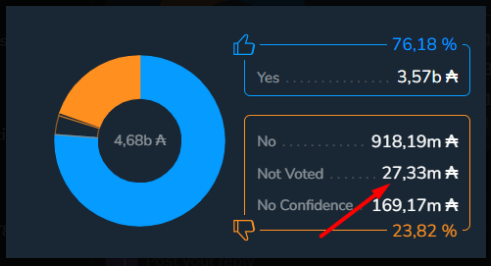

According to data from hashrateindex.com, a stunning 91 EH/s packed its bags and left the Bitcoin network after April 17, 2025, when the network was operating at a leisurely 917 EH/s. At its peak, just nine days earlier on April 8, it hit an all-time high of 926 EH/s, as measured by the seven-day simple moving average. But after April 17, it’s been a downhill slide, like watching your favorite TV show get canceled mid-season.

Daan insists that new coins often decide to throw a party once they’ve hit rock bottom and realized there’s nowhere else to go but up — kind of like your average Discworld wizard after a bad Monday. Add to that Bitcoin ($BTC) flexing muscles at 2-month highs and Ethereum (ETH) hanging tough like a bad smell, and suddenly the stars align for fresh recruits like $GUN and $NIL to make their debut. 🪙✨

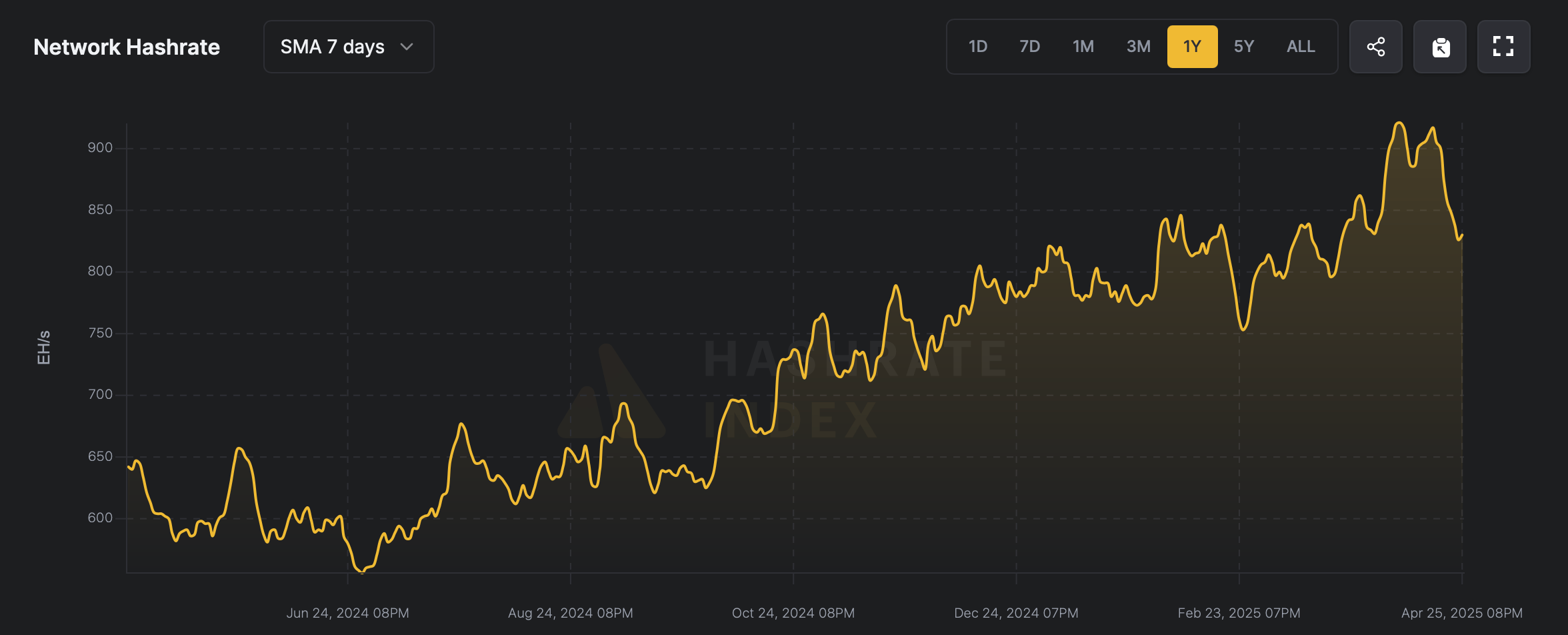

The esteemed Romain Pellerin, CTO extraordinaire of Input Output Global, revealed this jaw-dropping numerical ballet, where 4.657 billion ADA tokens sashayed their way through the Delegated Representatives system. Talk about social networking with style!

The global crypto colossus, swollen to a staggering $2.97 trillion from last week’s modest $2.69 trillion, marches on, indifferent to the faltering footfalls of these non-fungible wayfarers. Data from the soothsayers at CryptoSlam revealed a curious paradox: the battalions of NFT buyers swell by 54.33% to 391,498; sellers rise valiantly by 45.06% to 223,311, yet the trades themselves diminish by 10.25%, retreating like weary soldiers to 1,404,451.

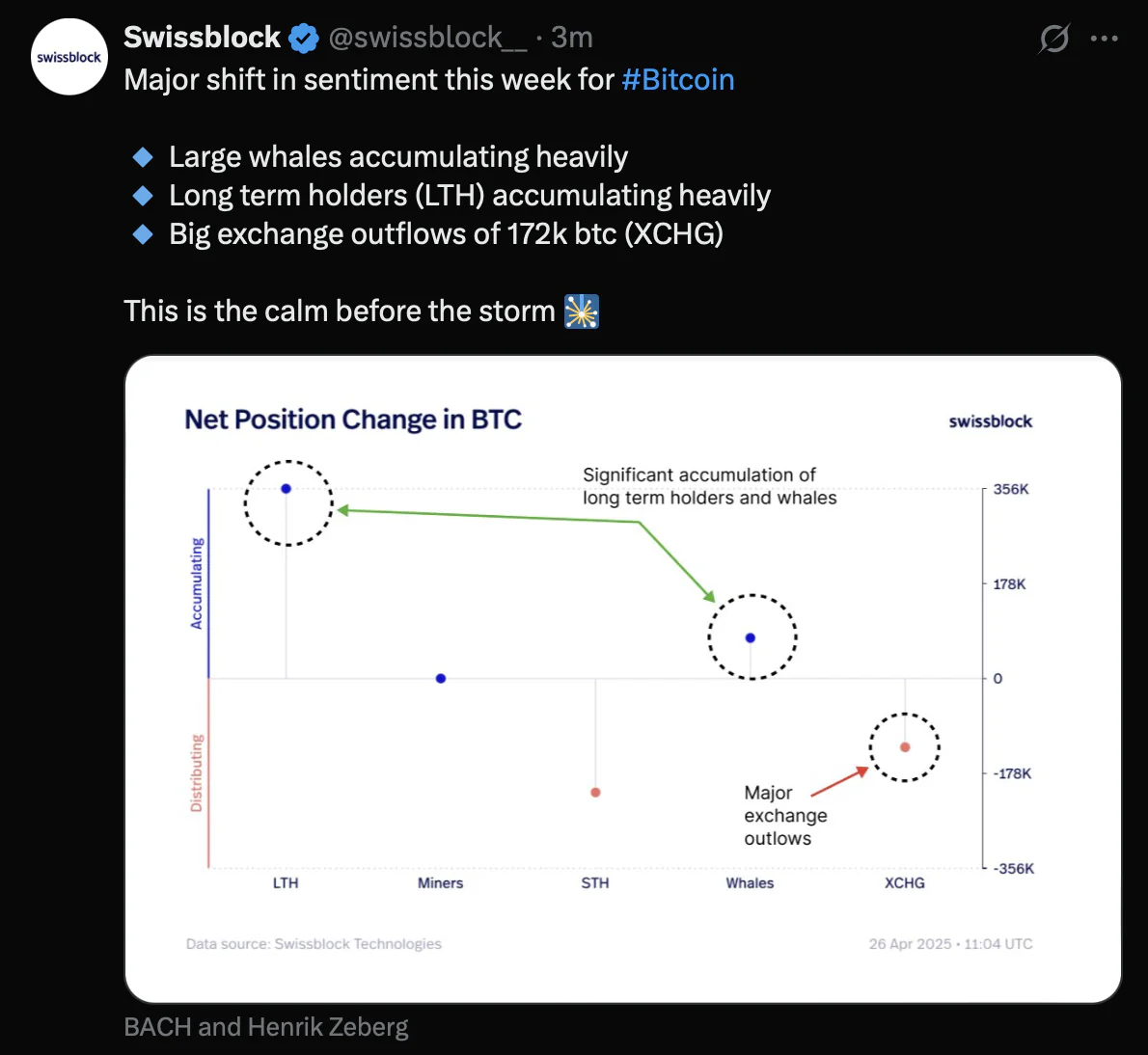

Now, let’s take a gander at the chart delightfully provided by Swissblock, shall we? It’s all rather clear, if you look closely: while miners and short-term holders are doing a little spring cleaning (with only a tiny bit of distribution), our dear whales and long-term holders are hoarding BTC like it’s the last bottle of champagne at a New Year’s Eve party.

Come Wednesday, whispers grew louder that the top holders of these digital valueless tokens would dine with His Excellency at his exclusive, secretive establishment in Washington, D.C. The promise: a rare, close-up glimpse into the future of crypto, straight from the man himself, as if the presidency and blockchain were chapters in the same fairy tale.

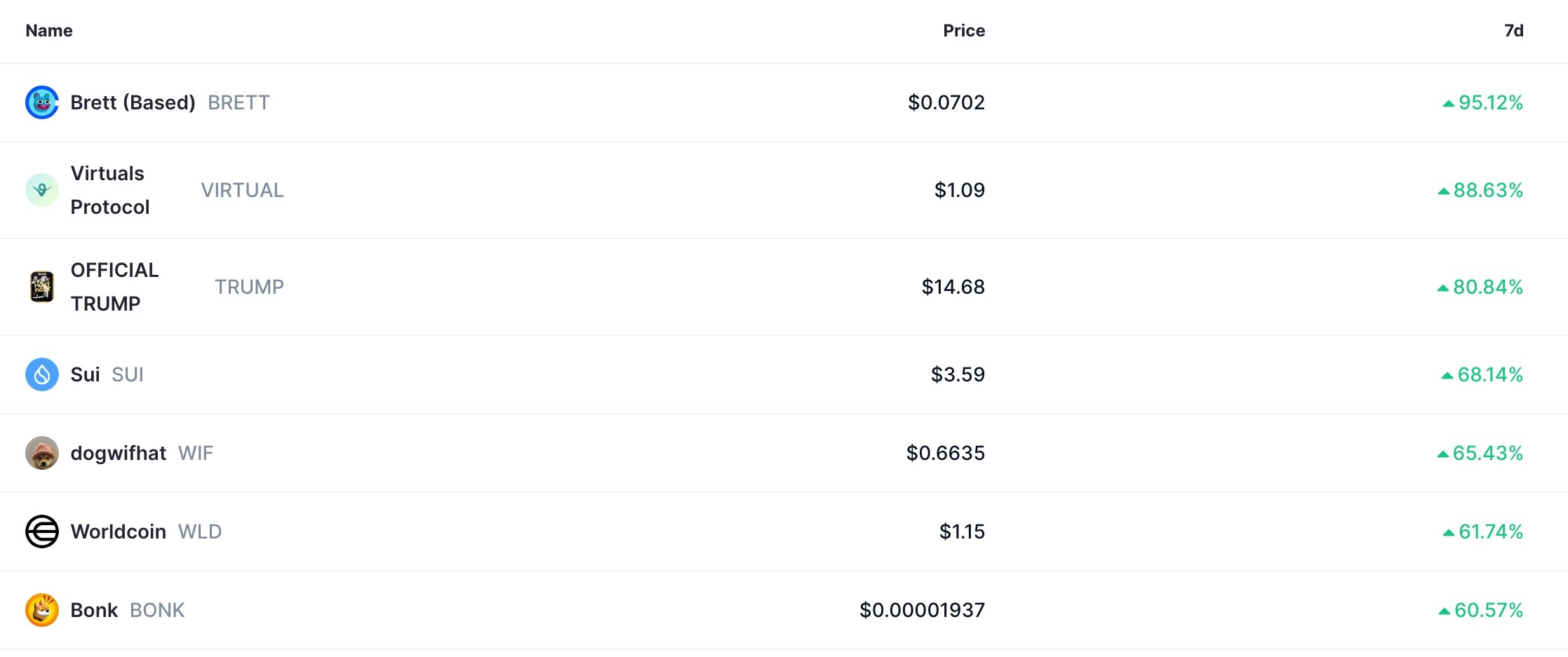

Bitcoin’s dance with the stock market has been nothing short of dramatic, while the Digital Gold narrative has been resurrected like some kind of mystical phoenix. Meanwhile, Trump (the meme coin, not the actual person—though who knows?) seems to have suddenly become everyone’s best friend. And, dare we say it, it might just be the catalyst for the crypto renaissance. 🚀

According to Glassnode’s weekly report, Bitcoin’s supply in profit has made a dramatic jump right along with the latest rally in Bitcoin’s price. Is this a sign of impending doom? Or is it time to make some popcorn and watch the drama unfold?