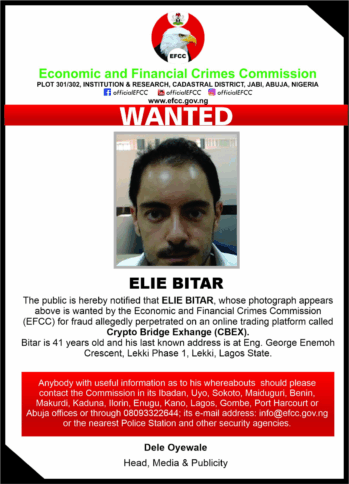

Crypto Barons Seize the Fields: Tether Snaps Up 70% of Adecoagro

It started with a $100 million “small” nibble last fall—just a taste, nothing to frighten the peasants. Then a jump to 51% in February. And now, with the appetite of wolves at a winter feast, 70%. Did anyone ask the cows how they feel about this? Of course not! 🐄