Solana’s Stunning Surge: Why SOL’s Price is Set to Soar!

Solana’s $10.9 billion TVL just left Ethereum’s Layer-2 ecosystem eating its dust. 😏

Solana’s $10.9 billion TVL just left Ethereum’s Layer-2 ecosystem eating its dust. 😏

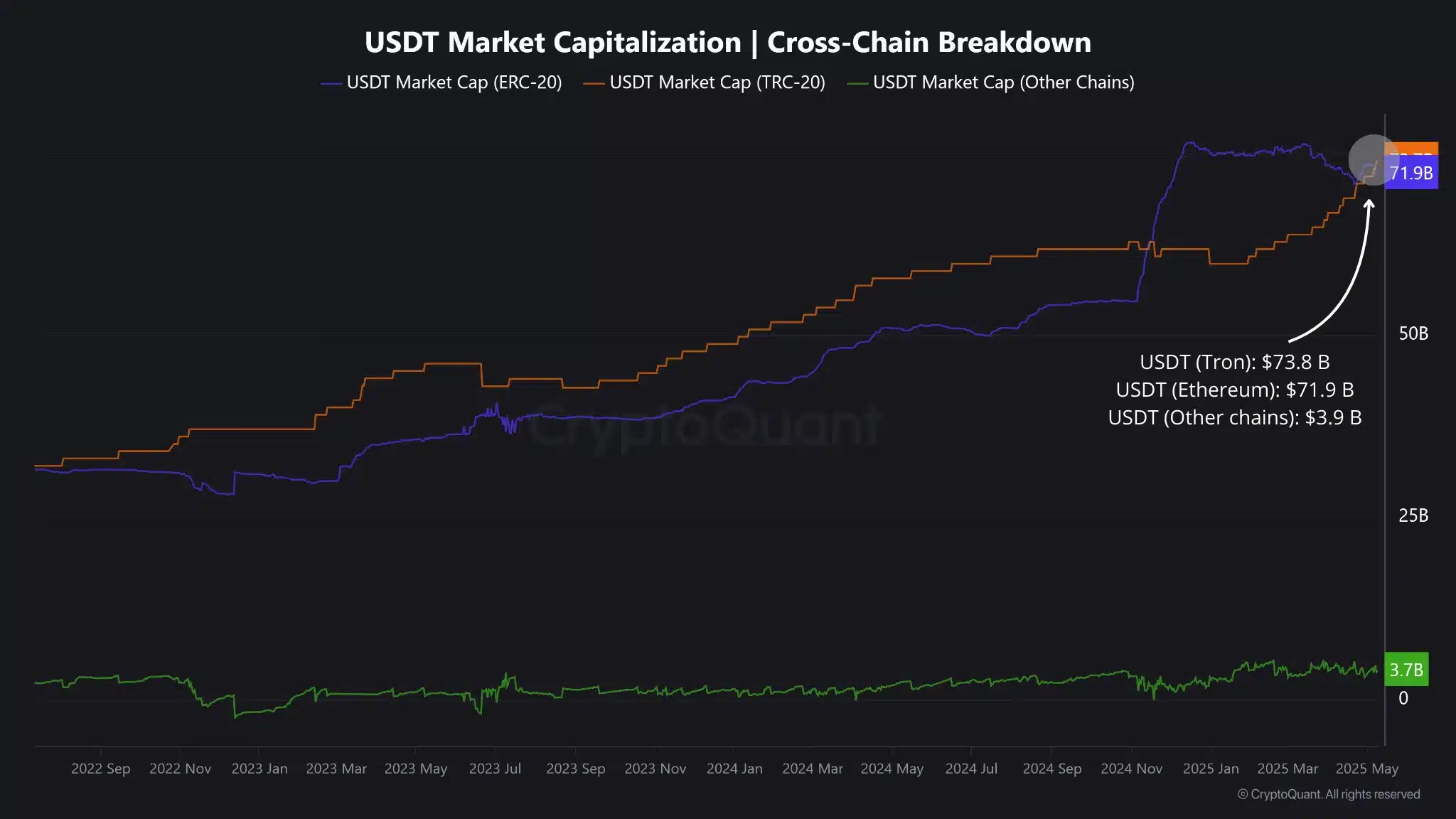

Presently, the stablecoin jamboree boasts a $240 billion shindig—presided over by Tether’s USDT ($145B, the loud uncle of the family) and Circle’s USDC ($60B, more like the slightly richer cousin). But according to Citi, this bash could balloon to $1.6 trillion by 2030, or, should we all get incredibly optimistic and the wind be blowing just right, $3.7 trillion. That would leave today’s $3.45 trillion crypto market cap looking positively sheepish in the corner. 🐑

“Institution of proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change. Institution of proceedings does not indicate that the commission has reached any conclusion with respect to any of the issues involved,” the announcement deadpanned, presumably unable to locate the ‘Yes’ or ‘No’ buttons on its keyboard.

In the manner of someone announcing the invention of the wheel, Coinbase’s chief financial wizard, Alesia Haas, declared this event a sign that the crypto industry has matured from its wild youth—sort of like a reformed hooligan suddenly being offered a seat in the House of Lords.

This grand enterprise isn’t meant for the man on the Clapham omnibus. Oh no, it’s curiously tailored for institutional sorts—hedge funders with more acronyms than socks, asset managers who sail yachts named “Alpha,” and those mysterious proprietary traders who always seem to know things they shouldn’t. The idea? To provide a fortress of transparency and security where one may frolic about trading Bitcoin index futures and options without the anxiety attacks usually reserved for watching England’s penalty shootouts. ⚽💸

The valiant ETH, bedraggled and stamped upon, has flung itself upward—behold, numbers such as $2,800 and even $12,000 have been uttered by the soothsayers. Some reckon it echoes the fabled leap of BTC after the pestilence, which, incidentally, did not care for anyone’s feelings either.

Out of absolutely nowhere—like your ex texting “U up?” at 3 a.m.—the U.S. and China decided to ghost their own tariffs. Bye-bye, 145%-level drama; hello, “just” 30% (still rude, but whatever). China, true to type, matched with an equally theatrical slide from 125% to 10%. Markets? Obsessed. Traders? Frothing. Risk appetite? On Ozempic and running wild.

With over 3 billion users across Facebook, Instagram, and WhatsApp, Meta’s stablecoin could be the biggest crypto on-ramp ever. If this madness works out, we might be looking at the largest digital migration in history. Forget the Gold Rush; this is the Meta Rush! 🤑

But the fun doesn’t stop there! The deal is expected to conclude in the latter half of 2025, as promised in a press release on May 13. Yes, they’ve put it in writing, and who are we to doubt the word of a multi-billion-dollar fintech company?

In case you’re wondering (pun intended), the deal is an all-cash acquisition that puts a price of 36 Canadian cents per share on WonderFi. This, of course, is a 41% premium over its closing price before the announcement. Yeah, it’s a nice little bump for investors, but is it really worth it? Time will tell. 😏