XRP’s Neckline Break Will Shock Your Attorney and Amaze Your Landlady

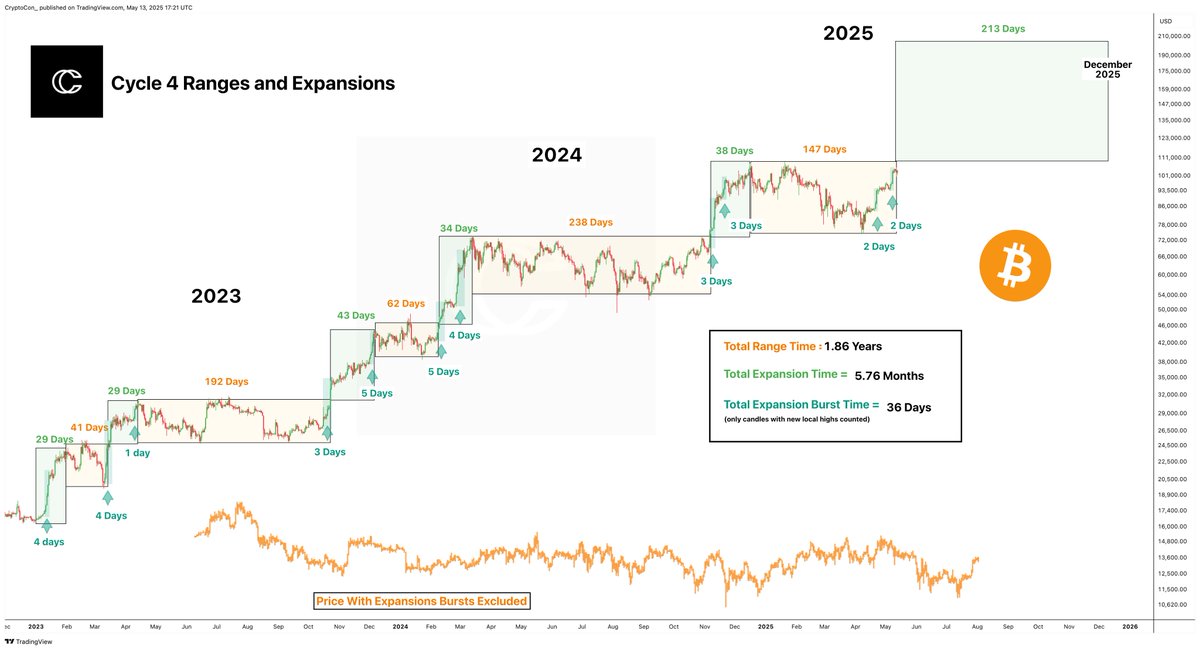

“While you noble souls were busy fawning over COIN’s debut in the mighty S&P, dear old XRP tiptoed right out of the shadows,” BigMike announced, twirling his chart-pointer like a conductor’s baton. The applause was palpable—mostly from himself.