BNB Price War! Spot vs. Futures: Who Wins?! 🤯

But fear not, dear reader, for beneath this placid surface churns a sea of intrigue! Market whispers and on-chain omens tell a tale more twisted than a bureaucrat’s alibi. 🤔

But fear not, dear reader, for beneath this placid surface churns a sea of intrigue! Market whispers and on-chain omens tell a tale more twisted than a bureaucrat’s alibi. 🤔

As Wu Blockchain, our keen-eyed observer, notes, the number of active addresses on Avalanche has soared past 1.95 million this May. Such a spike makes one nostalgic for January, when the entire crypto universe danced in bullish delight. Ah, the good ol’ days!

The market at large, a fickle beast, is growing restless. Many, blinded by avarice, expect Bitcoin to ascend to unprecedented heights. Yet, a shadow of caution lingers. Crypto analyst Daan, a fellow with a name as concise as his insights, suggests that Bitcoin has lately shown a certain…weakness compared to those stalwarts of tradition, the stocks. According to Daan, this underperformance – a veritable case of the sulks – followed the announcement of a US-China trade deal. It seems that reducing macroeconomic uncertainty is like offering a shot of vodka to the stock market, but Bitcoin prefers the angst! 🤔

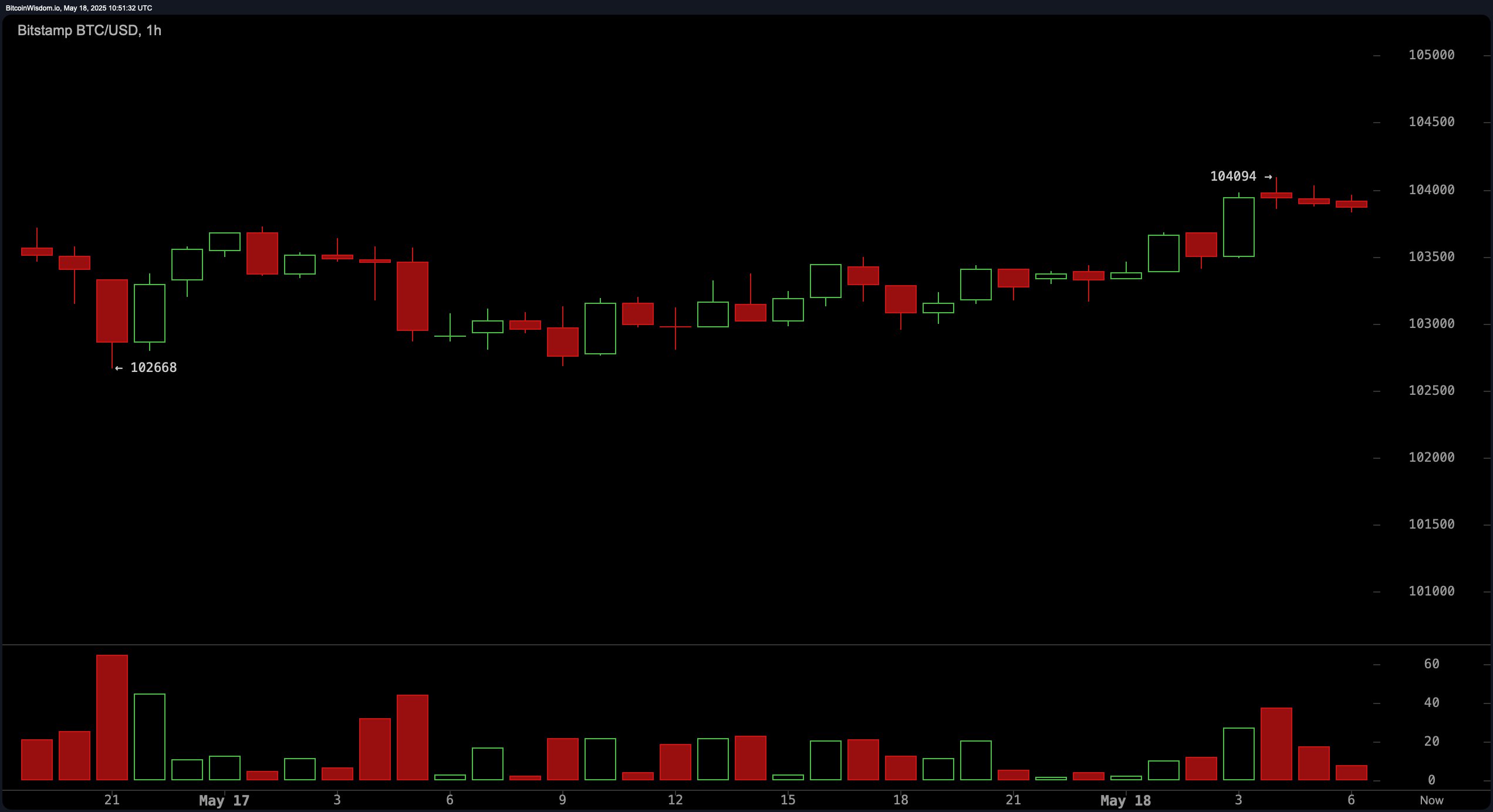

Apparently, it’s been doing this little dance since May 16. Higher lows, higher highs… sounds exhausting. The ‘key resistance’ is $104,094. Honestly, who comes up with these numbers? And support at $102,668. So precise. So… arbitrary. If it bursts past $104,100 with enough oomph, apparently, we’re all in for the long haul. But if it doesn’t? Short-term bearish reversal, darling. Short-term. Don’t panic. Maybe.

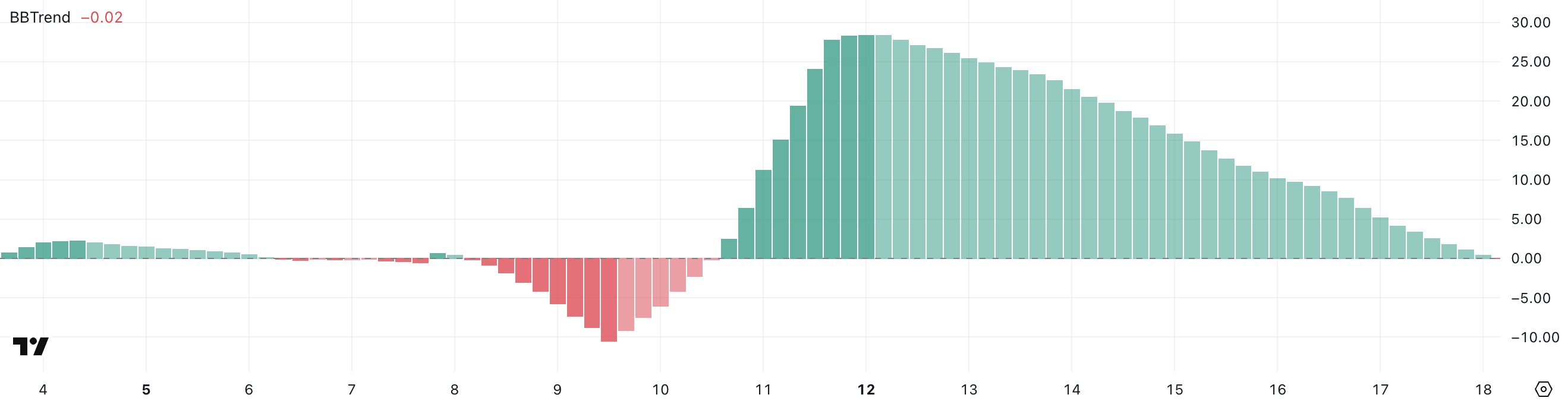

BBTrend has decided to play the villain, turning negative, while whale accumulation is… well, barely swimming. The short-term EMA momentum? Let’s just say it’s taking a nap. These aren’t the kind of signals you want if you’re hoping for a sustained bull run. Could we be staring at the beginning of a reversal? Let’s dive in, shall we? 🤔

France, that most prudent of nations, hath responded with fervor—clad in armor of security measures—due to the recent spate of villainous abductions of notable figures in the *criminally* lucrative crypto industry. It seems, mon ami, that even millionaire moguls and their daughters are not safe from the grasp of the nouveau riche miscreants. 🤑🤺

Crypto analyst Chad (not a character from a superhero comic, but close enough) recently posted on X (formerly Twitter, but with more attitude) that our charismatic coin might be in the early stages of developing a snazzy right shoulder of this pattern. Think of it as Bitcoin doing its best impression of a swimmer mid-stroke—except it’s probably just avoiding a dip in the $90,000s. Chad pointed out that a quick plunge could help cool off the overheated RSI, which is basically just a fancy thermometer that’s been left in the sun too long. This dip could also shake out the folks who buy high and sell low—those charming people who think ‘investing’ is just another word for gambling.

Ethereum, being the reliable overachiever, has been climbing steadily with its 3% weekly gains, keeping everyone’s hopes high. PEPE, on the other hand, is like that unpredictable cousin who shows up to the party, does a wild dance, and then disappears into thin air. But is PEPE just reloading for a big comeback? Or is Ethereum just quietly setting up for the long haul?

Yes, you read it right. The portal to the digital goldmine, Cointree, blinked and missed the deadline for reporting suspicious matters, that stuff that keeps the authorities busy and the criminals, well, on edge. The Australian financial watchdog, AUSTRAC, which apparently has more patience for tardiness than a school teacher with a detention slip, handed over these fines after Cointree, in a rare act of honesty, admits it bungled the schedule. Bravo! Or perhaps just a sign of the times? 🥴