Sony’s New Crypto Plan: Game On or Just a Gamble? 🎮💸

Sony Bank plans to issue a stablecoin in the U.S. as early as the fiscal year 2026, the Nikkei reported on Monday. How delightfully futuristic! 🚀

Sony Bank plans to issue a stablecoin in the U.S. as early as the fiscal year 2026, the Nikkei reported on Monday. How delightfully futuristic! 🚀

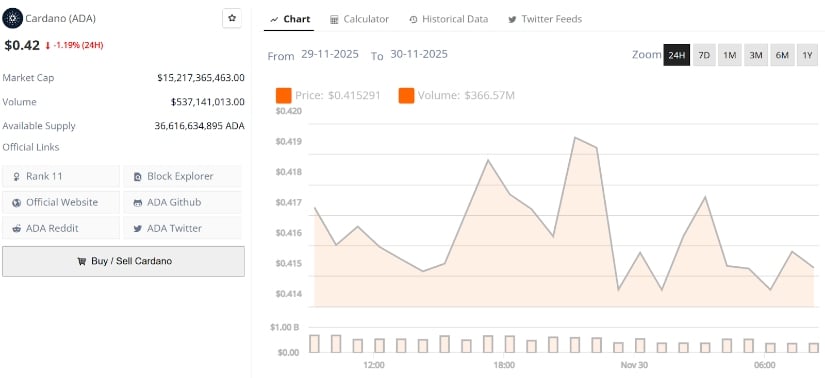

Guess what? ADA’s trading at the same price it was in 2017-around $0.4167. Yes, you read that right. Eight years, two cycles, and we’re back where we started. 🌀 It’s like that ex who keeps sliding into your DMs after all these years. Milk Road’s chart is basically screaming, “How deep is your drawdown?” But hey, Cardano’s back in its long-term value zone, where the cool kids accumulate like it’s going out of fashion. 💼

Market sentiment, once a ghost of itself, now pirouettes like a hopeful fool after John Williams, that benevolent overseer of the FOMC, hinted that monetary policy remains “restrictive”-a code word for “we’ll break the economy, but at least it’s exciting.” This masterstroke of ambiguity birthed the fantasy that December might bring a rate cut, prompting investors to fling money into crypto like it’s the last dance before the rapture.

Volatility? More like a circus act! 🎪 BTC/USD flirted with $85,000, leaving bulls in a state of existential dread. 🦬

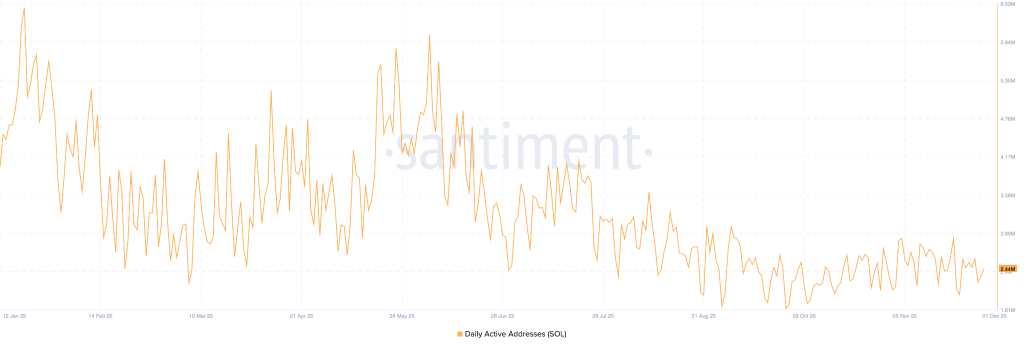

Solana’s crash wasn’t exactly a surprise, though. While Bitcoin’s collapse was all about liquidity gaps and chaos, Solana’s tumble had more to do with a slow, painful decline in on-chain activity. Its user base was basically taking a nap long before the storm hit. With fewer people using the network and less buzz around it, the token became a sitting duck for any macro pressures that came its way. Not great, right?

A double bottom, dear reader, is not the be-all and end-all of market movements. It is, instead, a humble suggestion that a reversal might be on the horizon-though not a confirmation. The 50-day, 100-day, and 200-day EMAs (those moving averages we all know and love) are still on their downward path, stubbornly below SHIB, as if to say, “Do not get ahead of yourself.” This speaks volumes about the general momentum, which seems more inclined to resist any upward march. The resistance wall, a rather imposing structure, stands between $0.0000093 and $0.0000105, and it has held firm for months, as if mocking any efforts to rise above it. Any hopeful SHIB rally will face this rather obstinate barrier, which seems to have developed a certain sense of permanence. Furthermore, let us not forget volume-or rather, the conspicuous lack of it. The true double-bottom breakout is supposed to bring forth a surge in demand, signaling that buyers are entering with enthusiasm. But alas, SHIB’s volume remains, well, uninspiring. A dull, flat line on the chart. How dreadfully unexciting! If a genuine reversal were afoot, one might expect at least a bit of market fervor. But no, the excitement is conspicuously absent.

Key takeaways:

Yet, as with all things fleeting, whispers of doubt have begun to circulate. The token, once buoyant, has since dipped by 24%, a harbinger of what may come. 🐢

Bitcoin’s fate hangs by a thread as Jerome Powell, that venerable oracle of monetary mysticism, prepares to speak on December 1. The quantitative tightening (QT) program, which has been strangling liquidity like a boa constrictor in a suit, will finally expire. Yet the odds of a rate cut? A mere 86%-a number so high it could make Santa’s sleigh crash. 🚨

The San Francisco-born giant, with its blockchain heart, now wields a new license, a key to unlock the gates of Asia’s crypto kingdom. A realm where the Monetary Authority of Singapore, that stern yet fair gatekeeper, has carved a path for digital dreams. 🧭