Will Bitcoin’s “Uptober” Bewitch Us with Crypto Sorcery? 📈🔮

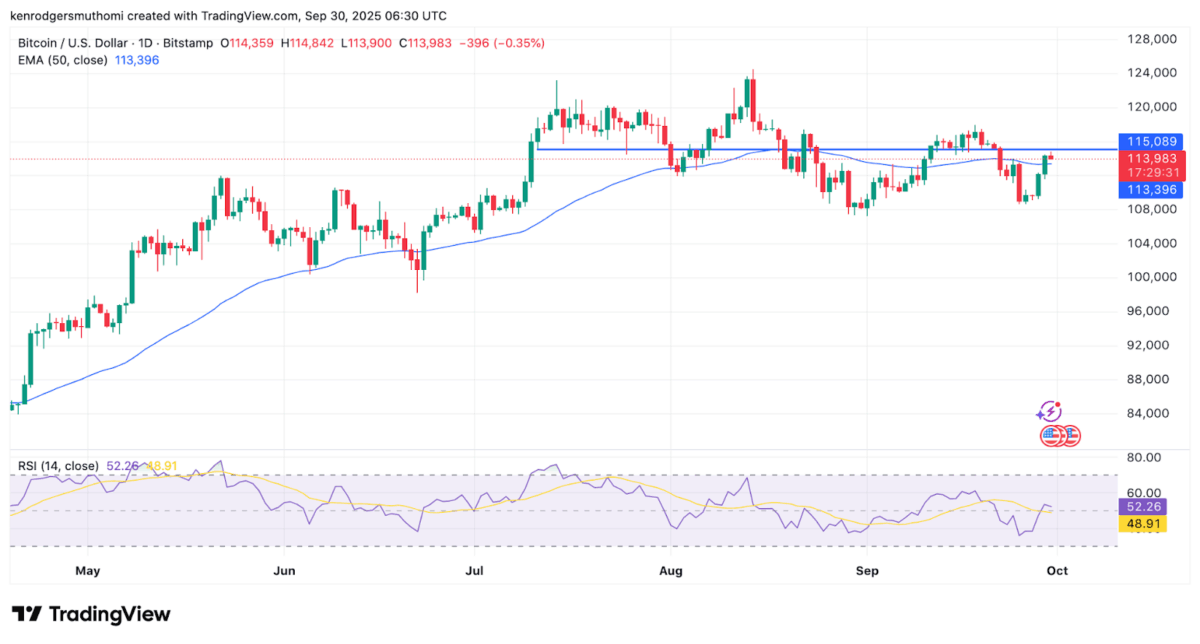

Not so long ago, Bitcoin saw itself tumbling from the grand heights of $124,457 to a piteous $108,000, succumbing to a 13% tumble, much to the shock and sober disbelief of those monitoring CoinMarketCap. The rumblings speak of a decline peak, yet Bitcoin, ever the tenacious twilight soldier, has managed to claw its way up to $113,940, whilst trading volume buzzes through the air at a lively $61 billion.