DEXE nears KEY support as $5.3M sell-off triggers price drop!

Surprise, surprise – bearish sentiment dominates. Out of 20 exchanges, 19 have traders betting against DEXE. Perhaps they know something we don’t? 🧐

Surprise, surprise – bearish sentiment dominates. Out of 20 exchanges, 19 have traders betting against DEXE. Perhaps they know something we don’t? 🧐

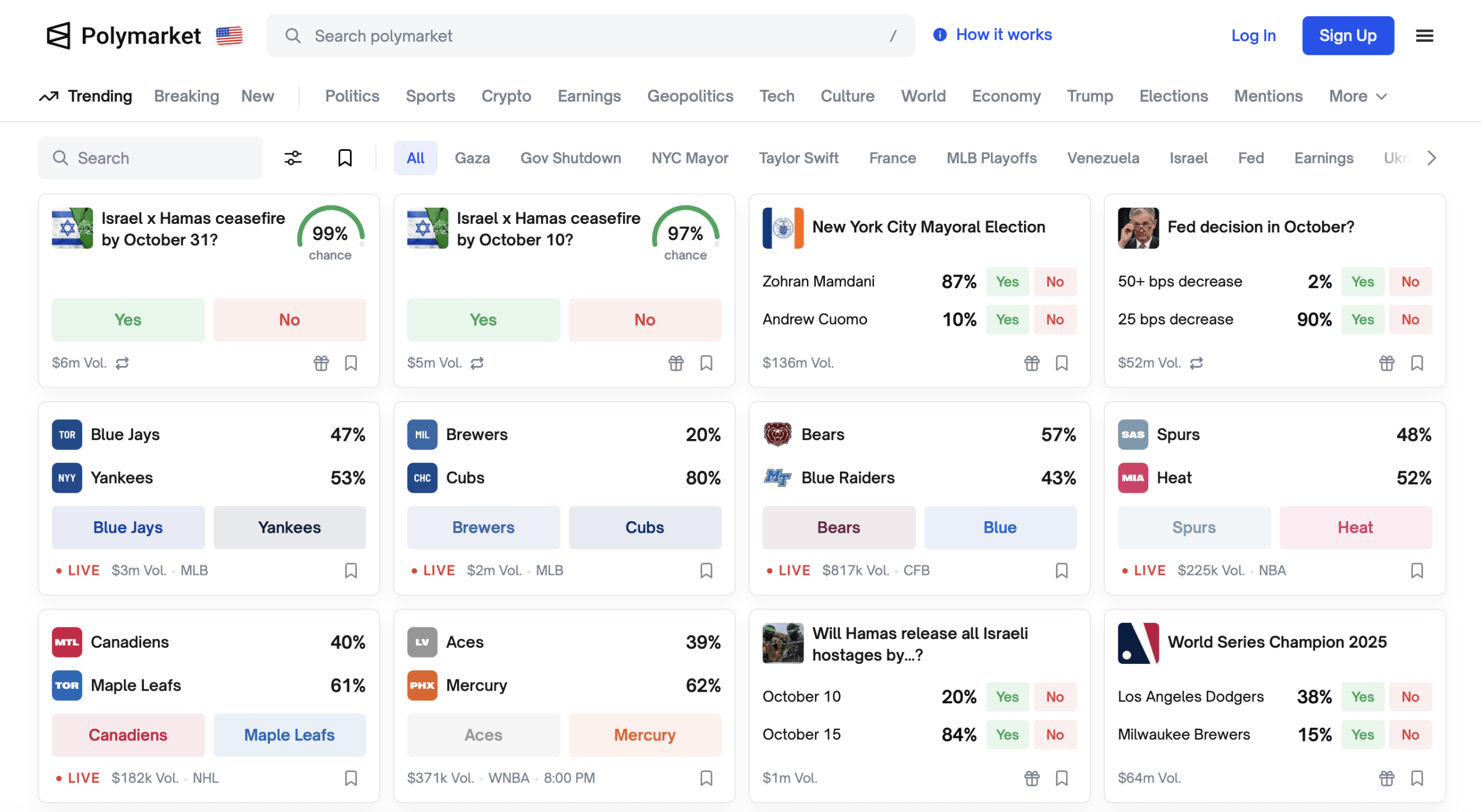

Polymarket, born out of blockchain dreams and a little bit of madness in the Polygon blockchain, has kicked its growth into overdrive thanks to a recently leaked news byte about the $2 billion investment from ICE. Launched back in the wild, freewheeling year of 2020 by none other than the enterprising Shayne Coplan, Polymarket lets users pit their wits against one another by buying and selling shares on an array of real-world events-from the nail-biting suspense of elections to the heart-pounding drama of sports, all while basking in the glow of “yes” or “no” outcomes. You know, the usual high-stakes gambles.

Ryan Polk, a sage of sorts at the Global Encryption Coalition (GEC), a gallant band defending encryption with all the fervor of Don Quixote facing windmills, ceremoniously inked an open letter on Thursday. In it, he lamented that Minister for Justice Jim O’Callaghan’s legislation could usher in a glorious era of cybercrime and frighten businesses away from the Emerald Isle. Who needs tourism when you have a robust cyber underbelly?

In a move that can only be described as a triumph of bureaucratic inertia, Peru has authorized its first officially regulated crypto platform, the whimsically named Cryptococos. This marks the nation’s maiden voyage into the choppy waters of digital assets, with only the most privileged clients of Banco de Crédito del Peru (BCP) permitted to board this financial ark. They shall be allowed to buy and hold Bitcoin and USDC, with BitGo acting as the custodian of these precious digital trinkets. 🧐

Oh dear reader, hold onto your hats! Solana’s price is grabbing headlines with a frolicksome leap-thanks to SOL DAT’s whimsical plan to snatch up 5% of the total supply. This delightful maneuver, draped in bullish technical finery, has cornered many joyful analysts into projecting a jolly romp towards $1,300. 🎉

According to Square, the package consists of Bitcoin Payments, Bitcoin Conversions, and a built-in Bitcoin Wallet, announced during the company’s second Square Releases event-like a play within a play, with a bow and a whispered aside.

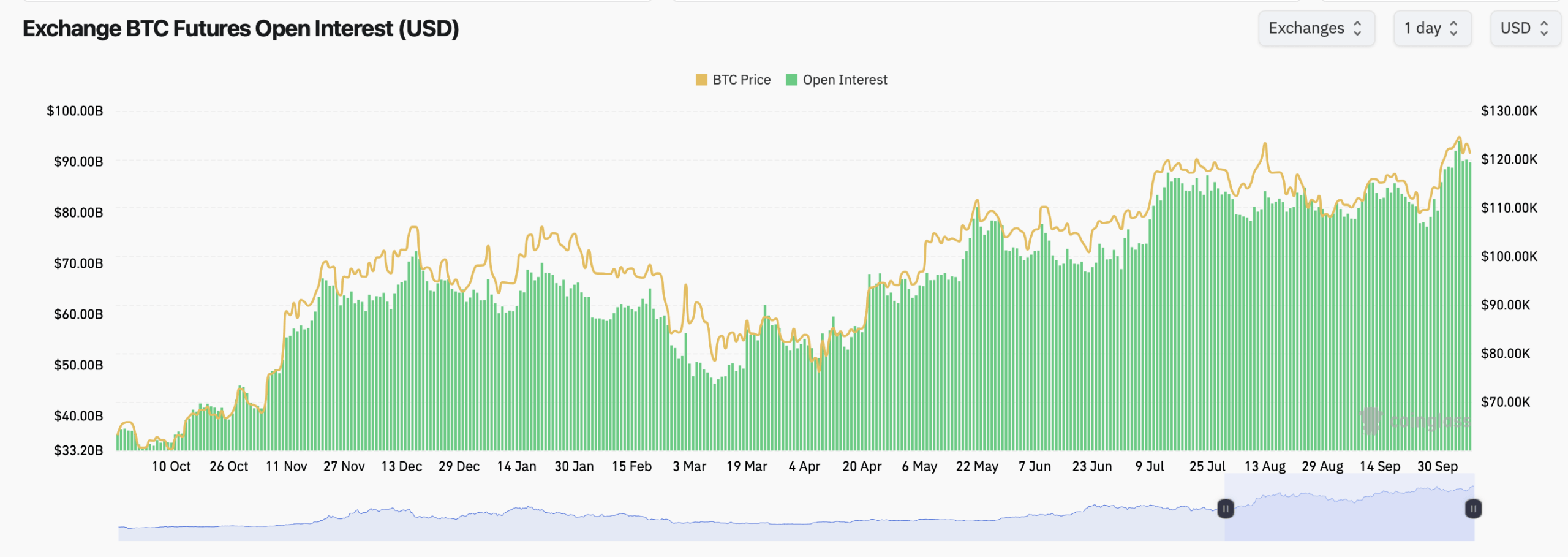

From the halls of Coinglass, where numbers are crunched with the fervor of a revolutionary pamphlet, comes the news: total BTC futures open interest has ballooned to a staggering $100 billion. Leverage, that double-edged sword, is wielded with abandon, and the institutions, those titans of the financial world, are positioning themselves like chess masters. Or perhaps, like fools rushing in where angels fear to tread? 🤔

Now, dear readers, picture this: LBTC holders, those fortunate souls, can restake their lustrous Bitcoin through Symbiotic to secure Cap’s lavish institutional USD loans. Yes, indeed! Bitcoin is now the glittering collateral gracing credit lines. And of course, borrowers will pay their premiums in USDC for this delightful coverage, whilst our clever restakers earn a little extra yield atop their native BTC rewards. Quite the win-win, wouldn’t you agree? 💃

As the coin took its dramatic plunge, the open interest on Binance-that barometer of trader sentiment-shriveled by a whopping 7.9%. Analysts, those modern-day soothsayers, clucked their tongues and declared it a sign of caution. “Traders are closing their positions,” they intoned gravely, “like cats fleeing a sinking ship.” 🐱⛵

As the Bloomberg scrolls proclaim, Yuma Asset Management unfurls its banner under DCG’s Yuma division, a knight errant in the realm of Bittensor. 🏰 Its birth coincides with the return of the Trumpian era, a time when the digital winds blow warm and wild. 🌪️