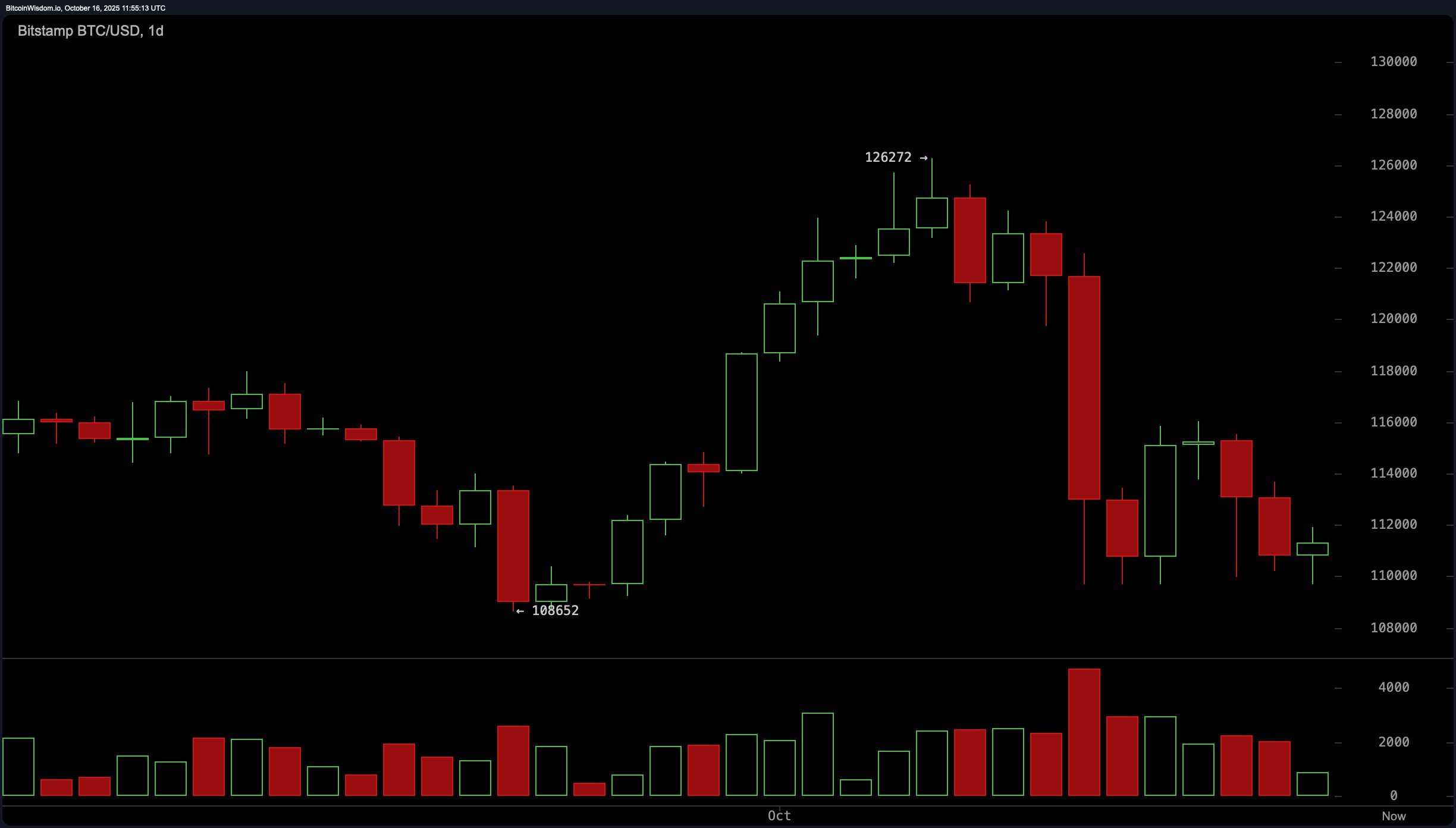

Bitcoin Plunges Below $109K: The Crypto Struggle is Real and Liquidity’s the Villain

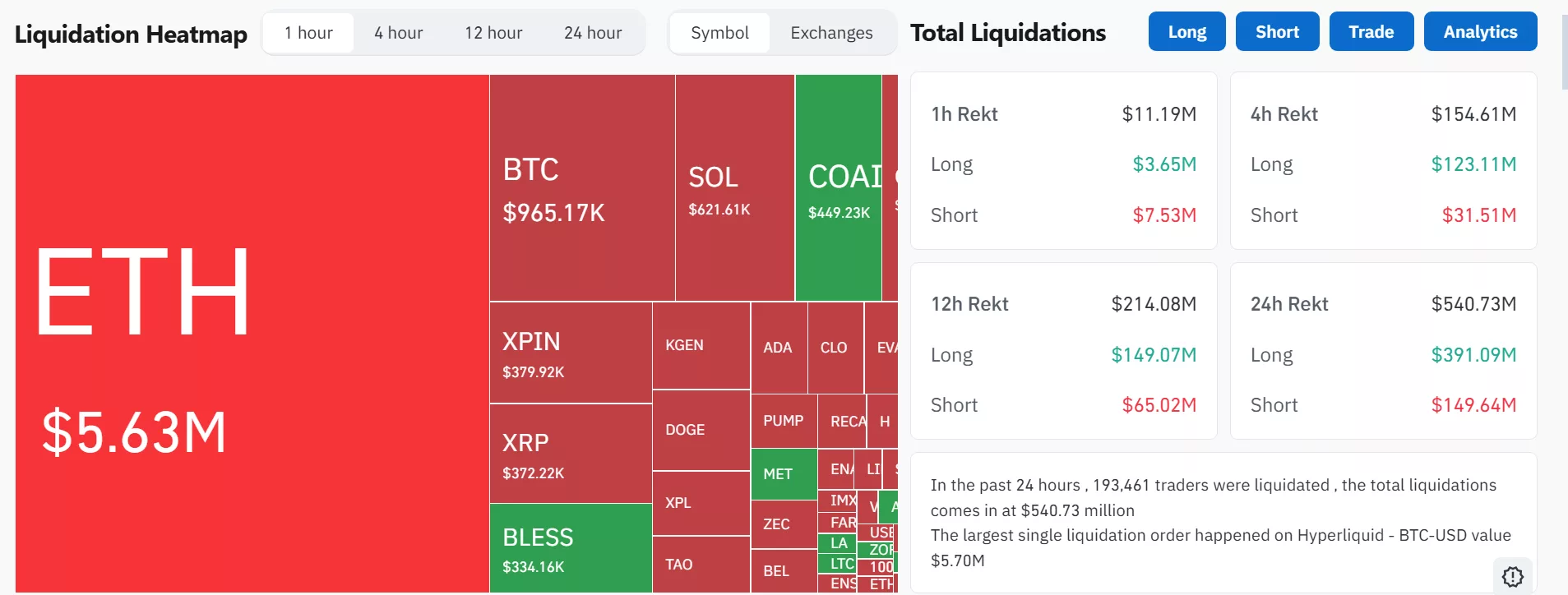

And so the familiar saga unfolds-cryptos are slipping down the hill as gold and silver keep climbing to uncharted territory. How quaint. Bitcoin has dropped by around 2% in the past hour, now sitting at a measly $108,800, having lost most of its post-crash bounce from Friday. Meanwhile, the rest of crypto is on a similar path to despair, with Ethereum and Solana suffering even worse declines-around 3% in just the last 60 minutes. Oh, the humanity.