Bitcoin’s Wild Ride: Will It Crash or Soar? 🚀

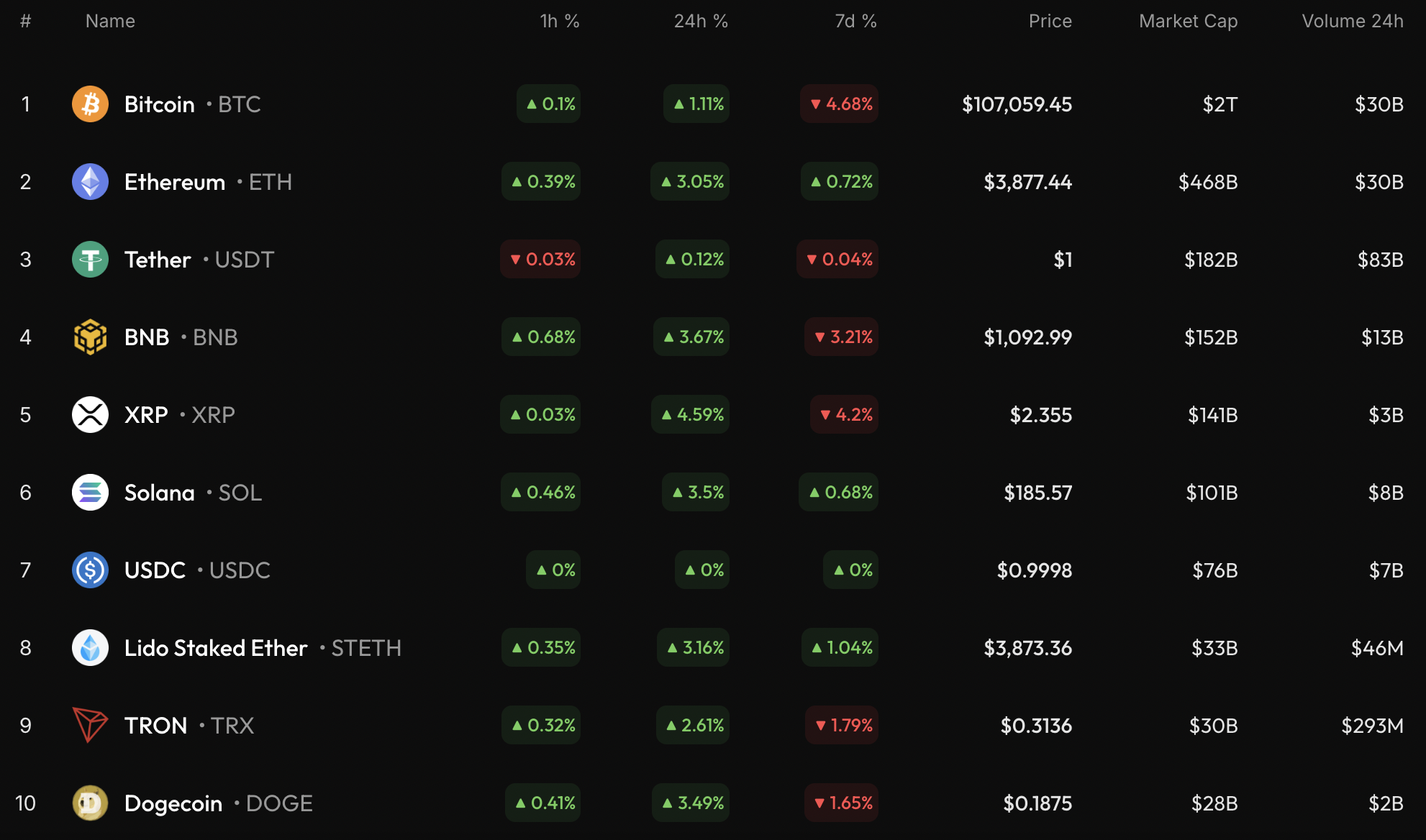

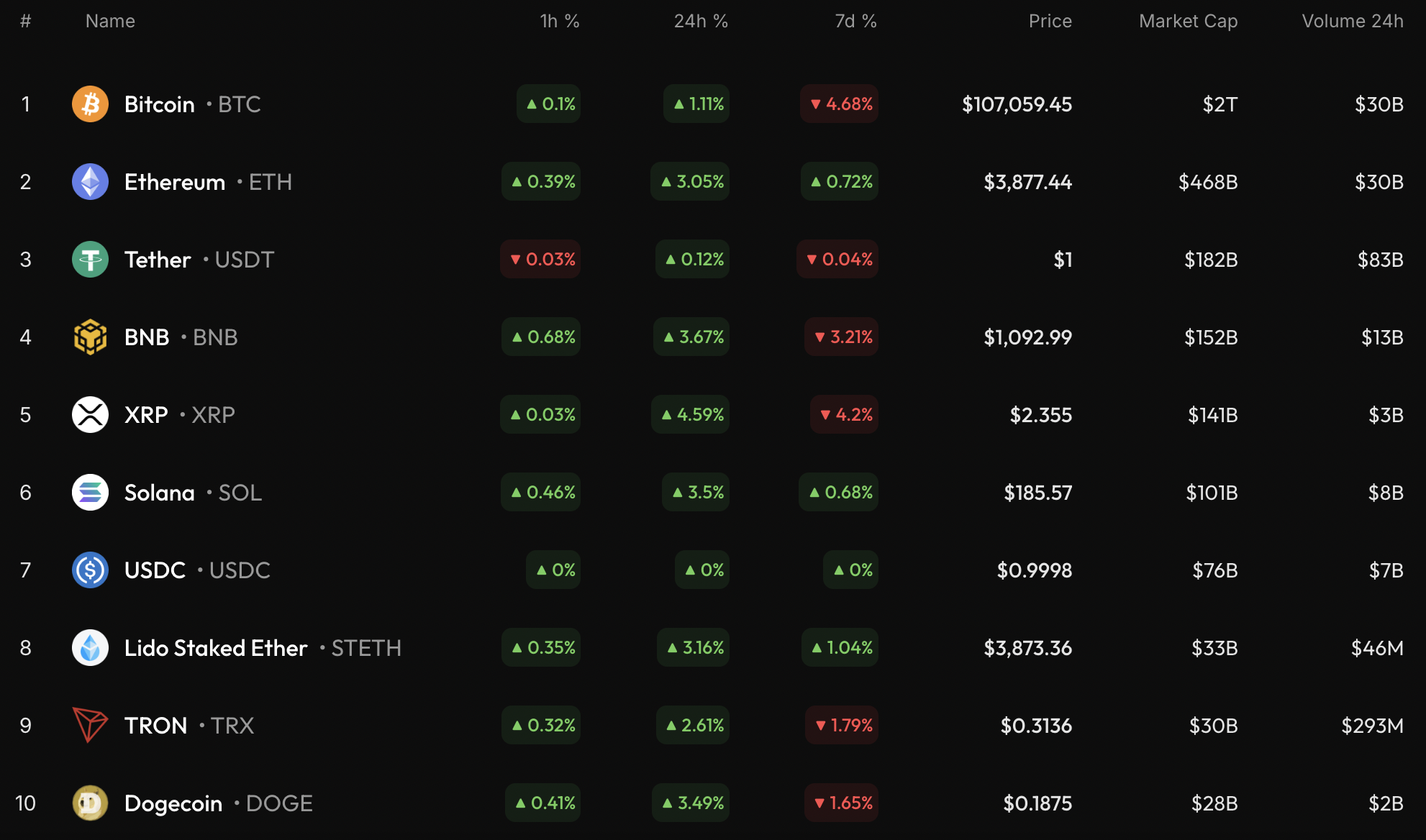

The rate of Bitcoin (BTC) has risen by 1.11% since yesterday. Because nothing says “I’m feeling lucky” like a 1% increase. 🎲

The rate of Bitcoin (BTC) has risen by 1.11% since yesterday. Because nothing says “I’m feeling lucky” like a 1% increase. 🎲

On October 17th, our dear friend Darkfost, lurking behind the pseudonym, spilled the beans on social media with a sense of mild excitement about Bitcoin’s old guard. Turns out, those venerable investors – the pogs of the crypto world – have been sending their coins to Binance at a rate that’s caught some attention.

If everyone’s feeling lucky and the market’s not in a total meltdown, maybe. Or probably not. But hey, if you’re a gambler, it’s a wild ride-just don’t blame me when the rollercoaster drops you in the kiddie pool. 💦

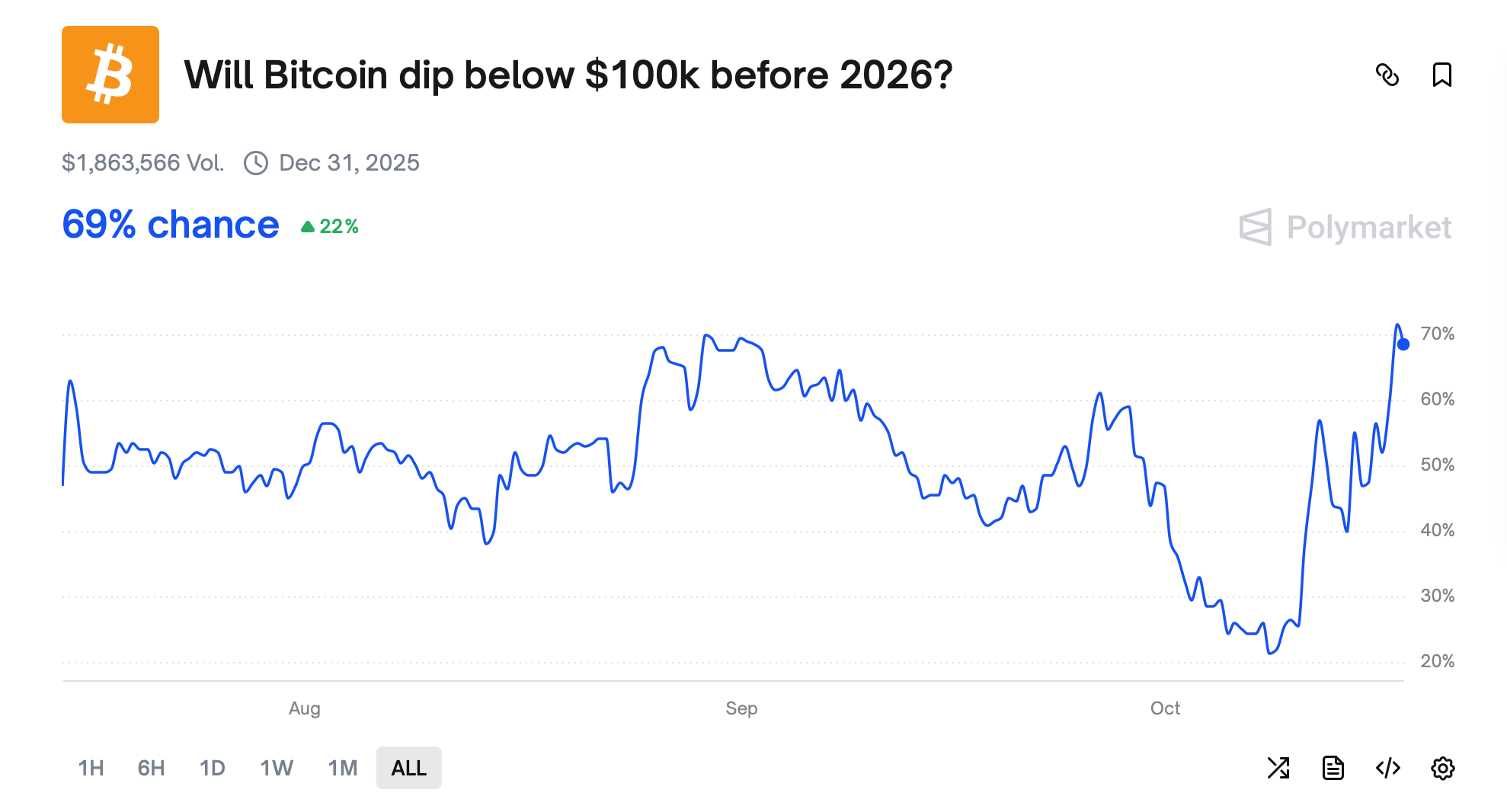

Speculation abounds that bitcoin (BTC) might slip under $100,000-or worse, nosedive toward a $90,000 “floor.” One X user opined, “Every time BTC hits a new ATH, it does a ~25-30% dip/downside. This time is no different. BTC will dump a little below 100K (maybe 90K?), then the rally can start.” A masterclass in optimism, delivered with the enthusiasm of a tax audit. 🤯

Despite its stalwart efforts, the XRP price hath dipped by 24.02% and 3.89% in the last 30 days and seven days, respectively. The coin hath managed to evade the troubled zone through sustained buying, yet the volume count remainth but a meager trickle, insufficient to stoke upward price movement. One might liken it to a candle in a gale-valiant, yet easily extinguished. 🕯️🌬️

Yep, you read that right. Ryder, the people behind the ridiculously simple Ryder One wallet, has wrapped up a $3.2 million funding round. This wallet promises to give you top-notch crypto security in under 60 seconds. That’s right, in less time than it takes to decide if you should buy another avocado toast, you can secure your digital assets.

Bitcoin fell to a low of $103,516 on Friday, marking four consecutive days of drop since Oct. 13 as macro uncertainty and liquidity stress kept traders cautious across crypto markets. Gold’s price also fell after reaching a record high at $4,379 earlier on Friday. Silver mirrored the drop in Bitcoin and gold, falling as the broader precious metals group retraced after a steady rally this week. 💸 (It’s like watching a toddler lose interest in their favorite toy.)

Shiba Inu is currently trading between $0.000010 and $0.000011, a zone identified by traders as a critical battleground between bulls and bears. According to crypto analyst Shib Spain, the asset “needs to hold the range between $0.000010 and $0.000011 until the next breakout is achieved.” Translation: Don’t expect fireworks yet. Just more waiting. And maybe a few retweets of the same chart. 📊

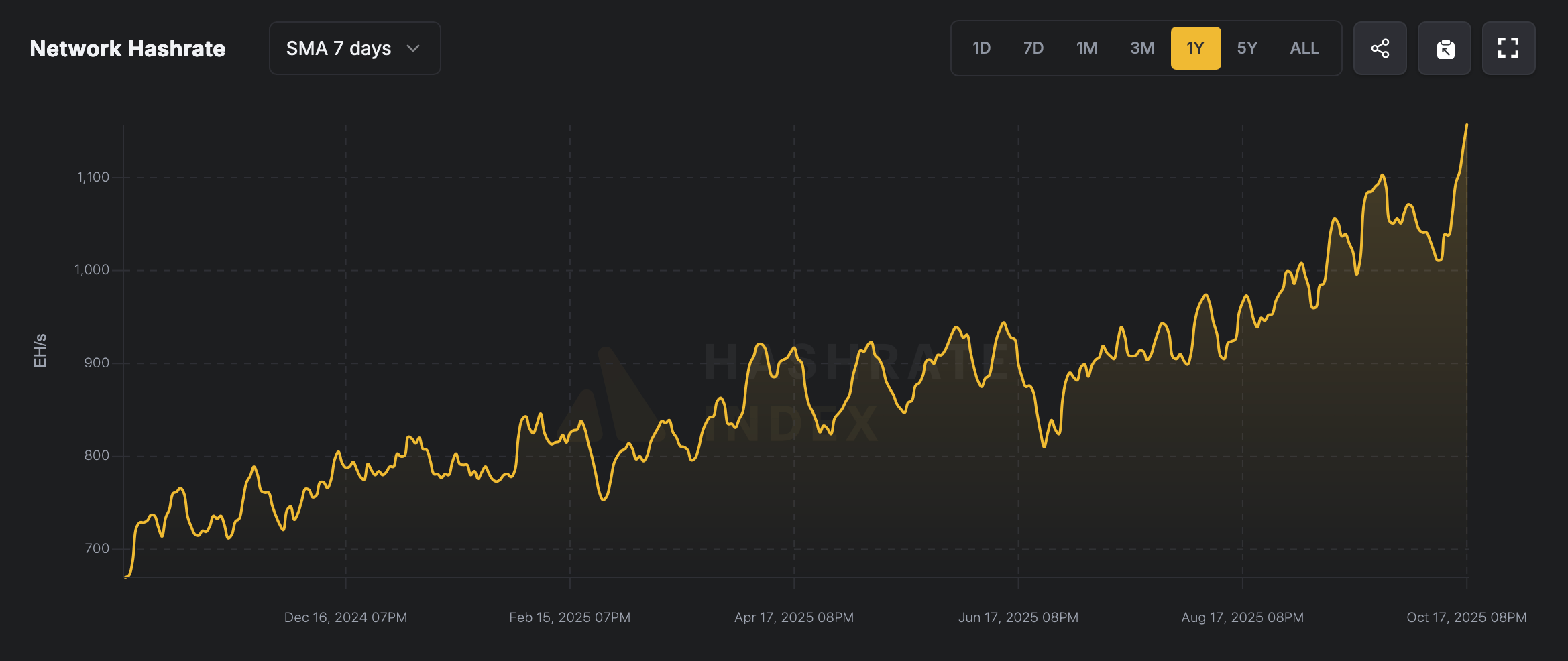

As the weekend looms, Bitcoin’s hashrate surges to 1.1489 zettahash per second-a number so vast, it makes the human mind recoil in existential terror. Behold, 1,148.90 exahash per second, a figure that would make a mathematician weep into their coffee. ☕️

Behold, the cosmos has finally aligned its bureaucratic gaze upon stablecoins-a financial instrument so thrilling it could put a sleeping bagel into a coma. Regulatory forces across galaxies (U.S., EU, HK, SG) have decreed that stablecoins must be backed by “high-quality assets” and banned from paying interest. Because nothing says “financial innovation” like a cosmic convergence of regulatory red tape. 🌌