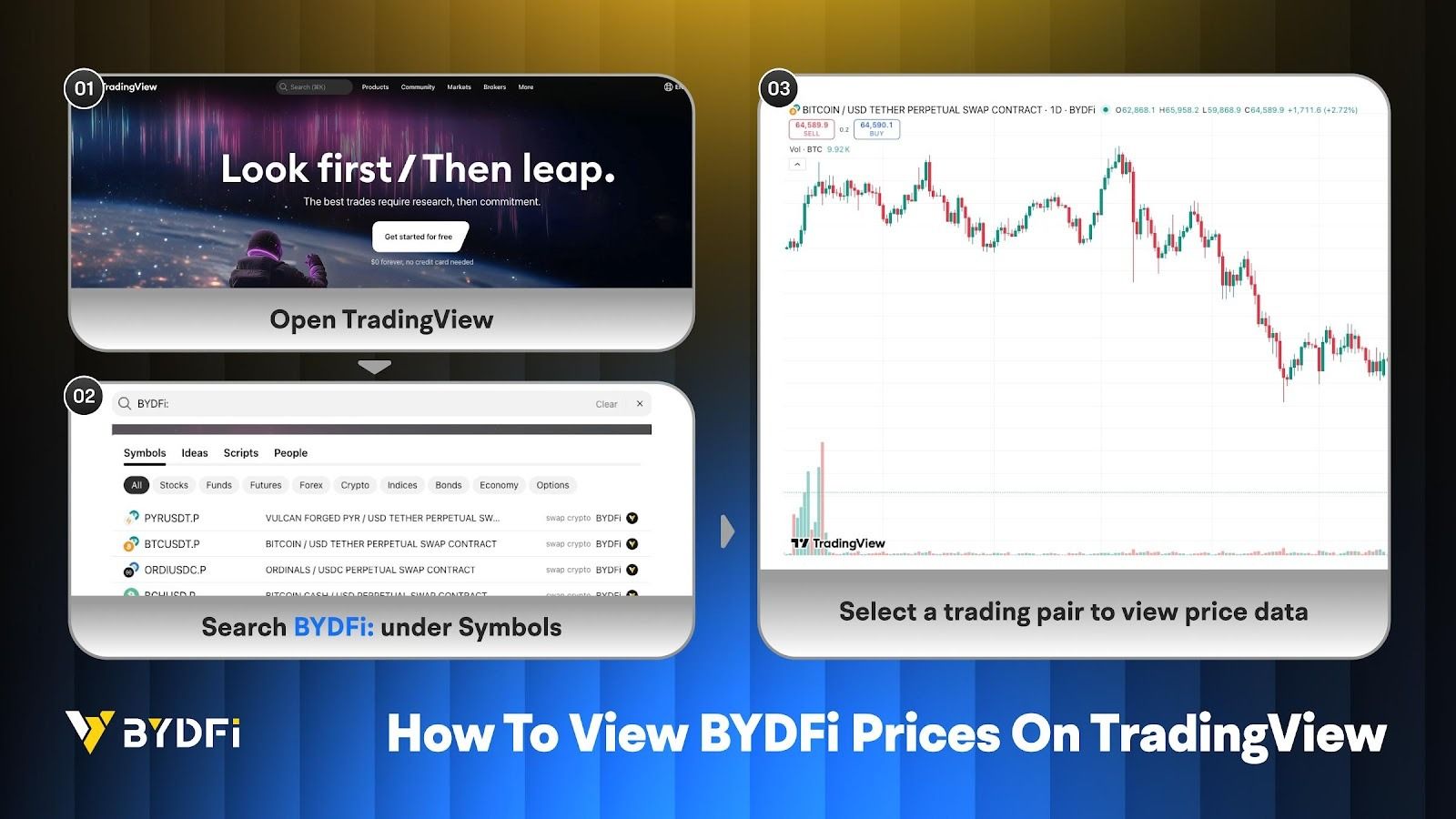

Crypto Traders, Rejoice! BYDFi and TradingView Are Now BFFs

Imagine this: you’re sipping your third latte of the day, staring at TradingView, and BAM! BYDFi’s perpetual futures data is right there, waving hello. Monitor price action, volume dynamics, and all those fancy market structure signals without breaking a sweat. It’s like your chart workflow just got a Botox injection-smooth and efficient. From BTCUSDT to the wild world of crypto derivatives, it’s all there, darling. No more juggling tabs like a circus performer.