Solana’s V-Shaped Miracle: Will It Hit $87 or Crash Like a Tea Cup?

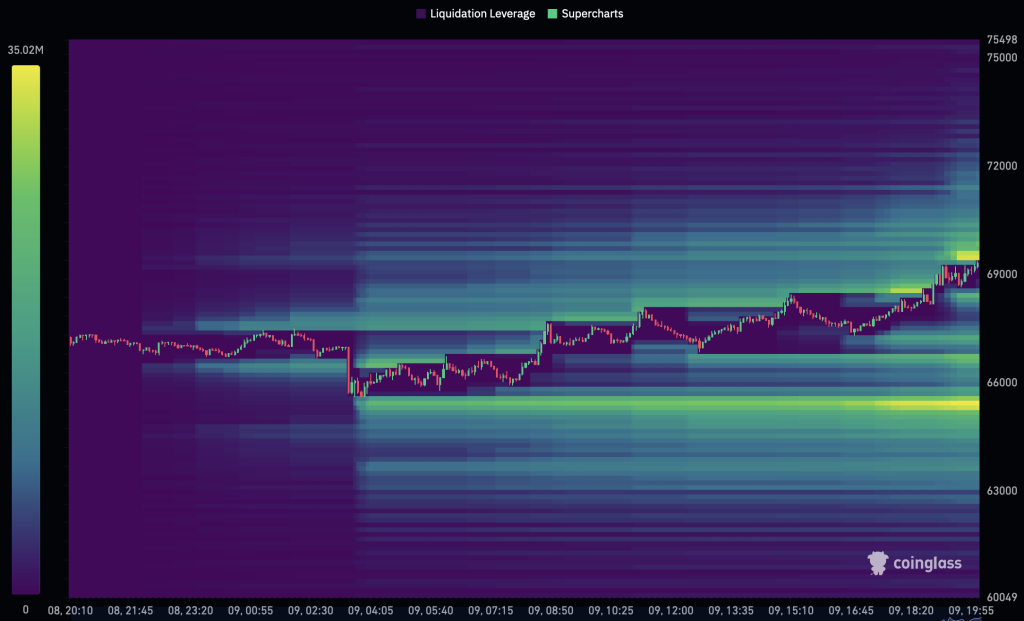

Market observer CRG, a man of questionable sanity, highlighted an impressive reversal in Solana’s futures market activity, where price initially dropped sharply before recovering in a V-shaped move. Such sudden reversals often indicate liquidity sweeps, where leveraged positions are flushed out like a particularly enthusiastic cat. This, of course, is all very scientific, and entirely unrelated to the fact that someone might have accidentally spilled a cup of tea on the trading floor.