In the vast theater of markets, where fortunes rise and fall with the whims of the invisible hand, a drama unfolds-one that would amuse even the most jaded observer of human folly. 🌍✨

What to know: 🧐

- Bitcoin, the enfant terrible of finance, eyes $120,000, while XRP dithers like a man at a crossroads, and Dogecoin barks northward. 🐶🚀

- The S&P 500, that grand barometer of human greed and fear, carves out a rising wedge-a pattern as ominous as a storm cloud on a summer’s day. ☁️⚡

- BTC and ETH options lean bearish, as if the market itself is hedging its bets against its own exuberance. 🐻

- U.S. inflation data looms like a specter, ready to exacerbate volatility and remind us all that the gods of finance are fickle. 💨💸

This daily analysis, penned by the sagacious CoinDesk analyst and Chartered Market Technician Omkar Godbole, offers a glimpse into the soul of the market. 🧙♂️📈

Ah, the markets! They are a mirror to the human condition, reflecting our hopes, our fears, and our unquenchable thirst for gain. Major cryptocurrencies, those digital darlings of the modern age, appear bullish. Bitcoin, the undisputed leader, exhibits a classic inverse head-and-shoulders breakout-a pattern as reliable as a Tolstoy novel is long. Yet, as in life, there is always a catch. 🕳️💰

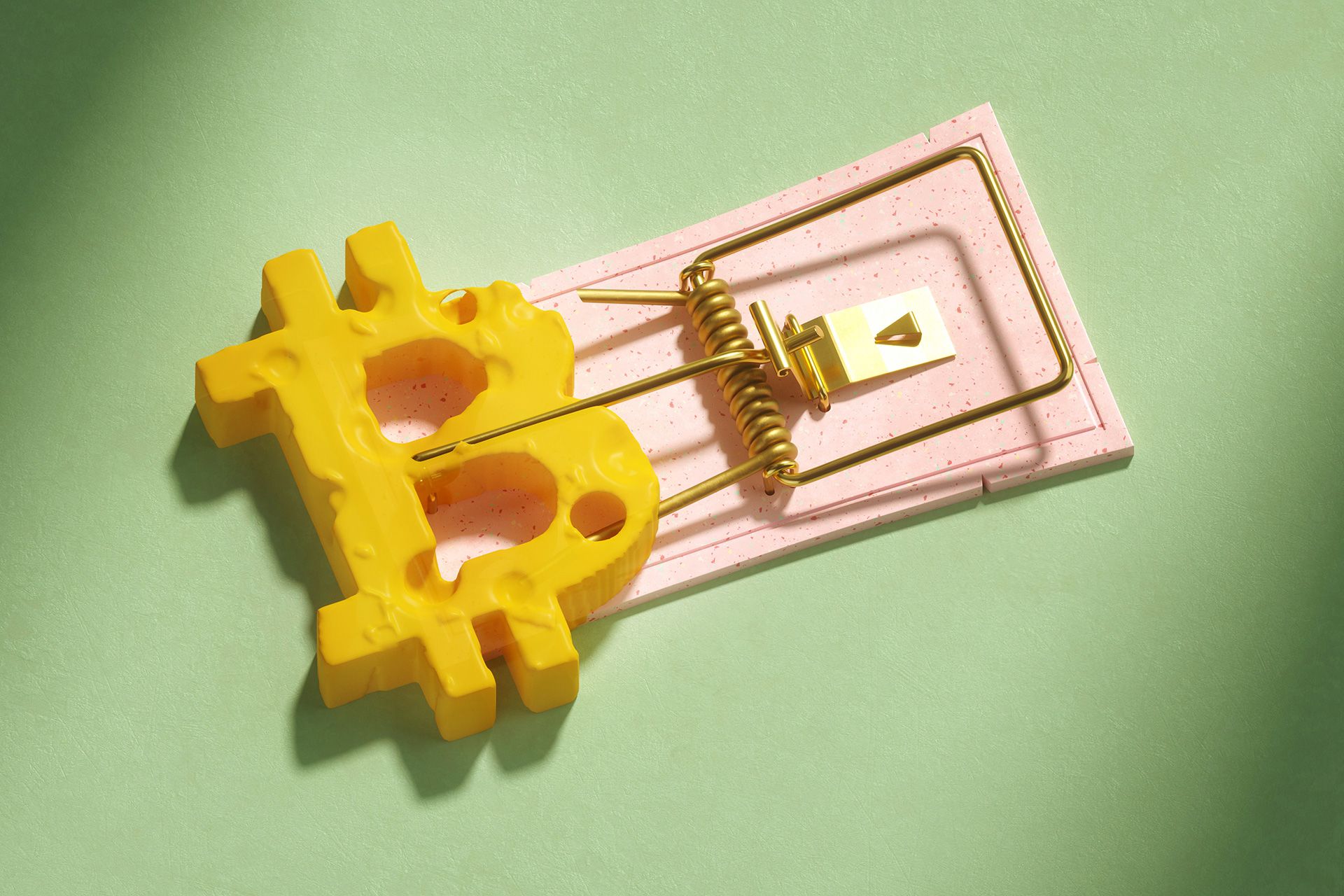

The daily chart for the S&P 500 E-Mini futures reveals a bearish pattern, a rising wedge that whispers of a potential sell-off. Could this be the moment when the bulls, so confident in their charge, find themselves trapped in a snare of their own making? 🪤🐂

S&P 500 hits record high with rising wedge 🏔️📈

The E-mini futures have ascended nearly 5% to a record high of $6,542 since Aug. 1. Their slow climb has taken the shape of a rising wedge, a pattern as foreboding as a Tolstoy protagonist’s inner turmoil. The converging trendlines suggest that bullish momentum is waning, like a dying ember in a hearth. 🔥❄️

When queried, Google Gemini, that modern oracle, intoned: “When a rising wedge appears after an extended rally, it significantly increases the probability of a sharp downside move. It suggests that buyers are exhausted, and the rally is running on fumes.” How apt, for in the markets, as in life, all things must come to an end. ⏳⚰️

Cryptocurrencies, ever the faithful companions of Wall Street sentiment, may soon feel the chill of a declining S&P 500. Will Bitcoin and its kin be left out in the cold? ❄️🪙

Inflation eyed 👁️💹

The specter of inflation looms large, like a ghost at a feast. If Thursday’s U.S. consumer price index (CPI) prints hotter than expected, the odds of a breakdown in the S&P 500 could rise sharply. Combine this with labor market weakness, and fears of stagflation-that most dreaded of economic maladies-may resurface. What a grim prospect for risk assets, both equities and cryptocurrencies alike! 👻💔

The median forecast for the U.S. CPI in August 2025 is a 2.9% year-over-year increase, the highest since January 2025. The core CPI, excluding food and energy, is expected to rise 3.1%. These figures, like the tolling of a bell, signal trouble ahead. 🔔⚠️

BTC, ETH options are already biased bearish 🐻📉

The 25-delta risk reversals tied to Deribit-listed bitcoin and ether options were negative out to December expiry. Short and near-dated BTC and ETH puts traded at a premium to calls, a clear sign of a bias for downside protection. It seems even the options market is preparing for a fall, like leaves bracing for winter. 🍂❄️

According to Imran Lakha, Founder of Options Insights, the put bias in BTC is likely due to institutions placing long-term hedges. Flows on Paradigm have continued to trend lower, with the [ETH] 26 Sep 4k put lifted up to 73v. Ah, the institutions-always one step ahead, or so they think. 🏦🤔

XRP is indecisive, DOGE looks north 🧭🐕

While BTC’s inverse head-and-shoulders breakout suggests a strong bullish direction, XRP’s price action is as indecisive as a character in a Tolstoy novel. Locked in a descending triangle and trading within the Ichimoku cloud, XRP seems content to consolidate, unsure of its next move. 🌀❓

A breakout from the triangle might invite stronger buying pressure, potentially leading to a re-test of $3.38. Yet, the descending triangle is generally bearish, a pattern that suggests sellers are gaining strength. Will XRP break free, or will it succumb to the bears? 🦅🐻

DOGE, ever the optimist, has retaken its bullish trendline from June lows, trapping sellers on the wrong side of the market. Prices have crossed into bullish territory above the Ichimoku cloud, hinting at a test of the July high of 28.76 cents. Yet, traders must remain vigilant, for a rising wedge breakdown in S&P 500 futures could cap DOGE’s gains and weigh on its momentum. 🐕🚀

In the end, the markets are a grand stage, where human emotions play out in the form of numbers and charts. Will the bulls charge forward, or will they be ensnared in a trap of their own making? Only time will tell. Until then, let us watch with a mixture of fascination and amusement, for in the markets, as in life, there is always a lesson to be learned. 🎭🌪️

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- 🤑 New Hampshire’s Bitcoin Bond: Revolution or Reckless Gamble? 🤑

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

2025-09-11 11:21