Oy vey! Bitcoin, that meshuggeneh digital dreidel, has found itself a bubbeleh, a blankie, a…ETF? 😲 Could it be? Is the wild man finally settling down? For the past month and year-to-date (YTD), those fancy-schmancy U.S. spot Bitcoin ETFs have been swimming in gelt! 💰💰💰

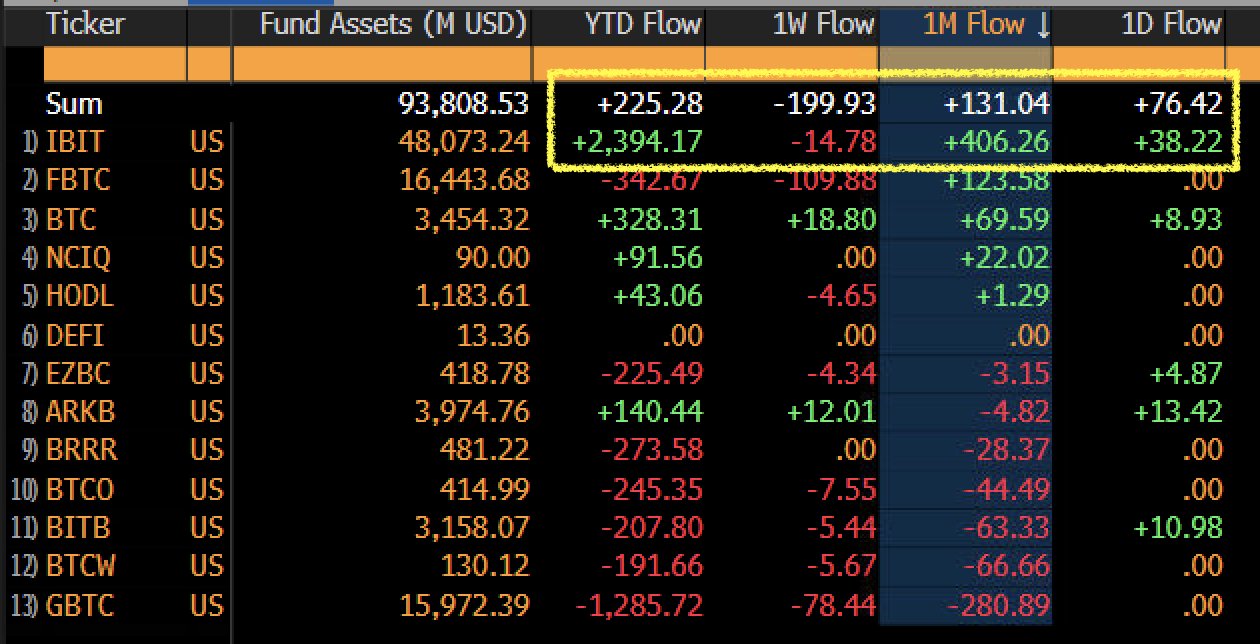

- Those Bitcoin ETFs, they’re like little landsmen, showing steady inflows this year, with IBIT leading the whole mishigas at over $2.4 billion YTD. It’s like a bar mitzvah, but with more zeroes!

- And get this, strong ETF participation adds to the reduction of long-term volatility. Less kvetching, more kaching!

Bitcoin Gains Stability as ETFs Absorb Sell-Side Pressure (Or Is It Just Sleeping?)

Leading this whole parade of profits is BlackRock’s IBIT, with a ka-CHING-ing $2.4 billion in flows this year! According to Bloomberg ETF data, this puts them in the top 1% of all ETFs YTD. They’re practically royalty! 👑

These inflows, they’re shouting from the rooftops: Institutional and retail demand for Bitcoin is HUGE, even with the market doing the hora and getting a little crazy. It’s a sign that investors are finally starting to believe the baloney! 🤡

New Holders Replacing Weak Hands (Like a Game of Musical Chairs, but with Crypto!)

These ETF buyers, they’re like the sanitation department, cleaning up after the previous owners who sold over the past 15 months. Out with the old, in with the new!

And who were those sellers, you ask? FTX-collapse victims (oy, what a tragedy!), former GBTC arbitrage traders (may their profits rest in peace), recipients of unlocked legal coins (finders keepers!), and government-seized assets (Uncle Sam always gets his cut!). It’s a regular garage sale of regret! 😫

Meanwhile, that maven Michael Saylor and his MicroStrategy, they’re still buying BTC like it’s going out of style! Absorbing sell-side pressure? More like a bottomless pit of Bitcoin desire! This has helped Bitcoin stay resilient in the $60K–$70K range, limiting volatility. Huzzah!

Unlike those short-term traders who panic at the drop of a matzah ball, ETF holders, they’re playing the long game. They’re like a bubbe watching her soup simmer – patient and wise.

Combined with Saylor’s unwavering strategy, BTC has become less reactive to daily macro events and altcoin speculation. This shift is evident in the rising concentration of whales and committed holders, while retail trader dominance has declined. The big fish are eating the little fish! 🐟

What’s Next for Bitcoin? (Besides a Nice Bowl of Chicken Soup?)

Beyond reducing volatility, this whole shebang may have bigger implications. It’s like finding an extra day in the week!

As more BTC is held via regulated ETFs, its correlation with risk assets could weaken. Over time, Bitcoin may align more with traditional capital flows rather than crypto-native sentiment alone. Maybe it’ll finally learn to behave itself! 🙏

The impact of large ETF inflows is clear in Bitcoin’s price action. Historically, BTC has undergone multiple consolidations before staging breakouts. It’s like a caterpillar turning into a butterfly… a very expensive, digital butterfly!

At press time, BTC hovered just above $80K. If ETF inflows continue at this pace, a breakout for Bitcoin could be imminent. Get ready to rumble! 🥊

Read More

- Crypto Chronicles: The Week’s Wild Ride with Bitcoin, Ethereum, and XRP! 🚀💰

- Gold Rate Forecast

- USD TRY PREDICTION

- EUR CNY PREDICTION

- INR RUB PREDICTION

- BONK PREDICTION. BONK cryptocurrency

- USD ARS PREDICTION

- SUI PREDICTION. SUI cryptocurrency

- XMR PREDICTION. XMR cryptocurrency

- TIA PREDICTION. TIA cryptocurrency

2025-04-17 23:07