Ah, Bitcoin! That digital darling, forever teasing us with its capricious nature. 🎭 It seems our leading coin has been playing a rather dramatic game of see-saw these past weeks, causing a flutter amongst the faint of heart—those delicate souls we affectionately call “paper hands.”

Yet, even amidst this delightful volatility, the long-term holders (LTHs), those paragons of patience, remain as steadfast as a statue in a storm. 🗿 They show no signs of relinquishing their ambition to elevate BTC back to the dizzying heights above $85,000. The question, of course, is: How soon will their dreams materialize? 🤔

Bitcoin Long-Term Holders: From Selling to Stacking, A Curious Conversion

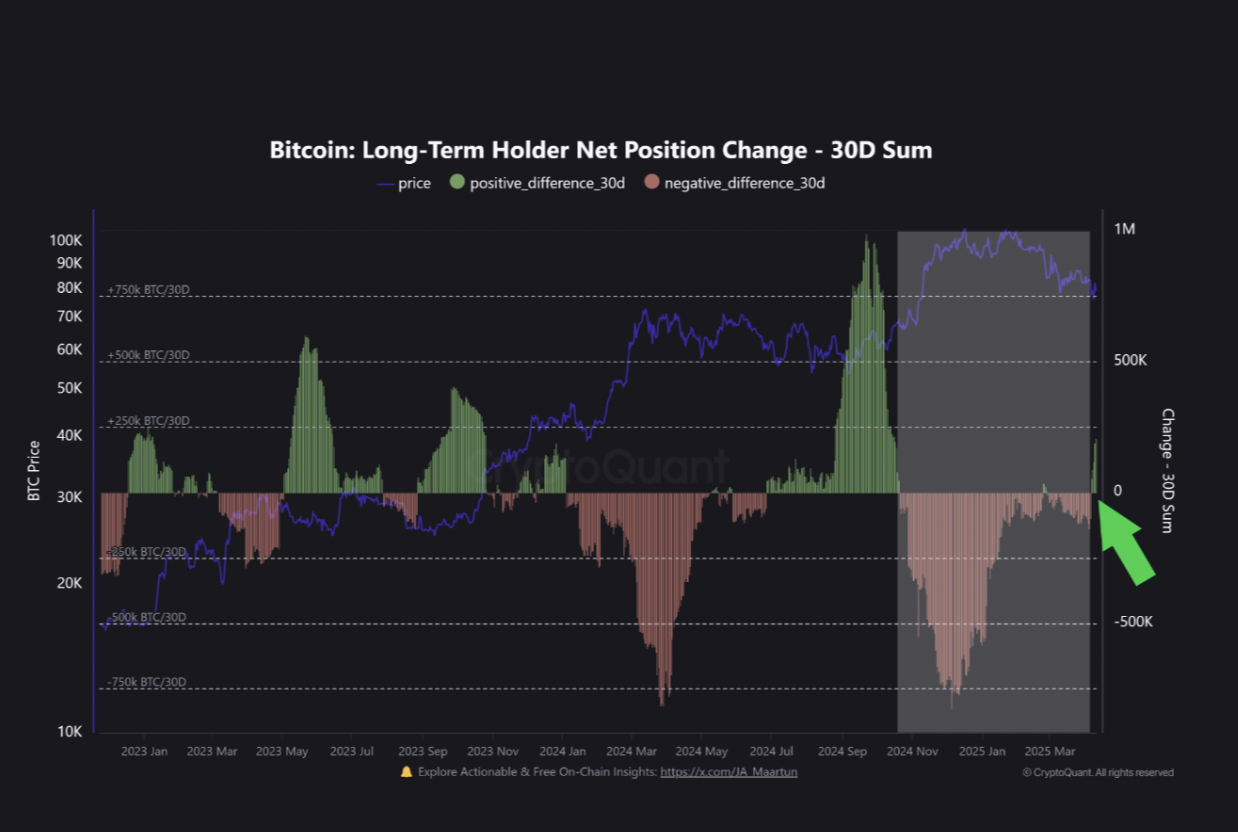

In a report penned with the flourish of a novelist, CryptoQuant analyst Burak Kesmeci has observed BTC’s Long-Term Holder Net Position Change (30d sum). 🧐 Since April 6, this metric has taken a turn for the positive, showcasing a decidedly upward trajectory. According to Kesmeci, this ascent has already propelled BTC by a respectable 12%. Bravo! 👏

Now, for those of us not fluent in crypto-speak, BTC’s Long-Term Holder Net Position Change tracks the buying and selling habits of LTHs (those who have graciously held their assets for a minimum of 155 days). It measures the shifting sands of coin holdings by these venerable investors over a given epoch. ⏳

“While it’s too early to pronounce judgment, the burgeoning positive momentum in this metric could be a harbinger of returning long-term conviction in the market.”

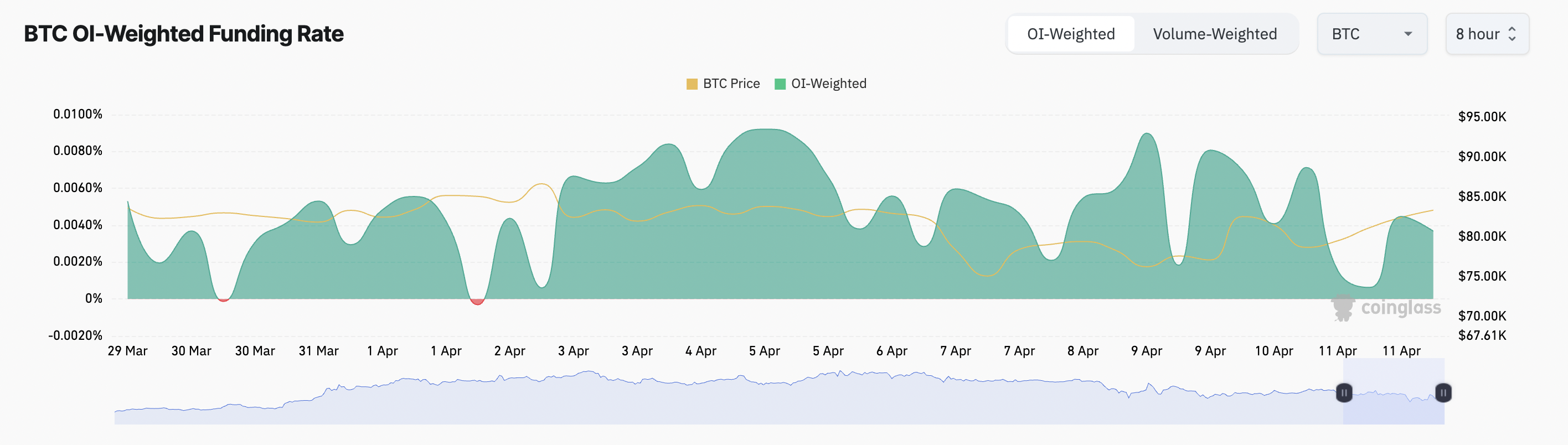

Furthermore, BTC’s funding rate has maintained a positive stance amidst its price tribulations, further solidifying the bullish outlook. At the present moment, it stands at a respectable 0.0037%. Quite! 🧐

For the uninitiated, the funding rate is the periodic exchange of payments between long and short traders in the perpetual futures markets. It is designed to keep the futures price in harmonious proximity to the underlying asset’s spot price. A delicate dance, indeed! 💃

When it is positive, as it is now, long traders are compensating short traders. This indicates a bullish market sentiment, as more traders are staking their fortunes on BTC’s ascent. 🐂

Long-Term Holders: Setting the Stage for an $87,000 Extravaganza

The surge in accumulation from BTC LTHs has propelled the coin’s price above the key resistance at $81,863. At the time of this writing, the king coin trades at $83,665. A regal performance! 👑

As the market responds to these sustained buying pressures from LTHs, the coin’s price may be poised for a significant rally in the near future. A most exciting prospect! 🎉

Should retail traders follow suit and amplify their coin demand, BTC could breach the $85,000 threshold and surge towards $87,730. Oh, the audacity! 🤩

However, should this accumulation trend falter and these LTHs succumb to the temptation of profit-taking, BTC could resume its decline, plummet below $81,863, and descend towards $74,389. A cautionary tale, indeed! ⚠️

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- USD PHP PREDICTION

- INR RUB PREDICTION

- OM PREDICTION. OM cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- ILV PREDICTION. ILV cryptocurrency

- MNDE PREDICTION. MNDE cryptocurrency

2025-04-12 11:37