Oh, what a circus! 🎪 The grand stage of finance, once glittering with the fool’s gold of crypto dreams, now resembles a haunted marketplace at midnight-abandoned carts, wailing traders, and the faint echo of someone whispering, “I thought it was going to the moon!” Yes, dear reader, Bitcoin-our beloved digital tulip-has shed over 35% of its value since its fleeting flirtation with $126,000, leaving investor confidence scattered like cigarette butts after a bathtub riot.

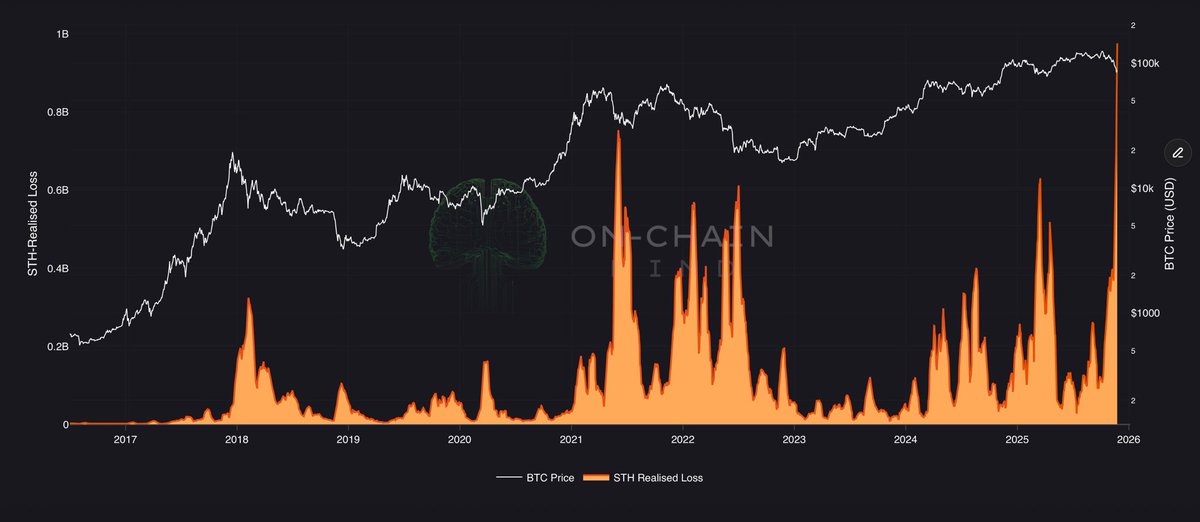

But wait! There’s more! 🎭 Just when you thought the show couldn’t get grimmer, enter: the short-term holders. 🫣 These brave souls-bless their impulsive hearts-rushed in like peasants chasing a carnival mirage, only to be vaporized by the cold breath of market reality. According to On-Chain Mind (yes, that’s a real name, not a rejected philosophy podcast), these modern-day Don Quixotes are now sustaining the biggest realized losses in Bitcoin’s entire checkered history. We’re talking over $900 million per day flushed into the abyss-enough to fund a small country’s espresso addiction for a decade. ☕💸

For context, let’s compare: during the China mining ban, markets trembled. During FTX’s meltdowns, angels wept. During the COVID crash, even gold ETFs side-eyed crypto like a disappointed father. Yet, none of those tragedies reached the operatic despair of today. This isn’t just capitulation-this is surrender with a full orchestra and interpretive dancers. 🩰💀 The short-term holders, those fragile flowers of volatility, have collectively decided: “No more! Take my coins and my dignity!”

Some say this is the end of the bull run-a bear is sharpening its claws on Wall Street, preparing to hibernate in our portfolios. Others, the eternal optimists (possibly delusional or just well-medicated), whisper that such mass panic has, in the past, signaled the prelude to miracles. 🌈 Could this be the soil where the next rally roots? Perhaps. But if so, it’s growing out of financial compost and tears.

Short-Term Holders Face Record Losses as Market Capitulates

Yes, sir, yes! The $900-million-a-day bloodletting continues, as if the market hired a team of accountants whose sole job is to record sorrow. On-Chain Mind’s data doesn’t lie-though it might be weeping quietly in a spreadsheet. Short-term holders are selling at levels that would make even a distressed landlady blush. Panic? Oh, it’s not panic-it’s a full spiritual collapse, like discovering your lover was actually your cousin in a folk tale. 😵💫

When these tenderfoot traders flee en masse, it usually means one thing: sentiment has snapped. The herd has been trampled. And unlike past crises-the FTX implosion, the mining exodus from Xinjiang, the time Elon Musk sneezed and BTC dropped 8%-this bout of misery is… different. It’s deeper. More existential. As if the entire market has just read Kafka and realized it’s the main character. 🕷️

Yes, some still cling to hope. “This could be a major bottom!” they cry, like street preachers at 4 a.m. If Bitcoin stabilizes near $80K-$85K, perhaps the brave will return. But until then, the vultures circle, and the bears sharpen their spreadsheets.

BTC Tests Weekly Support After Sharp Reversal

The weekly chart, once a proud banner of ascent, now droops like a tired flag over a fallen empire. From the dizzying peak of $126K, BTC now languishes around $86,900-back to the vicinity of the sacred 100-week moving average, currently loitering at $83,000 like a suspicious stranger near a park bench.

This moving average, once a humble line on a chart, has now become the Gates of Mordor. 🔥 Should Bitcoin close below it on a weekly basis, the bear market will be officially anointed, and analysts-those wise owls who were wrong all last year-will nod gravely, as if they predicted it all along. “We warned you,” they’ll say, sipping tepid coffee in their pajamas.

For now, a slight glimmer of resistance forms around $80,000-$85,000-a zone of yesteryear consolidation, now sanctified by memory and blood. Tiny wicks flicker like candle flames: weak, but not yet extinguished. It could be early demand. Or just a nervous twitch. Only time-and margin calls-will tell.

Momentum still points southward, faster than a bureaucrat fleeing an audit. The 50-week moving average has been left behind like a forgotten lover. And to reclaim bullish dignity, BTC must storm the $95,000-$100,000 fortress-a region now occupied by resistance and scorned former buyers.

Until then, the market remains in that peculiar limbo between despair and resurrection. Awaiting the next miracle. Or the next disaster. Probably the disaster. 🌪️

But fear not, comrade! In the words of every bad trader: “It’s just a correction.” 🫡

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- KuCoin’s Bold Foray Into Thailand: Crypto Drama Meets Tropical Charm! 🐘💸

2025-11-27 04:15