BNB price has wandered into a corrective groove, sliding more than six percent and slipping its nose below the storied six hundred, all while the rest of the crypto landscape shivers like a catfish in a hailstorm. This weren’t no random stumble. The price action, if you squint and tilt your hat just so, shows a bear flag broke on the daily chart-proof that the recent lull was naught but a foreman’s feather bed for a continued tumble. With sentiment stiff as a dry biscuit and risk appetite retreating across the big altcoin herd, BNB stands at a crossroads, facing a crowd with selling fingers itching at a critical moment.

Bearish Flag Breakdown Shifts BNB Price Lower: Is $500 the Next Stop?

For several sessions, BNB carved out a tight, upward-slanting channel after its prior tumble-a plain-as-day bearish flag if you’re lookin’ with one eye closed and the other half-asleep. This sort of pattern typically signals a short-lived relief hop before another leg lower, and the latest sell-off gives that yarn a full-throttle tailwind. The breakdown showed its face near the $620 zone, where sellers kept slapping the upside attempts like a nudge from a stubborn mule. Once BNB ceded the $600 support, selling pressure deepened, proving that buyers couldn’t soak up the supply at that key gate.

The momentum with RSI and MACD tilt toward the bearish, crossing in unfriendly fashion. The break with heavier-than-usual volume lends the move some real cred-bearish conviction instead of a mere liquidity drift to the bottom.

Now that BNB trades under $600, that old floor turns into a stubborn ceiling. Any quick hop back toward $600-$610 is apt to meet renewed selling pressure unless the broader market wakes up from its nap and dusts off its pockets.

On the downside, the first technical checkpoint sits near $560, a modest intraday reaction level. Yet the heftier demand band lies between $520 and $500, where buyers have shown their faces before. A clean break below $500 would tilt the bigger medium-term structure and could lay bare deeper retracement levels, though for the moment the crowd’s eyes are on whether the bulls can defend the mid-$500s.

Top Exchange Positioning Shows Shorts in Control

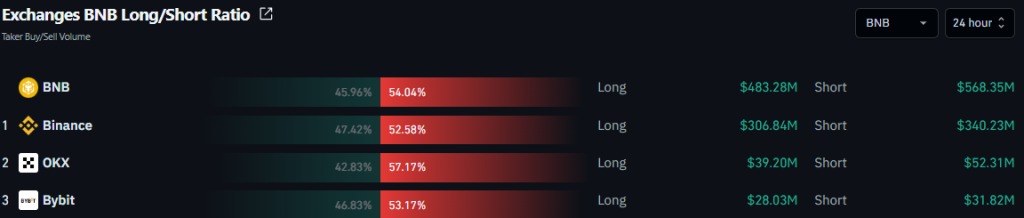

Derivative data positioning weighs in on the bear’s side across the major exchanges over the last day. On Binance, short exposure sits around $584 million against roughly $492 million in longs, showing sellers currently hold the directional reins. On OKX, about $351 million in shorts eclipses nearly $315 million in longs, reinforcing the broader tilt toward downside among active derivatives traders. Bybit also echoes this imbalance, with shorts near $53 million versus longs around $40 million, suggesting bettors are still leaning toward more correction rather than a swift comeback.

This steady dominance of short exposure across the top three moons and stars of exchanges signals that participants aren’t rushing to mount a heroic rebound. Instead, traders seem to be leaning into continuation risk, especially after the confirmed bearish flag breakdown beneath the $600 threshold. Liquidation data backs this story as well: as BNB slid below key support, leveraged longs were flushed out, accelerating the fall. Meanwhile, cumulative short liquidity now clusters above the $610-$620 band, meaning any sharp recovery into that zone could light a fire under forced buying. Until that level is reclaimed decisively, derivatives positioning keeps tipping toward the sellers.

Can $500 Become the Next Magnet?

BNB price remains structurally vulnerable below $600. The confirmed bearish flag breakdown nudges technical focus toward the $520-$500 region as the next meaningful support cluster. A relief bounce toward $600-$610 is possible, particularly if the broader market conditions straighten up. Yet, without a sustained reclaim of $610 accompanied by rising volume and improving long/short ratios, upside moves are likely to be treated as mere corrective hops. If sellers keep the stage and derivatives keep lending the bears a hand, the $500 zone could become the next magnet for liquidity before any durable reversal gets its feet under it.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

2026-02-11 16:07