Analysts report that the BlackRock’s iShares Bitcoin Trust exchange-traded fund surpassed the $70 billion milestone quicker than any other ETF ever introduced, significantly outpacing its peers in terms of speed.

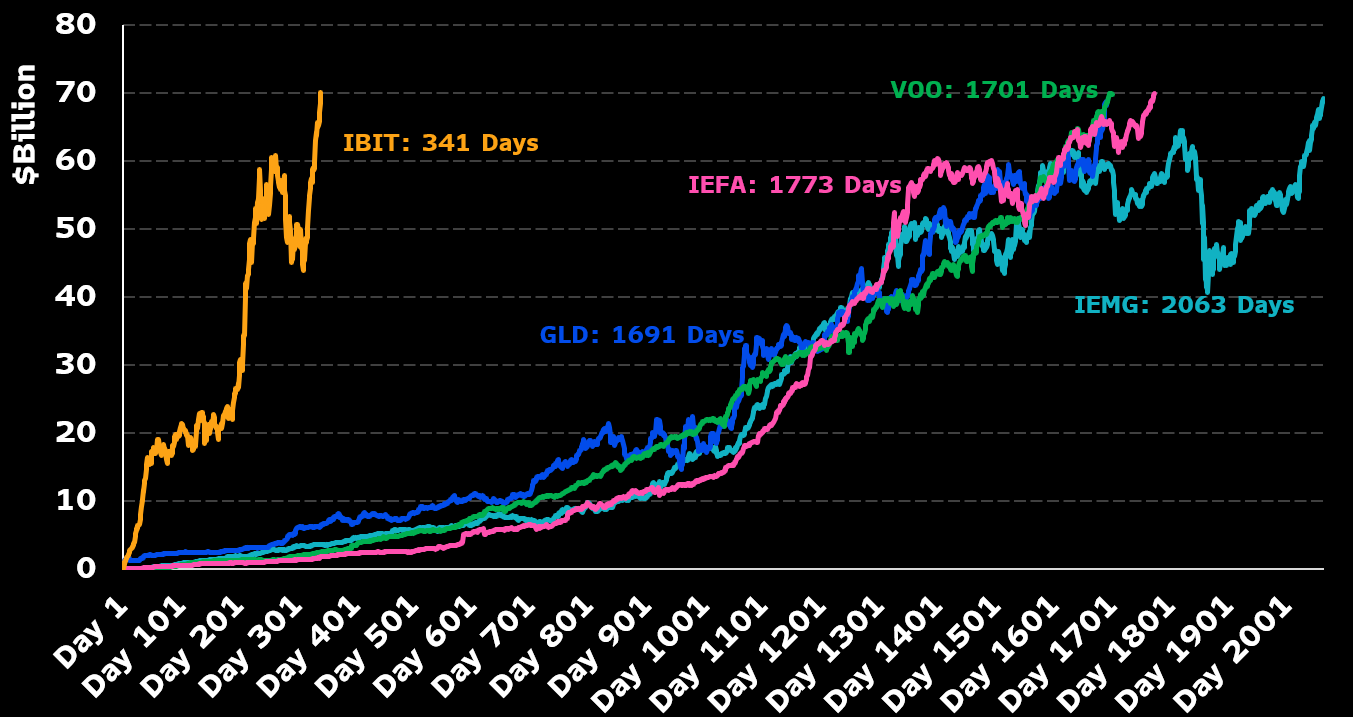

Eric Balchunas, an expert in ETFs at Bloomberg, notes via social media platform X that the IBIT has hit the $70 billion milestone five times quicker than the gold-backed GLD fund.

IBIT surpassed the $70 billion milestone in just 341 days, making it the ETF to reach this figure fastest. This is five times quicker than the previous record set by GLD, which took 1,691 days.

Initially, when BlackRock submitted its application for IBIT, the value was around $30,000 with the lingering scent of FTX in the air. Now, it has soared to $110,000, representing a return that is seven times greater than the S&P 500’s mighty growth. As a result, it has gained legitimacy among other significant investors.

Based on information from the blockchain analysis platform Arkham, it’s estimated that BlackRock possesses a whopping $76.19 billion in digital assets within their cryptocurrency portfolios at present.

In his yearly message to shareholders, BlackRock’s CEO, Larry Fink, expressed that the dominance of the US dollar won’t persist indefinitely and is currently showing signs of erosion. This isn’t just because of escalating national debt but also due to the growing influence of digital currencies and financial systems that are not controlled by any central authority (decentralized finance, or DeFi).

Says Fink,

“The US has benefited from the dollar serving as the world’s reserve currency for decades.

However, it’s important to note that this current state isn’t set in stone forever. Since the Debt Clock in Times Square started counting in 1989, the national debt has been increasing at a rate three times faster than our country’s GDP. This year alone, interest payments on the debt are projected to surpass $952 billion, eclipsing defense spending. By 2030, mandatory government spending and debt servicing could consume all federal revenue, leading to a persistent deficit. If we don’t address our national debt soon and curb the growing deficits, there’s a risk that America might lose its dominant economic position to digital assets like Bitcoin.

Let me clarify, I’m not against digital assets at all – in fact, you’ll see my support for them in the following section. However, it’s important to acknowledge that two things can coexist: Decentralized finance is indeed a groundbreaking invention; it speeds up markets, reduces costs, and enhances transparency. But if investors start viewing Bitcoin as a safer investment option than the U.S. dollar, it could potentially weaken America’s economic standing.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

2025-06-10 21:22