Ah, dear reader, imagine a world where our dear Bitcoin (BTC) dances a lively quadrille in May, gently coaxed by enigmatic forces. One might muse—if not wryly chuckle—that furtive miner economics, the capricious network hashrate, hoarded fortunes of steadfast holders, and a torrent of global fiat liquidity conspire to herald a most curious rally of prices.

In a twist reminiscent of a Gogolian farce, this venerable digital coin, our modern treasure, valiantly recovers from the doldrums of early April, boasting a robust 14.6% increase over the past month—a phenomenon as puzzling as it is delightful.

Has the Fabled Bitcoin Bull Run Returned?

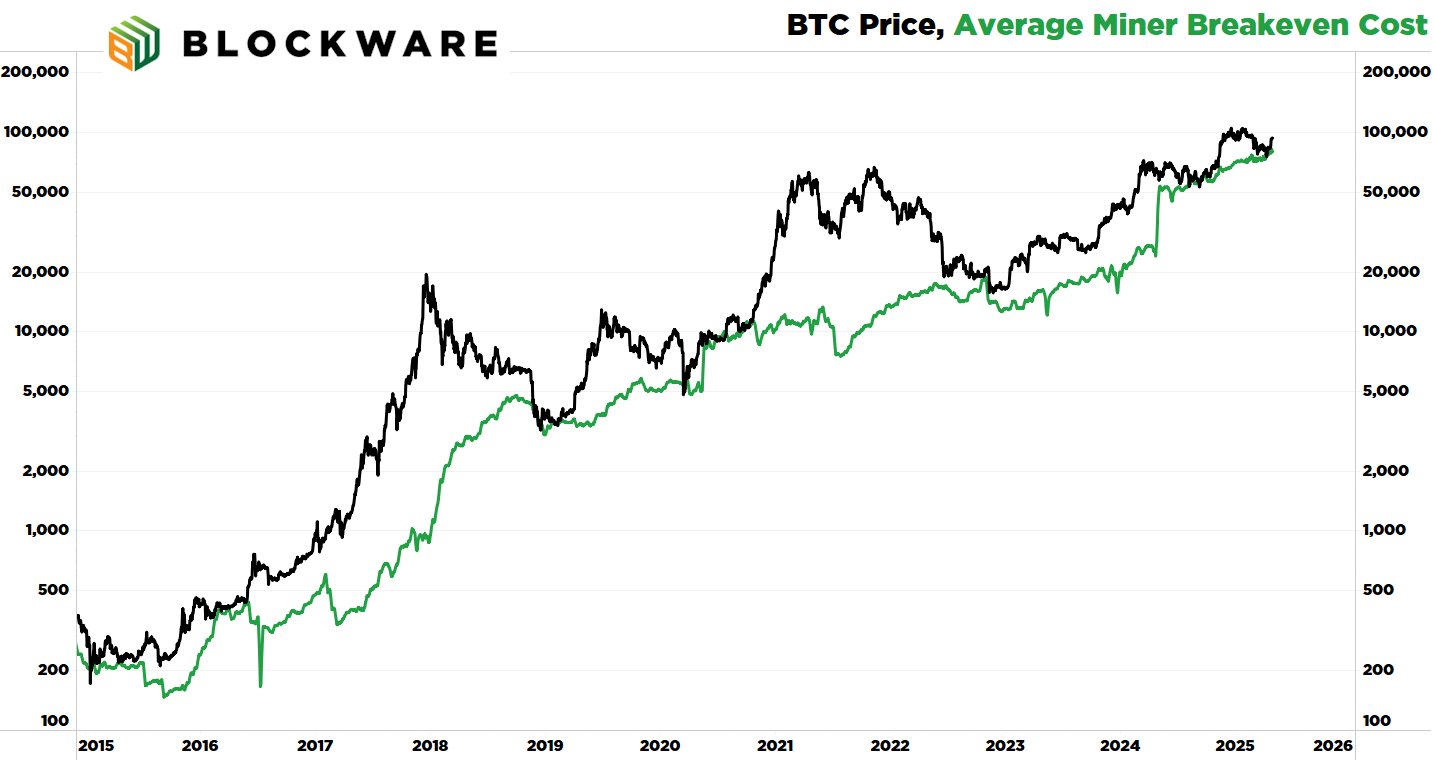

In the latest missive on X (formerly the chattering Twitter), the cryptic sage and founder of WiM Media, Robert Breedlove, invoked the spectral wisdom of Blockware Team’s miner breakeven data. With a wry smile and a knowing nod, he intimated that Bitcoin may now be poised on the very brink of a bull market—a sentiment so absurdly hopeful it could make one laugh amidst the tears.

He mused that prices normally dare not linger beneath the miner’s breath-taking average for too long, for if the coins are too cheap, these diligent miners may decide to pack their tools and vanish, leaving a void in the cryptic bazaar.

“In a rational economy, assets rarely trade below their cost of production,” Breedlove declared, as if this maxim were the punchline to a cosmic jest.

Indeed, the fates, in their infinite mischief, have witnessed six such bottoms between the years 2016 and 2024. Now, a seventh—nay, an omen—whispers of yet another trough, intimating that Bitcoin’s ascent might be a matter of time.

The mysterious MacroMicro data, not to be outdone by satire, reveals that the 30-day moving average (MA) of the mining cost-to-BTC price ratio lingers at 1.05. A peculiar potion indeed, for it suggests our miners have been engaged in a dance of loss, perhaps hastening a tightening of supply and paving the way for a grand upward surge.

Adding to the delightful absurdity, the Bitcoin hash rate price model—a mechanism that courts the bizarre by measuring value through historical hash rates—further endorses the bullish caper.

An ever-sagacious analyst, Giovanni, proclaimed on X that the model has alighted upon a support level. One can only imagine this as a sign that, much like a plot twist in a Gogolian comedy, the local bottom has been reached.

“The fact the hash rate based BTC valuation is at the support level means that probably we reached some kind of local bottom,” the analyst quipped, a wry grin dancing upon his words.

And lo! Additional signals from the murky market extend their conspiracies. Breedlove noted that long-term guardians of Bitcoin have amassed roughly 150,000 BTC in the last 30 days—a hoard so grand that it may sedate selling temptations between the lofty realms of $80,000 and $100,000.

Thus, as the fickle market treads its eternal minuet, with demand abounding and available coins dwindling, upward pressure looms large, much like fate itself—both humorous and inevitable.

“At its core, the Bitcoin price is simply a function of supply and demand. After an increase in the Bitcoin price, you start to see previously inactive coins move on-chain. Inversely, after prolonged periods of sideways or negative price action, long-term holders begin accumulating more coins, setting the stage for a supply-shock and upward price pressure,” he added, as if narrating a grand epic penned by destiny.

Moreover, the rising tide of global fiat liquidity, expanding like a mirthful river, beckons new capital to dive into the tumultuous pool of Bitcoin investments. With ETFs, Bitcoin treasury companies, and convertible bonds intersecting in a charmingly absurd dance, traditional finance dare to mingle with the digital realm.

“And it’s not just USD liquidity that’s increasing – liquidity of all fiat currencies is on the rise, and Bitcoin is a global asset,” Breedlove proclaimed, as though declaring a universal truth wrapped in irony.

In a most unexpected twist, BeInCrypto too has sung praises of bullish omens. With demand now donning a jovial countenance and the Market Value to Realized Value (MVRV) ratio rebounding from a storied 1.74, the early stirrings of a bull market seem nigh inevitable.

The saga continues as BTC, after a brief dalliance below the 75,000 mark in early April, resumes its climb. The latest chapter finds Bitcoin trading at a princely $97,048—an ennobled rise of 2.3% on the day, and a mischievous 4.3% boost over the past week. Oh, the irony and delight of this modern fable!

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

2025-05-02 08:39