In the grand theater of finance, where fortunes rise and fall like the tides of human folly, Bitgo, the self-proclaimed custodian of digital treasures, has unveiled its latest act: a fourth amended Form S-1, a document so laden with ambition it could rival the War and Peace of regulatory filings. 🗄️✨

Bitgo’s Amended S-1: A Symphony of Shares and Vanity

The amendment, penned on the 12th of January, reveals a plan as intricate as a Tolstoy novel: an offering of 11.8 million shares of Class A common stock, with 11 million from the company itself and a modest 821,595 from existing stockholders. Bitgo, ever the optimist, anticipates an IPO price between $15 and $17 per share, though the final terms remain as elusive as a coherent plot in Anna Karenina. 🤔💸

Founded in 2013, Bitgo Holdings, Inc. positions itself as the grand architect of digital asset infrastructure, catering to the whims of institutional clients. Its platform, a sprawling empire of self-custody wallets, regulated custody, staking, liquidity, and infrastructure-as-a-service, serves exchanges, financial institutions, corporations, and even government entities. A true jack-of-all-trades, or perhaps a master of none? 🛠️🤹♂️

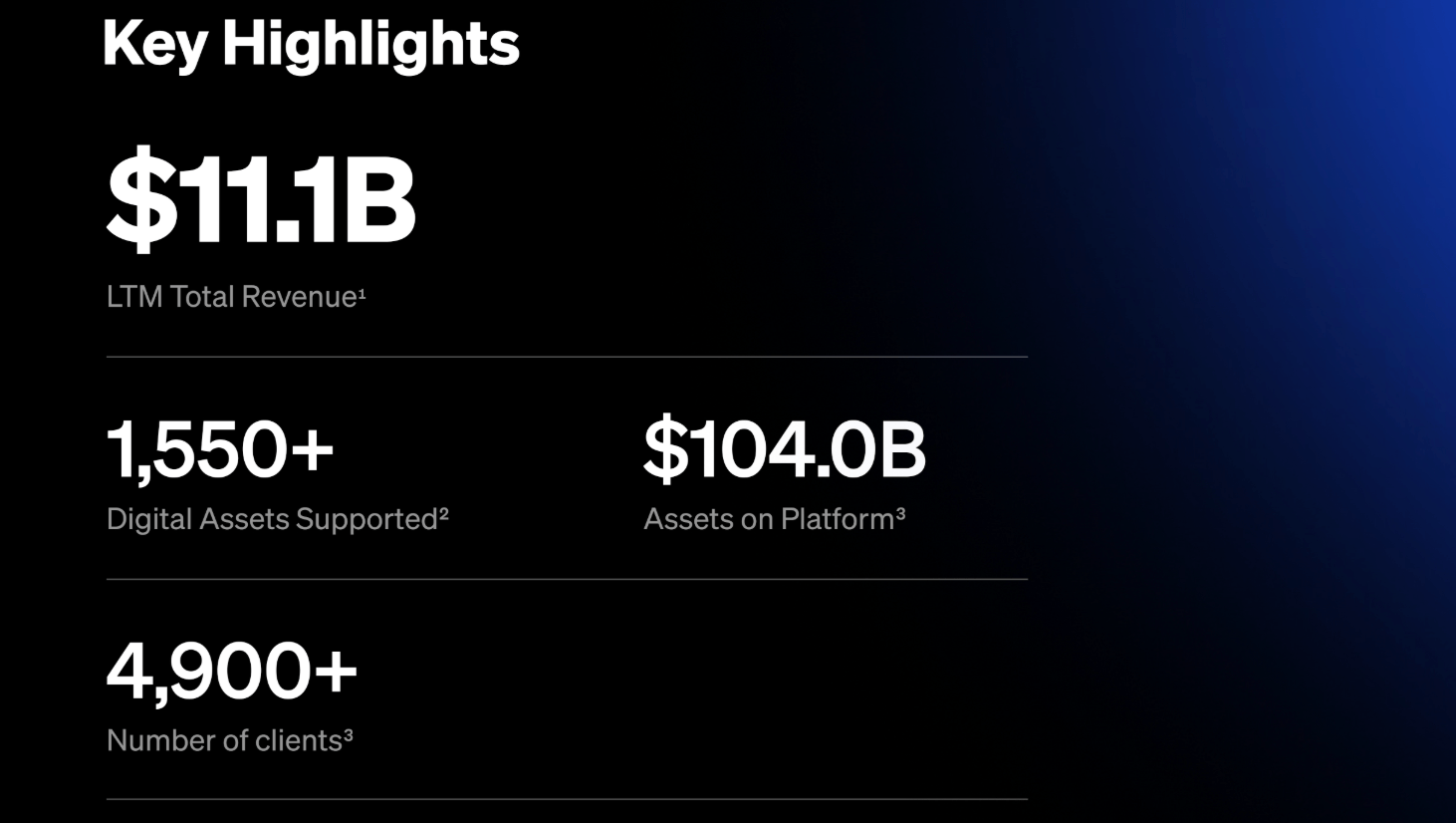

In its filing, Bitgo boasts of supporting over 1,550 digital assets and safeguarding a staggering $104 billion in assets as of September 30, 2025. With more than 5,100 clients and 1.18 million users across 100 countries, the company clearly favors the grand stage of institutional adoption over the humble retail trader. A noble pursuit, or merely a strategic dodge? 🌍🏦

Financially, 2025 was a year of dramatic growth, with Bitgo estimating total revenue between $16.02 billion and $16.10 billion, a leap from $3.08 billion in 2024. Most of this windfall stems from digital asset sales, with costs nearly mirroring revenue. Yet, despite such grandeur, the company expects a modest operating profit of $3.2 million to $3.5 million, a mere whisper compared to its ambitions. Profits, it seems, are as elusive as happiness in a Tolstoy novel. 📈💼

Among its new ventures, Stablecoin-as-a-Service generated a modest $63 million to $67 million in revenue, while staking brought in $367 million to $387 million, a decline from 2024 due to the fickle nature of digital asset prices. Ah, the perils of relying on the whims of the market! 📉💹

Governance, however, is where the true drama unfolds. Bitgo plans a dual-class share structure, with Class B shares wielding 15 votes each, compared to a single vote for Class A shares. Co-founder and CEO Michael Belshe, in a move reminiscent of a 19th-century aristocrat, will control over half of the company’s voting power. A “controlled company” under NYSE rules, Bitgo may yet rely on governance exemptions, though it claims no such plans-for now. Power, it seems, is as intoxicating as it is perilous. 👑🗳️

Regulatory approval, too, has smiled upon Bitgo. In December, its trust subsidiary received the nod to become a federally regulated national trust bank under the watchful eye of the OCC. A move, the company claims, that strengthens its standing with institutional clients. Yet, one wonders if this is merely another layer of veneer on the grand facade. 🏛️📜

Bitgo, ever cautious, notes it will not reap proceeds from shares sold by existing stockholders, and the offering remains subject to market conditions and regulatory review. Still, the stage is set for its public debut, complete with scale, ambition, and a governance structure that investors will scrutinize with the eye of a Tolstoy protagonist. Will it be a triumph, or a tragic tale of hubris? Only time will tell. 🎭🤔

FAQ ❓

- What is Bitgo planning?

Bitgo plans to go public through an initial public offering on the New York Stock Exchange under the ticker BTGO. A grand entrance, indeed. 🎟️ - How much revenue did Bitgo report for 2025?

The company estimates total revenue between $16.02 billion and $16.10 billion for 2025. A sum that would make even a Russian nobleman blush. 💰 - Who controls voting power at Bitgo?

Co-founder Michael Belshe is expected to retain majority voting control through Class B shares. Power, it seems, is a game best played by the few. 🧑💼⚖️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD GEL PREDICTION

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- ZK Price: A Comedy of Errors 📉💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2026-01-12 21:03