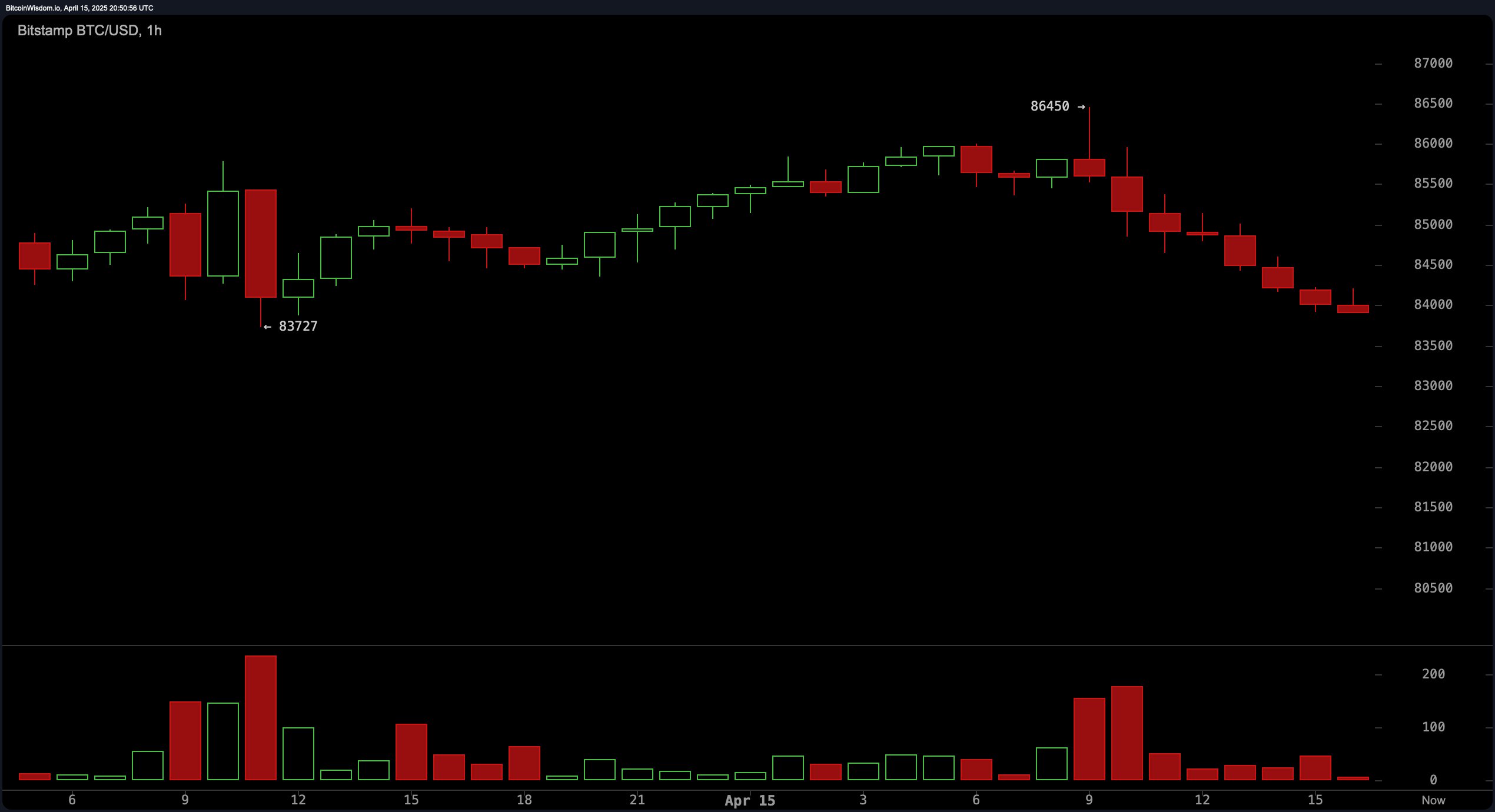

Bitcoin, that digital enigma wrapped in a cryptographic mystery, decided to take a little nap on Tuesday afternoon, slipping about 0.8% from $86,450 to $83,904. This minor tumble coincided with Wall Street’s own existential crisis, as equities decided to join the pity party amid tariff-induced anxiety. Because, of course, why not?

Equities and Crypto: A Tale of Two Markets and One Big Tariff-Induced Headache

As of 4:50 p.m. EDT on Tuesday, Apr. 15, the global crypto market capitalization had shrunk by 1.07% to $2.65 trillion. Bitcoin, the poster child of digital currencies, gave up approximately 0.8% after briefly flirting with $86,450 earlier in the day. Ethereum (ETH) followed suit, slipping 1.16%, while Cardano (ADA) decided to take a nosedive, falling 2.64% against the U.S. dollar. Because why not make it a competition?

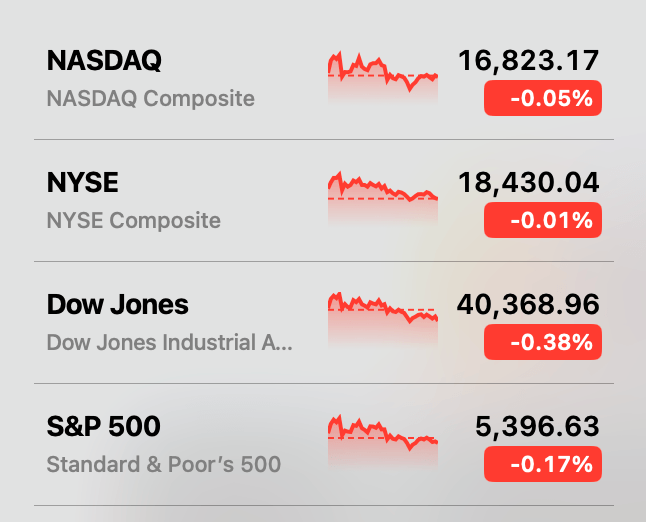

Meanwhile, stocks were also having a rough day, with key indices posting slight declines ranging from 0.05% to 0.38%. Quarterly reports from Citigroup and Bank of America were released, but both came with a side of cautionary notes. Bank of America CEO Brian Moynihan said, “There’s a lot that could potentially change given the uncertainty around the tariffs and other policies in the future path of the economy.” Translation: “We’re all just winging it here, folks.”

In the crypto derivatives space, the downturn triggered liquidations totaling $176.72 million, according to figures from coinglass.com. Of that amount, approximately $105.86 million came from long positions, with BTC longs alone accounting for $18.65 million. Meanwhile, MANTRA’s OM emerged as the day’s top performer, climbing 23% following the project’s weekend fallout. Because in crypto, even chaos has a silver lining.

Toncoin (TON) followed, albeit with a more tempered gain of 3.67%. On the flip side, PI recorded the steepest decline, dropping 10% over the past 24 hours. Gold, by contrast, has inched up 0.60%, with an ounce now trading at $3,229. Because when everything else is falling apart, gold just sits there, smugly sipping its tea.

As traders digest fresh data and liquidations unsettle speculative bets, the day’s contrasting gainers and decliners suggest a market still searching for conviction amid uncertainty. In Trump’s tariff era, volatility, it seems, remains the only constant for now. So buckle up, folks. It’s going to be a bumpy ride. 🎢

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- Shiba Whales Throwing Cash? 🐳💰

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

2025-04-16 00:27