Ah, Bitcoin—the digital rollercoaster that never fails to entertain! After a minor hiccup (or as we like to call it, “the market’s coffee break”), BTC dipped its toes near the $115,000 support level. But fear not, dear reader, for our beloved crypto king quickly bounced back, proving once again that it thrives on chaos and caffeine ☕. Bulls remain optimistic despite bears attempting their usual mischief.

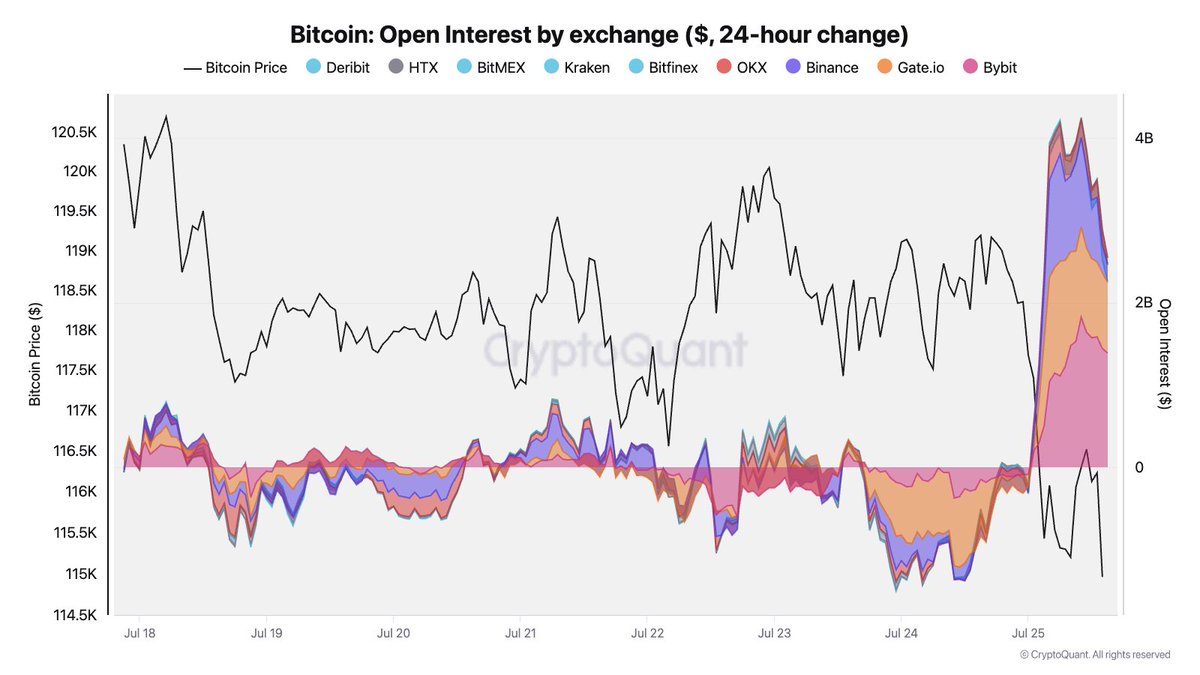

According to data from CryptoQuant—an organization presumably run by people who sleep less than traders—open interest across major exchanges surged dramatically in just 24 hours. Binance, Bybit, and Gate were flooded with large Bitcoin transfers earlier today. One can only assume these are the work of whales or institutions flexing their financial muscles 💪. Perhaps they’re preparing for battle, or maybe they just wanted to confuse everyone. Either way, it’s fascinating theater.

This sudden influx of activity hints at shifting sentiments among traders. Short-term players are jumping back into the fray while bulls stand guard over key levels like medieval knights protecting their castle 🏰. If Bitcoin manages to hold its ground, we might see another glorious ascent toward uncharted highs. However, if things go south, well… let’s just say no one wants to be caught holding the bag when the music stops 🎶.

The Drama of Leverage: A Comedy of Errors?

Julio Moreno, CryptoQuant’s head of research, reports a jaw-dropping $4 billion surge in open interest within the last day—a clear sign that leveraged positions, particularly shorts, have entered the arena en masse. It seems short sellers are betting big on Bitcoin’s downfall, but history has shown us time and again how such hubris often ends in tears 😭. With BTC already recovering from its recent dip, this could set the stage for a classic short squeeze—a spectacle even Shakespeare would applaud!

Meanwhile, Ethereum and altcoins are putting on quite the show themselves. Since May, ETH has been outshining Bitcoin, thanks to institutional love and regulatory clarity in the US 🇺🇸. As capital flows from BTC into altcoins, investors watch eagerly, popcorn in hand 🍿, wondering whether this trend will continue or fizzle out like last year’s diet craze.

BTC’s Support Saga: Can It Hold On?

Looking at the daily chart, Bitcoin still clings stubbornly to its bullish structure despite recent turbulence. After flirting dangerously close to the $115,700–$117,000 support zone, BTC found solace near the 50-day SMA ($117,593.23). Truly, this is where technical analysis meets poetry 📈. The uptrend since early May remains intact, with higher highs and higher lows painting a picture of resilience.

Volume tells its own tale: slight increases on red candles suggest some selling pressure, but panic? Not here, folks. As long as BTC stays above $115,700, the bulls retain control. Break above $122,000, and voilà—we may witness yet another sprint toward new records. Just remember, though, in the world of crypto, nothing is ever guaranteed except endless excitement—and memes 🚀.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- ETH PREDICTION. ETH cryptocurrency

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

2025-07-26 19:46