Short-Term Volatility, Long-Term Opportunity?

Ah, Bitcoin! The digital currency that dips faster than a politician’s promise when war breaks out. Yes, folks, when geopolitical crises rear their ugly heads, Bitcoin tends to take a nosedive. It’s like watching a toddler throw a tantrum—chaotic and utterly predictable. But fear not! This initial panic often fades quicker than your New Year’s resolutions as the market adjusts and those panic sellers turn into buyers. For now, Bitcoin is holding up quite well, or at least better than my last attempt at baking a soufflé. 🍰

Bitcoin has dropped from the $109,000 level, but is holding strong above $100,000, Source BNC Bitcoin Liquid Index

Geographic and Institutional Context Matters

Now, let’s talk geography. Where the war happens is crucial. Conflicts in developed markets (think Middle East, Europe, or the U.S.) hit Bitcoin harder than a bad haircut. Why? Because adoption is global but uneven, like my attempts at learning French. According to Chainalysis, developing nations like India and Nigeria are leading the crypto charge, while Western institutions are hoarding it like it’s the last slice of pizza at a party. 🍕

- Adoption is global, but uneven. Per Chainalysis, the biggest on-chain crypto use is in developing nations—India, Nigeria, Indonesia—while ownership is consolidating among Western institutions.

- Institutional exposure is new and growing fast. As of late 2024, ETFs alone held 1% of all Bitcoin, more than Satoshi himself. BlackRock, the U.S. government, and Coinbase are now major stakeholders. This means Bitcoin is no longer the rogue outsider; it’s more tightly correlated with Wall Street.

From Risk-Off to Risk-On?

In its early years, Bitcoin was like that kid in school who never got invited to parties—too niche to react to global events. But now, with ETF listings and corporate exposure, it’s strutting around like it owns the place, behaving more like a tech stock than a bunker asset. Who knew Bitcoin could be so trendy? 💃

This could be a paradigm shift. Bitcoin’s resilience in previous conflicts doesn’t guarantee future safety. If conflict escalates to include true global economic disruption—like an Iranian blockade of the Strait of Hormuz, as QCP Capital warns—then Bitcoin may no longer be immune. Yikes!

Bottom Line: Bitcoin Is Evolving

- Short-term: Bitcoin may dip at the start of a war due to panic selling, but usually recovers quickly.

- Medium-term: War-induced inflation and currency instability can benefit Bitcoin as a hedge.

- Long-term: Increasing institutionalization ties Bitcoin closer to global markets, meaning its future reactions could mirror equities more than gold.

In other words: Bitcoin isn’t a war-proof asset, but it’s proving to be more battle-hardened than skeptics give it credit for. The real question isn’t whether Bitcoin reacts to war—it’s which wars, and whose wallets are holding the keys. For a full analysis of Bitcoin’s reaction to global conflict events, head over to Coin Telegraph.

Iran’s Largest Crypto Exchange Nobitex Hacked for $90M

In a plot twist worthy of a spy novel, a suspected Israeli hacktivist group has gutted Iran’s top crypto exchange—not for money, but for a message. Talk about making a statement! 📢

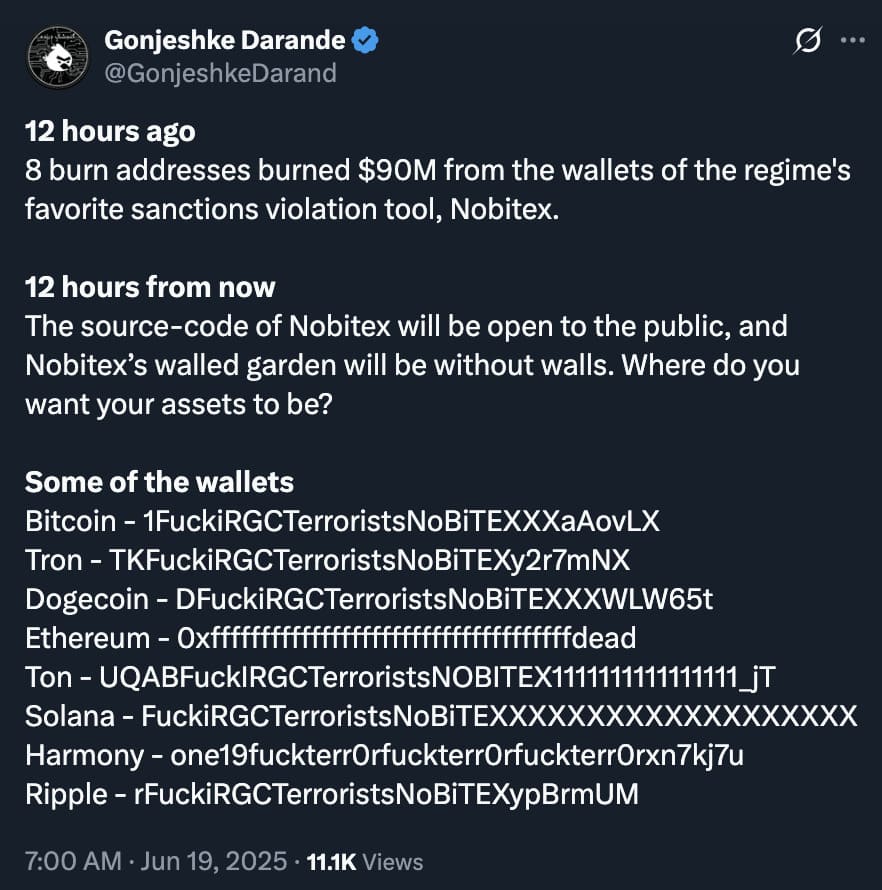

In the latest salvo of an intensifying shadow war, a politically motivated hacking group calling itself Gonjeshke Darande (aka “Predatory Sparrow”) has claimed responsibility for an audacious breach of Nobitex, Iran’s largest cryptocurrency exchange. The attackers reportedly made off with over $90 million in crypto and are threatening to publicly release Nobitex’s internal source code and sensitive network data, framing the platform as a core node in Iran’s global terror-financing apparatus. This isn’t your average crypto heist; it’s cyberwar with a blockchain twist.

What Happened?

The group first took aim at Bank Sepah, Iran’s state-owned financial giant, before moving on to Nobitex, announcing their follow-up strike in a now-deleted but widely archived post on X (Twitter):

“After Bank Sepah, it was Nobitex’s turn… In 24 hours, we’ll release its source code and internal network data. Any assets left will be at risk.”

A blistering $90M in crypto was siphoned out, according to blockchain sleuths, including ZachXBT, who first flagged suspicious outflows across Bitcoin, Dogecoin, TRX, and various Ethereum-compatible (EVM) chains. Early on-chain tracking clocked $81.7M, but later estimates raised that to over $90M, split across multiple addresses with vanity tags like:

- 1FuckiRGCTerroristsNoBiTEXXXaAovLX

- DFuckiRGCTerroristsNoBiTEXXXWLW65t

- 0xffFFfFFffFFffFfFffFFfFfFfFFFFfFfFFFFDead

Subtlety was not the objective. 😏

“Not About the Money” — A Political Burn

Unlike typical exploits, the Nobitex hack wasn’t about profit. According to a report from Elliptic, the attackers intentionally burned the funds by sending them to custom vanity addresses that are computationally infeasible to own. These aren’t just meme-laced addresses for style points—they’re mathematically unspendable. That means no one can recover the funds, including the hackers themselves. Talk about a self-sabotage! 🔥

“This wasn’t financially motivated,” Elliptic stated. “They torched the money to send a message.” This act of economic arson sends a chilling signal: “We can take you offline—and we don’t even care about your money.”

Why Nobitex?

The hacktivist group accused Nobitex of being deeply entwined with Iran’s efforts to evade sanctions, alleging the platform has become a state-endorsed tool for funneling crypto payments across borders and into proxy networks. They called Nobitex a “terror-financing tool at the heart of the regime.” Ouch! That’s a burn! 🔥

It’s a sharp escalation in an ongoing narrative where crypto meets geopolitics, and where exchanges become battlefield infrastructure.

Nobitex Responds

//bravenewcoin.com/wp-content/uploads/2025/06/response-tweet.jpg”/>

What Happens Now?

For Nobitex, the fallout could be existential. Source code leaks could expose vulnerabilities across the entire Iranian crypto ecosystem. Asset freezes or further siphoning may follow. And Iranian regulators—already walking a tightrope between embracing crypto for sanctions evasion and fearing capital flight—will likely respond with crackdowns or centralization moves.

For global crypto markets, though, the impact is muted. Nobitex serves a mostly local market, and the funds involved, while headline-worthy, are unlikely to shake institutional sentiment. But the precedent? That’s huge. Crypto infrastructure is now fair game in geopolitical warfare—and its decentralized nature offers no safe harbor. The line between hacker, activist, and state actor just blurred further. Welcome to the future, folks! 🤖

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- BTC Plummets: ETFs & Risk Aversion Send Crypto into Crisis 🚨

- Unbelievable XRP Futures Volume: What You Didn’t See Coming! 😲💰

2025-06-18 23:27