Now, picture the stage: Bitcoin, like some restless dust bowl wanderer, has kicked up dust between $86,678 and $87,105 over the past hour on this fine April 21. It’s restless, roving wide from $84,037.68 to $87,765 — a jittery outlaw staking out territory. The market cap’s sitting pretty at $1.73 trillion, with a daily hustle of $24.51 billion trading hands. Folks are squinting at the horizon, betting on a rally, but the shadows of short-term rest linger like dust clouds after a stampede.

Bitcoin

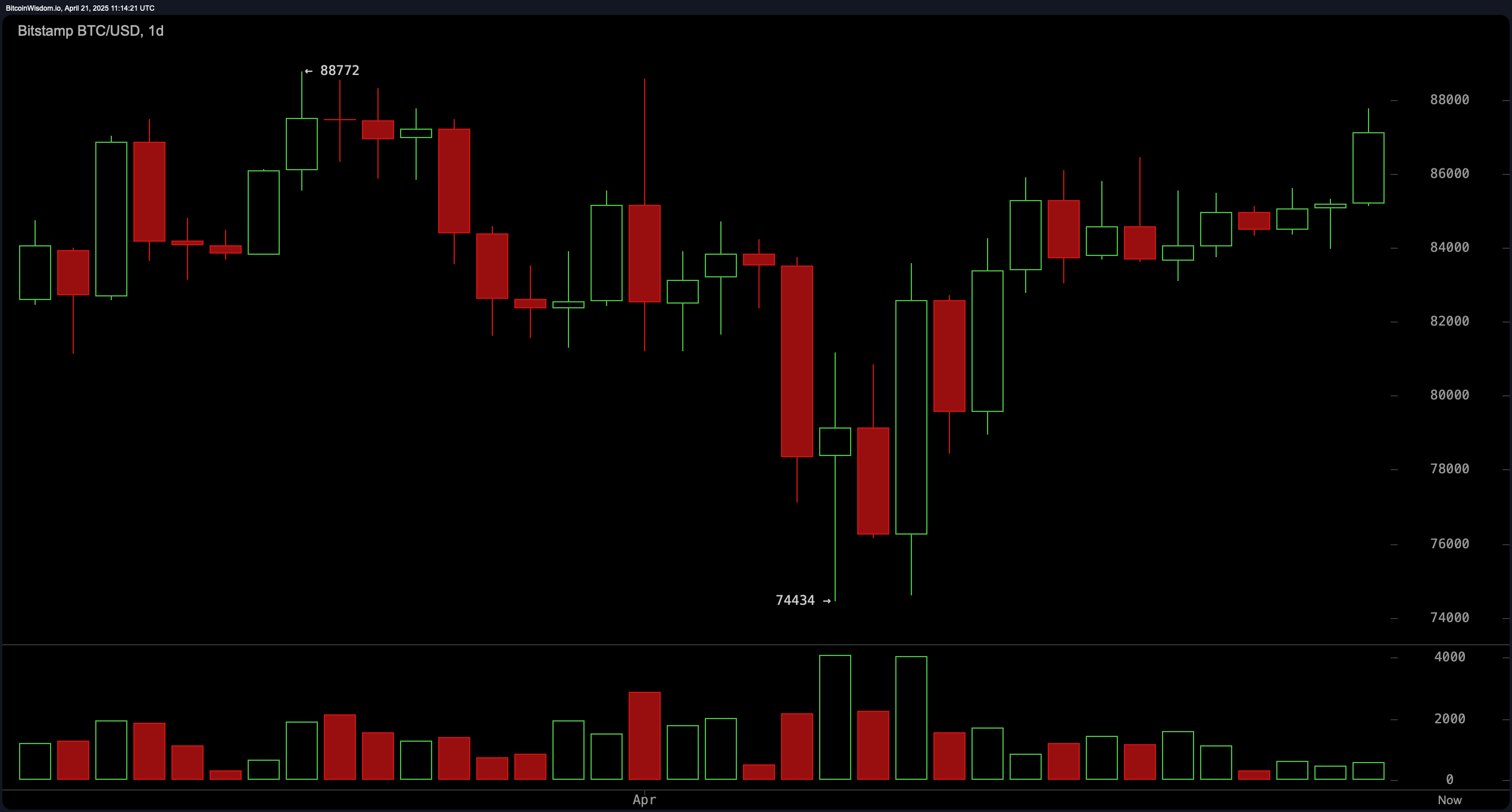

Take a glance at the daily chart — that stubborn trail of numbers showing a comeback story. Bitcoin clawed its way up from a lowly $74,434, climbing near $88,772 like a mule stubbornly making a hill climb. The surge, backed by volume swelling like a river after a rain, tells us the buyers are circling like buzzards eyeing a carcass, hungry and confident. That support at $74,400 stands firm, as reliable as a barn in a storm. But don’t get too cozy; the rising heat flirts with an overbought fever that could send this critter reeling.

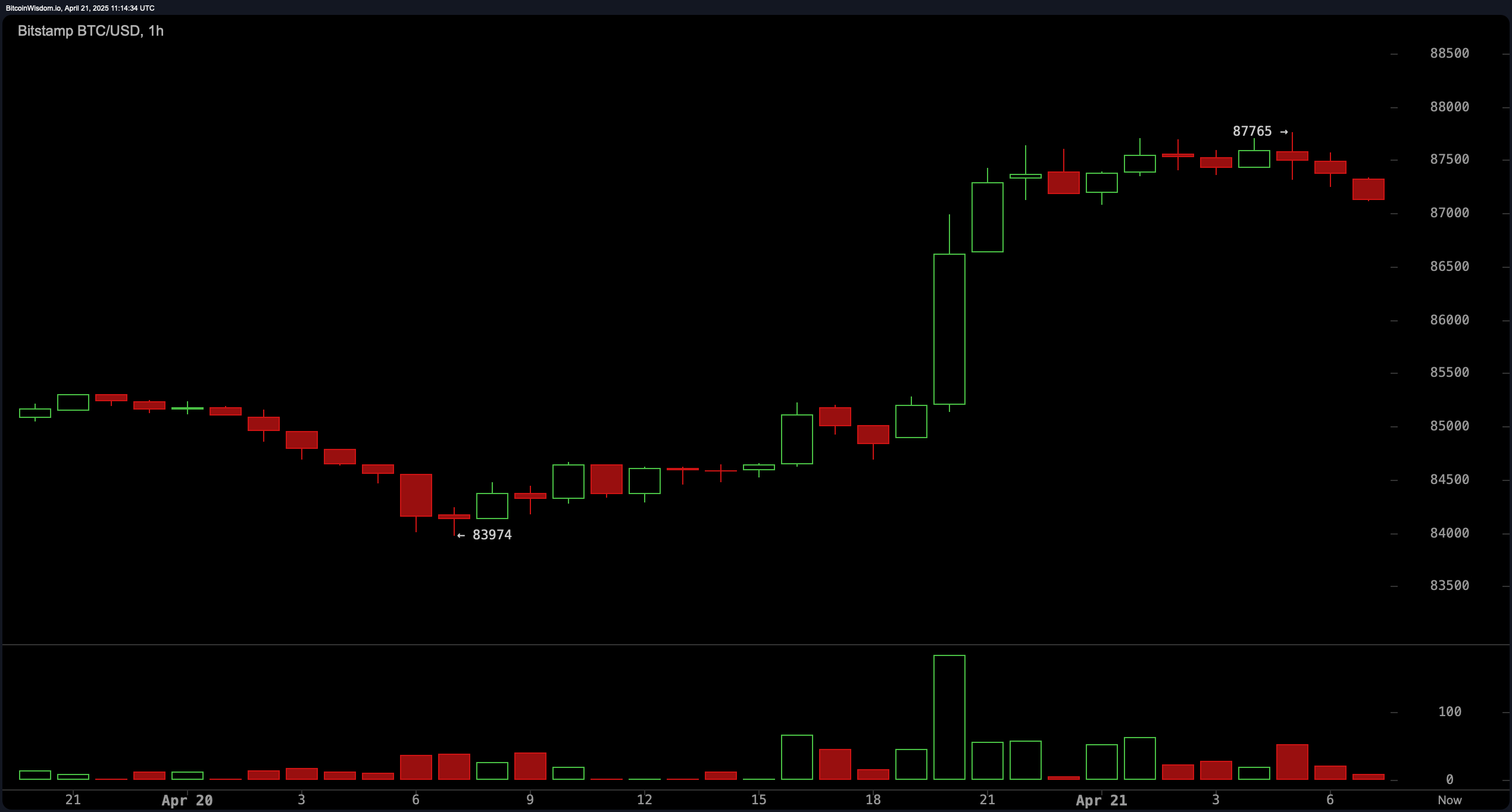

The four-hour chart tells a tale of a breakout past the dusty fence of resistance at $87,765, after bouncing belly-first off the support post at $83,100. This move, fueled by a spike in volume like a barn door flung open, spoke loud and clear of strength. But the price took a breather, pulling back just enough to whisper about a consolidation—a cowboy gathering his wits before chasing the next prize. Keep your eyes on the $86,000–$86,300 patch; that’s where the next hopefuls might ride in. Yet should the volume rise with a fall below $85,500, beware—a retreat to $84,000 might be on the cards.

On the one-hour clock, bitcoin’s recent charge to $87,765 happened with the gusto of a prospector hitting pay dirt. Big bullish candles marched up strong, but now comes the pause—the profit takers slipping in like coyotes under the moonlight, tugging prices back and testing the weak fences of short-term support. The formation of a bullish flag or pennant might be the market’s wink, promising another breakout if confirmed. Break above $87,800, and the scalpers’ dance begins. Fail to hold $86,000, and the selloff’s howl grows near.

Oscillators are behaving like town gossip—each telling a different yarn. The RSI sits right in the middle at 57, Stochastic spikes high at 91, CCI sings at 123, while ADX stays low at 14. There’s buying pressure humming via the Awesome oscillator and MACD, but the momentum indicator throws a cold bucket of water with bearish vibes. Just like a sheriff unsure whom to trust, traders ought to keep a weather eye on price structure and volume, rather than getting caught up in the chatter.

Moving averages lean toward a bullish camp, with the 10, 20, 30, and 50-period EMAs and SMAs all giving a nod upward. But wait—longer-term averages aren’t so sure. The 100-period SMA and EMA whisper doubts, and the 200 SMA joins their chorus of caution. The 200 EMA holds a stubborn bullish line, like a cantankerous old timer refusing to yield. In essence? The short and medium-term trail looks clear, but the horizon might be shrouded in resistance ahead.

Bull Verdict:

Bitcoin strides on with strong legs, bolstered by bullish price structure, volume-fueled breakouts, and mostly friendly short- and medium-term averages. Hold above $85,500–$86,000, breach back over $87,800 with volume, and the climb past $88,000 may well be on—painting a story of persistence and upward wanderlust.

Bear Verdict:

Yet every high climb risks a stumble. Bitcoin’s stretched thin, with mixed signals from oscillators murmuring for caution. Should it drop beneath $85,500 with growing sell volume, a tumble to $84,000 or lower might follow, reminding all that even dusty trails have their sinkholes. The longer-term averages cast a shadow on runaway climbs, hinting consolidation might be the only way forward.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- USD TRY PREDICTION

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Vanguard Calls Bitcoin a Digital Labubu 🧸- Will It Survive the Circus?

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- EUR UAH PREDICTION

2025-04-21 14:59