Oh, the eternal dance of the bulls and bears, where optimism waltzes with caution in the shadow of technical headwinds! 🐂🐻 Despite the chaos, the ETFs, long-term holders, and post-halving antics may yet tip the scales in favor of the bulls. 🎩💼

Market Overview: Bitcoin’s Technical Analysis – A Tragicomedy

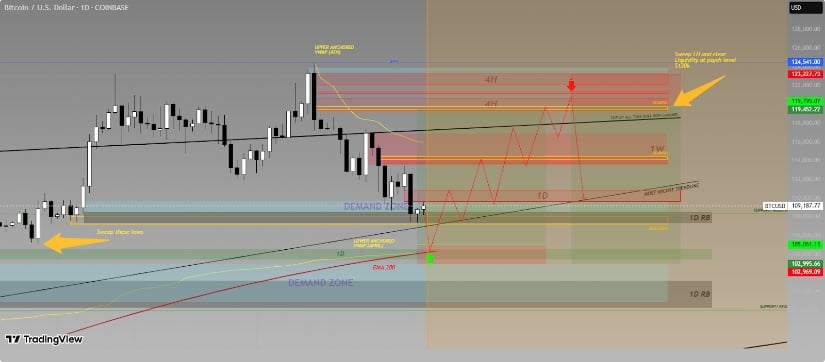

Behold, the daily chart of BTC, a tragicomedy of lower highs and lower lows, as August unfolds with all the drama of a Shakespearean tragedy! 📉 The heavy red volumes, like a relentless villain, add to the bearish chorus. A breakdown below $107k could spell disaster, as if the market itself were a fickle lover. 😢

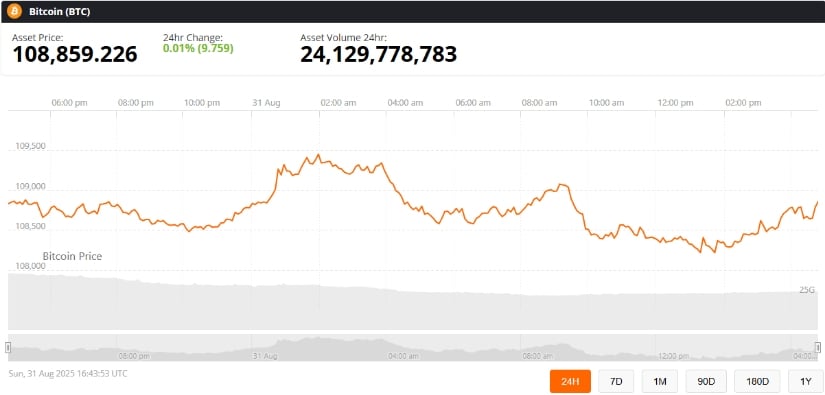

On the one-hour chart, a descending triangle forms, a classic move by the bears. Weak volume on upward moves? A sign that sellers still hold the reins. And the failure to breach $109k? A bear flag structure, ready to unravel if $107.5k falls. 🧵

Yet, the oscillators whisper of hope! RSI at 38, Stochastic at 10-oversold conditions, like a weary traveler seeking respite. The CCI at -118? A short-term bullish divergence, a flicker of light in the darkness. If these signals heed, BTC might rally toward $114k. 🌟

Halving, ETFs, and Whale Activity – The Bigger Picture

Beyond the charts, the halving of April 2024, a grand spectacle of supply tightening, while U.S. spot ETFs, the new darlings of the market, promise a future of 7% holdings. BlackRock’s IBIT, with $57B in assets, a titan among titans. 🏛️

Meanwhile, Bitcoin whales, those enigmatic figures, accumulate coins with the precision of a master thief. Long-term holders, ever the loyalists, signal their conviction. Yet, macro factors loom large-a Fed delay, global tensions, and a world on edge. 🌍

Still, the bulls persist, their hopes pinned on ETF inflows and political backing. A hedge against inflation? A savior in times of crisis? The market’s tale is as old as time, yet ever new. 🧠

Expert Insights: Bulls vs. Bears – A Tale of Two Camps

Forecasts for September 2025? A clash of titans! Standard Chartered and Bernstein, the seers of the crypto realm, foresee a $200k ascent, while the cautious ones warn of deeper corrections. A tale as old as time, with a twist of volatility. 🕰️

Charting Guy, the voice of reason, warns that failure to reclaim $95k could extend the bearish phase. Longforecast models predict a dismal $104k, with risks of sliding to $90k. Meanwhile, CoinCodex, the algorithmic oracle, calls for a modest $116k. A balanced outcome? Or a mirage? 🌀

The Road Ahead: BTC’s Next Move – A High-Stakes Gamble

With Bitcoin hovering above key support, the coming weeks may decide if the oversold signals are a prelude to recovery or a prelude to more despair. A daily close above $114k? A bullish reversal, or a fleeting illusion? 🕊️

Consolidation between $105k and $115k? A temporary truce, with ETFs and whales as the peacekeepers. Yet, volatility remains the king of the jungle, and investors must tread carefully. 🐆

As always, the market’s drama unfolds, a tale of greed, fear, and endless speculation. Stay tuned, for the curtain has yet to fall. 🎭

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- The Hilarious Collapse of Floki: Can It Bounce Back or Just Keep Drooling?

- Brent Oil Forecast

- Why Bitcoin Will Soon Be the Price of Your Childhood Dream and More

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin Apocalypse Imminent?! 😱

2025-08-31 23:59