Ah, the dance of the digital ruble! Bitcoin (BTC), that elusive phantom of the financial world, has once again stirred the hearts of the speculators. On a Thursday as gray as a proletariat’s overcoat, the derivatives markets awoke from their slumber, stretching their limbs like a factory worker after a 12-hour shift. Futures and options open interest (OI) climbed higher, as if the very air were thick with the scent of profit. BTC, that capricious comrade, hovered around $121,280, its price as steady as a bureaucrat’s promises-yet, for how long? 🤑

BTC Options Whisper Sweet Bullish Nothings: 59.57% Calls vs 40.43% Puts 😏

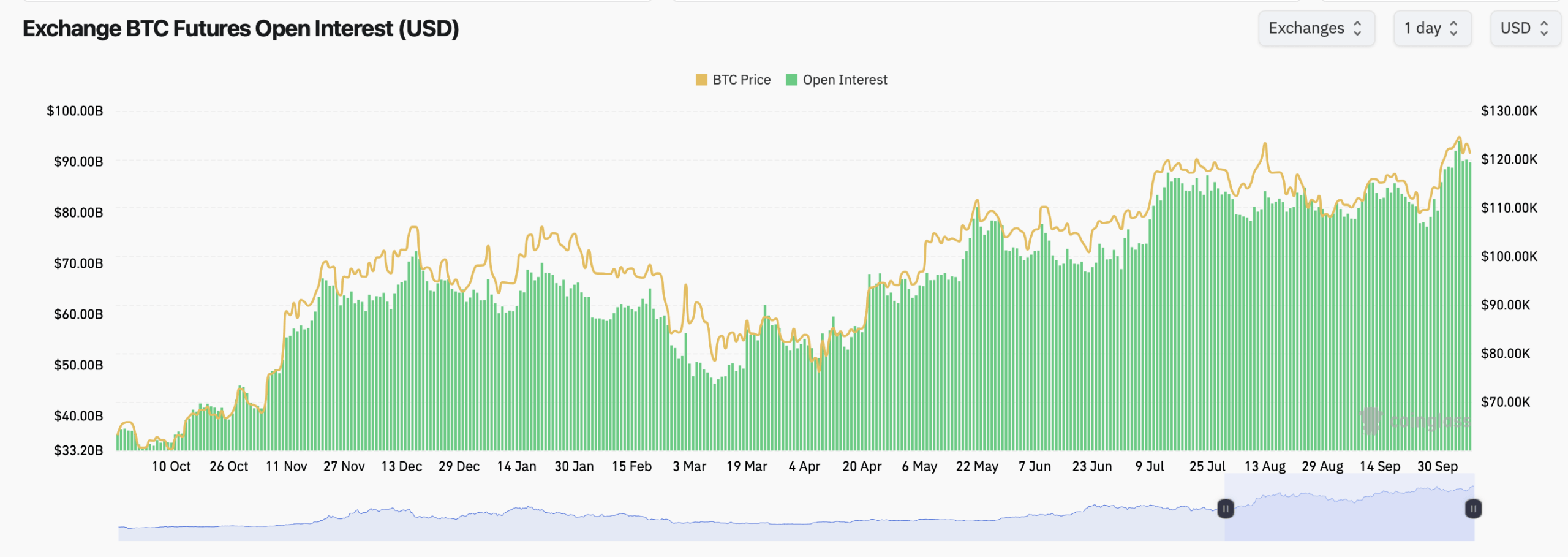

From the halls of Coinglass, where numbers are crunched with the fervor of a revolutionary pamphlet, comes the news: total BTC futures open interest has ballooned to a staggering $100 billion. Leverage, that double-edged sword, is wielded with abandon, and the institutions, those titans of the financial world, are positioning themselves like chess masters. Or perhaps, like fools rushing in where angels fear to tread? 🤔

The CME exchange, that bastion of the establishment, leads the charge with 149.94K BTC in OI ($18.17B), clutching over 20% of the market share like a miser hoarding gold. Binance, the scrappy upstart, trails close behind with 131.83K BTC ($15.99B), its OI swelling by 1.74% in 24 hours-a testament to the retail traders, those eternal optimists, pouring in like lemmings to a cliff. Or perhaps, like heroes to a cause? 🦸♂️

Elsewhere, the exchanges paint a picture of uneven fortunes. OKX and Bybit, those once-proud warriors, saw their OI shrink by 0.85% and 1.23%, respectively-a retreat as quiet as a defeated army. But WhiteBIT, that dark horse, surged ahead with a 2.66% growth, its traders as relentless as a Gorky protagonist. Or perhaps, as delusional? 🤪

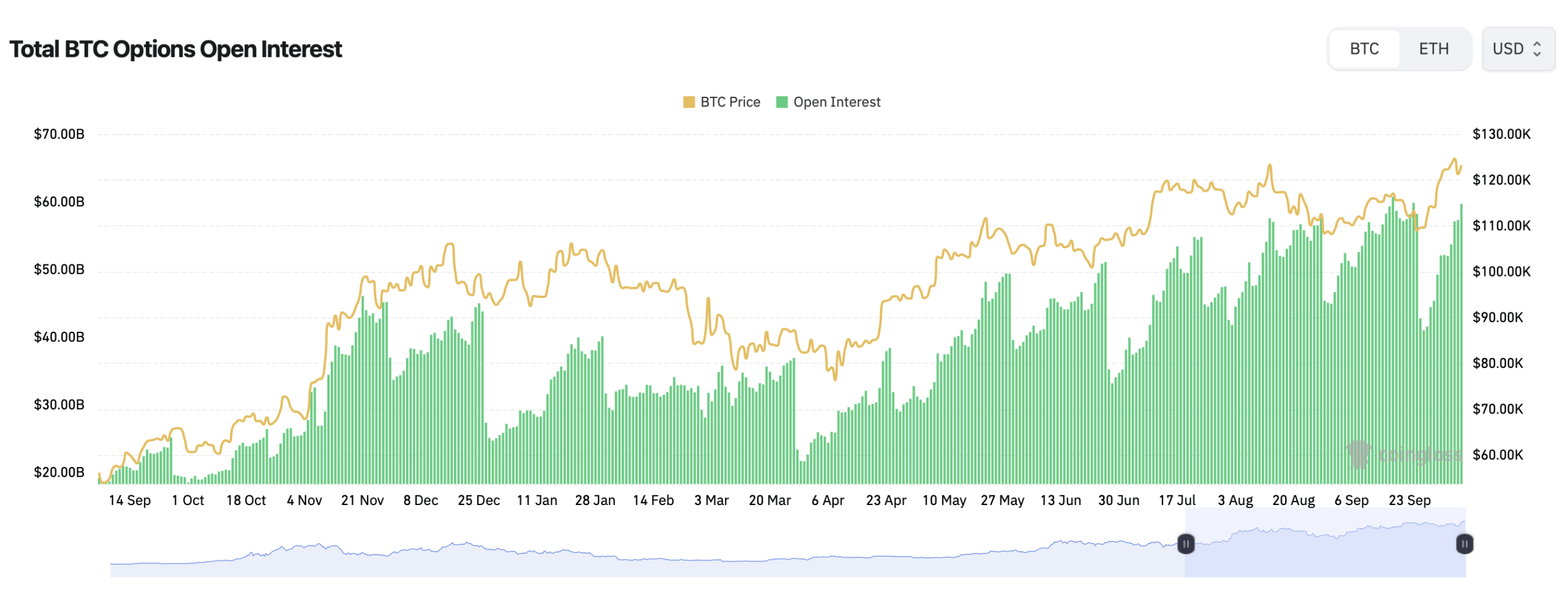

On the options front, Deribit reveals a bullish tilt so pronounced it could make a bear blush. Calls dominate with 59.57% of total open interest (264,371 BTC), while puts trail behind at 40.43% (179,430 BTC). In trading volume, calls lead with 55.47% (32,398 BTC), leaving puts in the dust with 44.53% (26,009 BTC). The message is clear: traders are betting on Bitcoin’s ascent, as if it were the second coming of the proletariat revolution. Or perhaps, a mirage in the desert of finance? 🌵

The largest open interest clusters around long-term call options, those contracts that bet on Bitcoin’s price rising by late 2025. Strikes at $140,000, $200,000, and $120,000 for December 2025 calls suggest traders are as optimistic as a socialist at a May Day parade. Or perhaps, as naive as a child believing in Santa Claus? 🎅

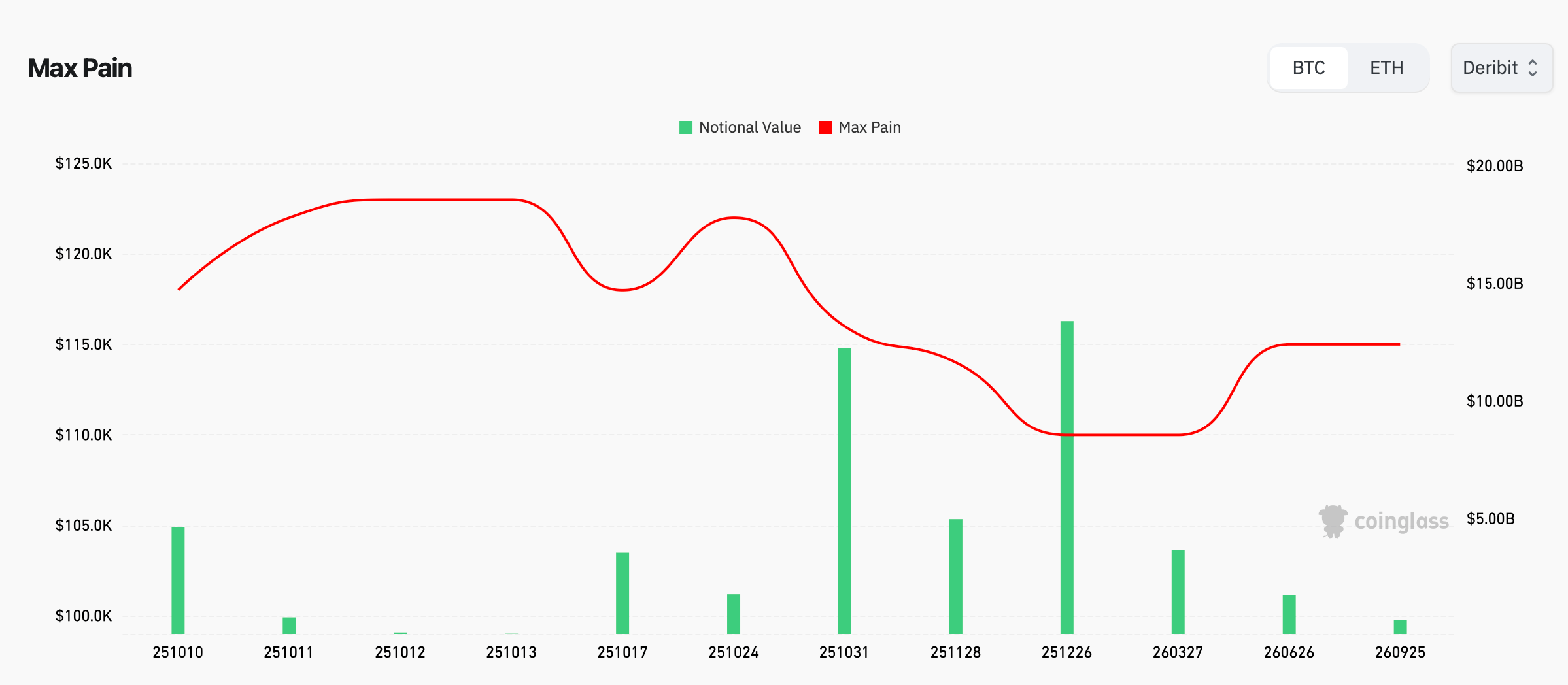

Meanwhile, the max pain point, that grim reaper of options trading, lurks near $120,000-a gravitational pull as inevitable as the march of time. Or perhaps, as cruel as a capitalist’s heart? 💔

Market analysts, those modern-day soothsayers, note that rising open interest coupled with stable prices often signals accumulation or hedging-the quiet before the storm. Or perhaps, the calm before the collapse? With both futures and options markets heating up, BTC derivatives remain the barometer of institutional sentiment, as reliable as a weathervane in a hurricane. 🌪️

💡 FAQ

What is Bitcoin open interest (OI)?

Open interest measures the total number of active derivative contracts, a thermometer of market fever. Or perhaps, a mirror reflecting the madness of crowds? 🌡️

Why is CME’s dominance significant?

CME’s lead points to institutional engagement, as it primarily serves professional and regulated traders. Or perhaps, the wolves in sheep’s clothing? 🐺

What does “max pain” mean in options trading?

It’s the price at which most option holders lose money at expiration-a financial guillotine. Or perhaps, the universe’s way of saying, “You should have known better.” ⚰️

Are BTC options traders bullish or bearish?

Current data shows a slight bullish bias, with more call options held than puts. Or perhaps, a collective leap of faith off a financial cliff? 🦅

How does rising OI affect BTC price movement?

Higher OI can amplify volatility, especially when traders unwind leveraged positions during rapid price swings. Or perhaps, the financial equivalent of a soap opera-dramatic, unpredictable, and utterly addictive. 🎭

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- GBP JPY PREDICTION

- The Bizarre Tale of a Pi Youtuber’s Million-Dollar Misadventure 🚀💸

- XRP’s 30% Surge? Don’t Bet Your Farm! 💸📉

2025-10-10 00:39