Ah, Bitcoin, the fickle mistress of the digital realm, continues her tempestuous dance beneath the shadows of resistance, as if the very gods of finance had conspired to keep her in chains. The market, that ever-whimsical jester, attempts to steady itself after a sell-off so prolonged, one might mistake it for a Russian winter. Yet, the asset lingers within the embrace of the bullish order-flow zone, a mere illusion of hope in a sea of bearish despair. Reclaims, they say, are necessary-but who among us dares to predict the whims of this capricious beast? 🌪️

Technical Analysis

By Shayan, the soothsayer of charts

The Daily Chart

Behold, Bitcoin has retraced its steps like a drunken poet, stumbling back toward the bullish order-flow zone after failing to reclaim its lofty throne. The death-cross, that harbinger of doom, has materialized between the 100-day and 200-day moving averages, confirming a shift toward sustained bearish momentum. Unless the price breaches the $100K-$104K region, we are but spectators to a tragedy in the making. 🦴

The latest wick toward $80K reveals a harvest of liquidity beneath the prior macro low, as buyers, those desperate souls, reacted with the fervor of a man clutching at straws. Yet, this recovery is but a corrective bounce, a fleeting moment of grace in a broader downtrend. As long as the market trades below the $92K-$96K supply cluster, we are but fools in a game of financial roulette. 🎭

Should the buyers, in a fit of madness, establish stability above the $96K pivot, a mid-range retest of $100K-$104K becomes possible. But failure, that ever-present specter, leaves the door ajar for another plunge into the abyss, toward the $80K-$83K accumulation band. Oh, the drama! 🎬

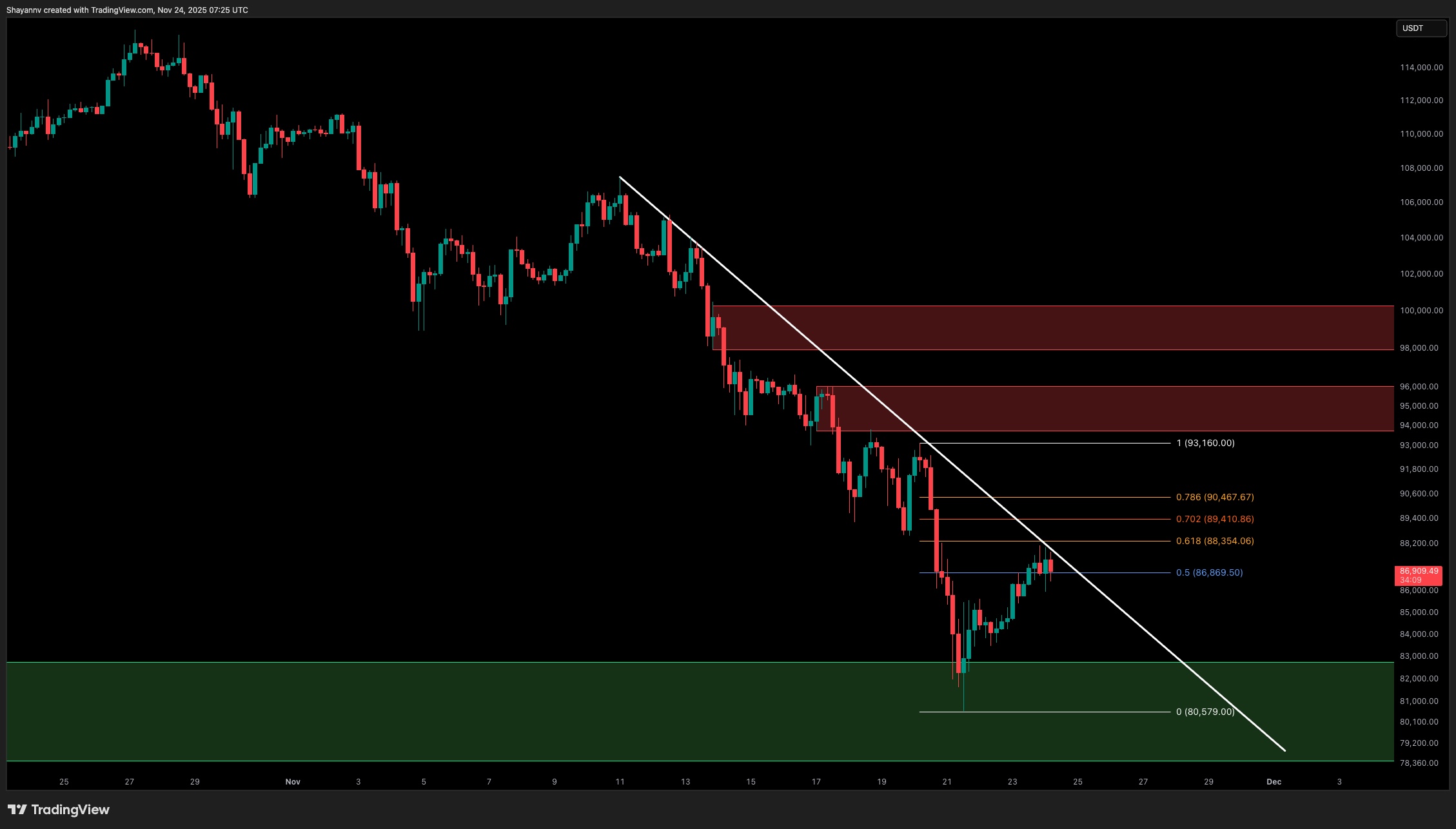

The 4-Hour Chart

The short-term structure, a labyrinth of despair, remains aligned to the downside, with the price respecting the descending trendline as if it were a sacred decree. Each rally, a fleeting dream, is shut down at lower supply levels. The most recent pullback stalled precisely at the 0.5-0.618 Fibonacci pocket, a testament to the compression against the trendline. Until this line is reclaimed, the upside remains as limited as a bureaucrat’s imagination. 🧱

A confirmed break above $90K-$92K would signal a rotation of momentum, opening a path toward the $96K-$98K inefficiency zone. But rejection, that cruel mistress, would send the asset back into the $83K-$86K support range, where the next volatility cluster awaits. Oh, the irony! 🤡

On-chain Analysis

By Shayan, the oracle of on-chain wisdom

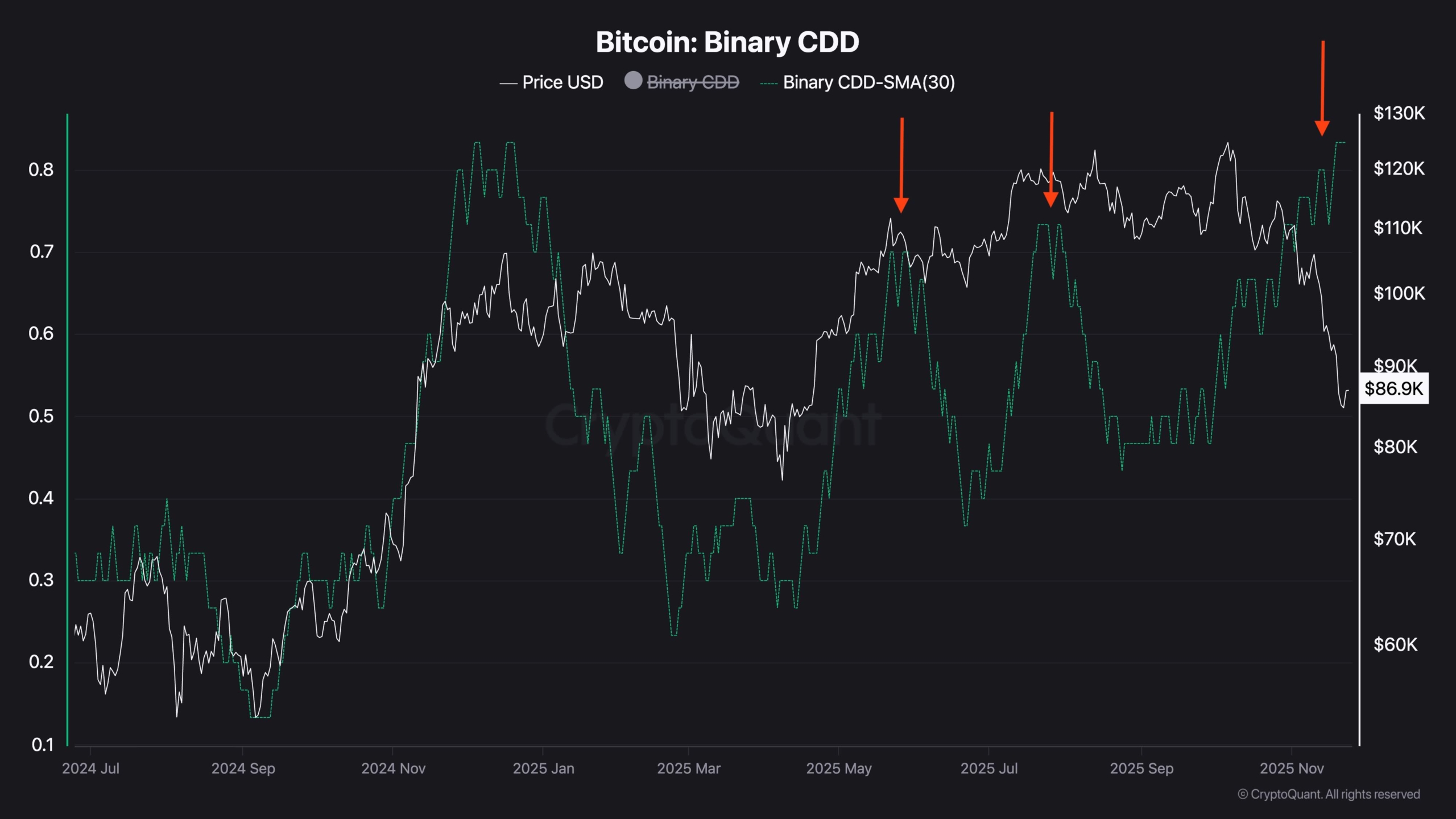

Bitcoin’s Binary CDD reveals a behavioral shift among long-term, smart-money holders, those cunning foxes who offload BTC into strength while retail investors dance to the tune of greed. Three upward spikes, like the strokes of a master painter, align with cycle highs, confirming that dormant supply was reactivated at premium prices. A classic hallmark of distribution phases, you say? But of course! 🦊

Short-term holders, those poor souls, have been capitulating aggressively. SOPR metrics show weeks of selling at losses, producing a deep capitulation band below 1.0. This combination-smart-money distribution at the top and reactive selling at the bottom-typically marks the later stages of a correction, not the early ones. Yet, the market, ever the trickster, may be transitioning into an accumulation phase. Sustained defense of the $80K-$83K realized-demand area would reinforce this scenario, but a breakdown below that region would signal the final washout. 🧼

In the end, Bitcoin remains a riddle wrapped in an enigma, a financial odyssey for the brave and the foolish alike. Will it soar to $80K or plummet into oblivion? Only time, that relentless march forward, will tell. 🕰️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Robinhood Wants Europeans to Trade US Stocks on Blockchain—What Could Possibly Go Wrong? 🤔

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-11-24 18:02