Markets

What on Earth is Happening? 🤯

- Bitcoin took a nosedive below $85,000, marking its most dramatic monthly plunge since the crypto apocalypse of 2022. 🌋

- Ether, Solana, and their crypto buddies followed suit, with liquidations hitting a whopping $2 billion. That’s a lot of avocado toasts gone wrong. 🥑💔

- Global markets are throwing a tantrum, and retail investors are running for the hills. 🏃♂️💨

Well, strap in, folks, because Bitcoin decided November was the perfect month to channel its inner rollercoaster. On Friday, it plummeted below $85,000 for the first time since April, thanks to a delightful mix of leveraged liquidations and sentiment that’s about as stable as a house of cards in a wind tunnel. 🌪️

BTC flirted with $81,600 before settling near $84,000, effectively erasing its year-to-date gains. Remember January’s ETF boom? Yeah, that’s ancient history now. 📉

The carnage didn’t stop there. Ether dropped below $2,750, shedding nearly 14% in a week. Solana took a 10% nosedive in 24 hours, and XRP, BNB, and Cardano all joined the pity party with declines between 8-15%. Small-cap coins? Let’s just say they’re having a worse time than a cat in a room full of rocking chairs. 🐱⚰️

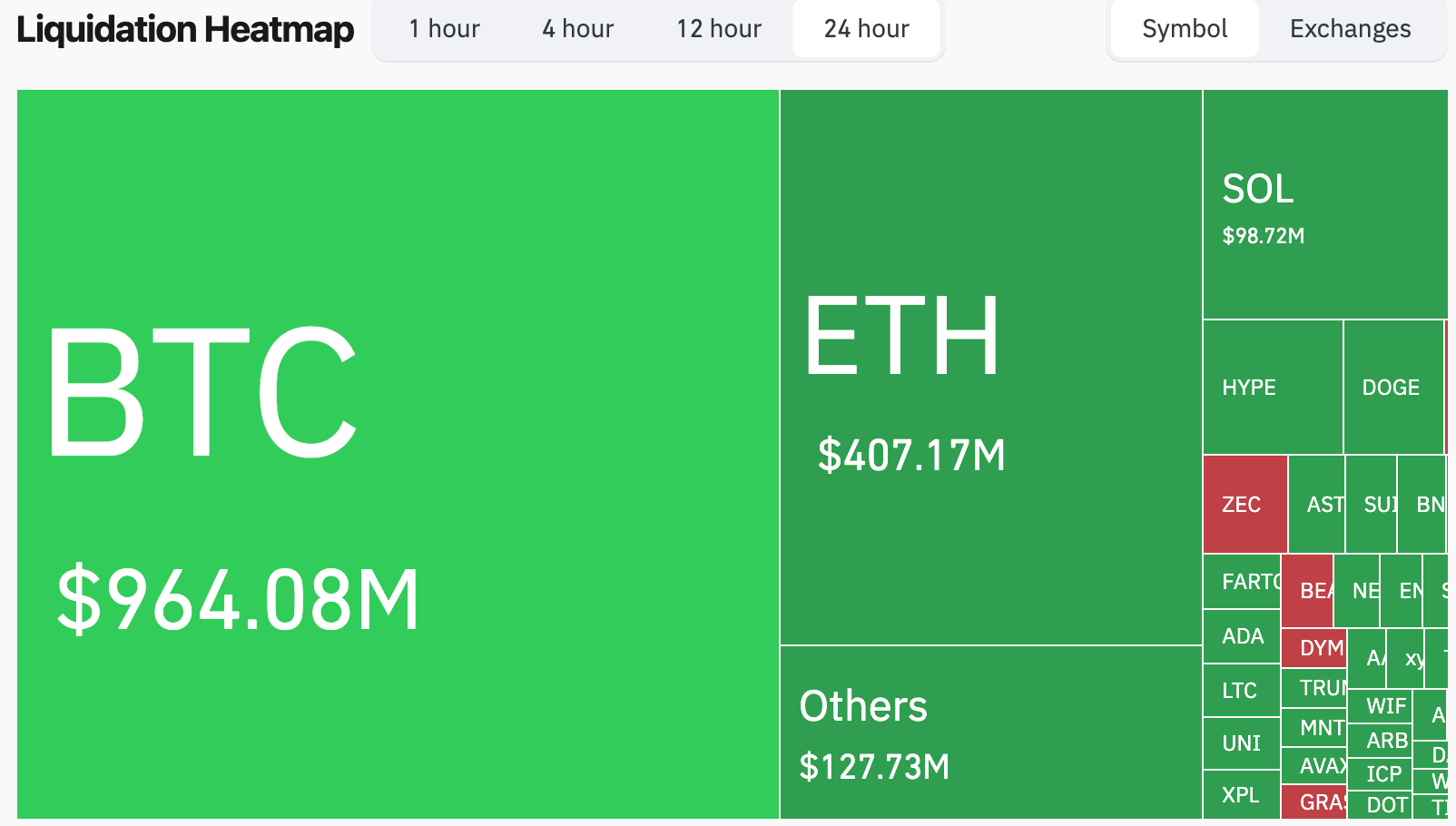

The sell-off coincided with nearly $2 billion in liquidations in 24 hours, according to CoinGlass. Bitcoin led the charge with $964 million, followed by Ether’s $407 million. Altcoins? They’re basically playing musical chairs without any chairs left. 🎶💥

Roughly 396,000 traders got liquidated, with the biggest wipeout being a $36.7 million BTC position on Hyperliquid. Ouch. That’s gotta hurt more than stepping on a Lego barefoot. 🧱🩸

Meanwhile, the rest of the financial world isn’t exactly throwing a parade. Global stocks had their worst week in seven months, thanks to AI-driven valuations looking shakier than a three-legged table. The Federal Reserve’s December rate-cut odds? Not helping. 🪑💔

The MSCI All Country World Index dropped over 3%, and U.S. tech shares are feeling the heat. Treasuries, however, are having a field day as investors flee risk like it’s a zombie apocalypse. 🧟♂️💼

Crypto-specific flows are in freefall. U.S.-listed Bitcoin ETFs saw $900 million in net outflows on Thursday, their second-worst day since launching in 2024. Open interest in perpetual futures has plummeted 35% since October’s peak, leaving liquidity thinner than a dieter’s wallet. 💸🚫

Retail sentiment? Let’s just say the Crypto Fear & Greed Index hit 11 on Monday, firmly in “extreme fear” territory. The last time it was this bad was late 2022. Historically, this precedes a major swing low, but with prices breaking support and institutional flows reversing, the market’s stability is about as reliable as a weather forecast in Britain. ☔🇬🇧

Read More

- Gold Rate Forecast

- XRP: The Calm Before the Storm?

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Silver Rate Forecast

- USD HUF PREDICTION

- Doge Doomed?! 😱🐳

2025-11-21 12:21