Ah, the great American shutdown circus! 🎪 The only thing still running? Friday’s consumer price index (CPI), of course! Because even when the government’s asleep at the wheel, numbers must march on. 🧮

Bitcoin Soars to $111K on Inflation’s Slippery Slide 🛷💸

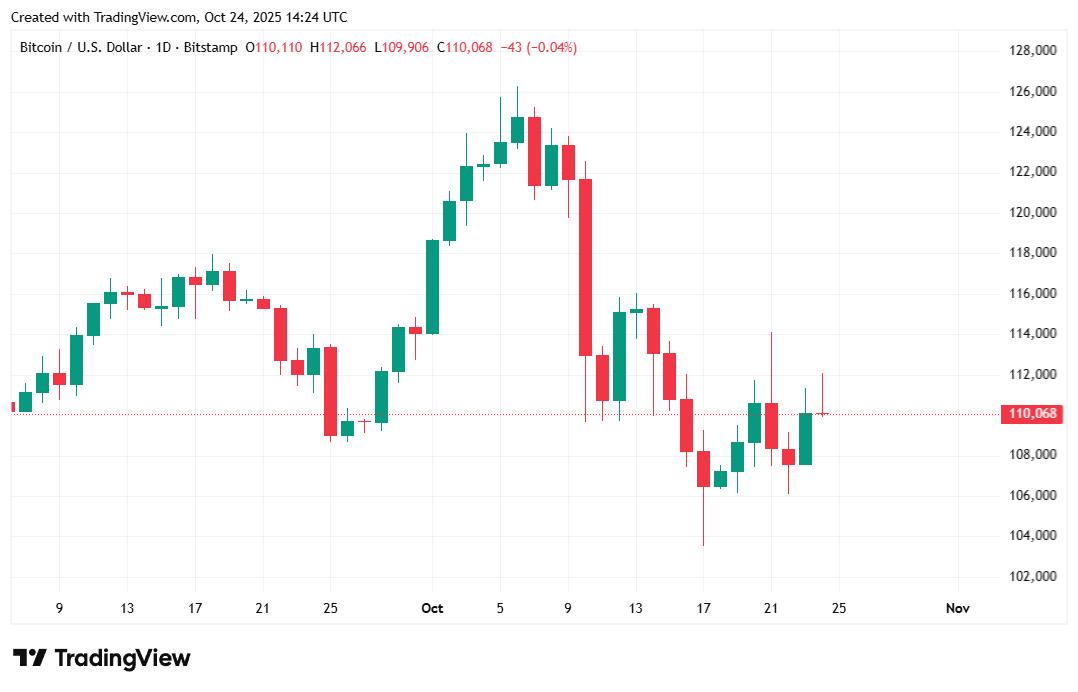

Imagine the economists’ faces when the CPI report waltzed in, all cool and collected, like a cucumber at a tea party. 🥒 The U.S. Bureau of Labor Statistics (BLS) dropped the news Friday morning, and the markets did a happy dance. 🎉 Why? Because inflation took a nap, and the Federal Reserve’s rate-cut dreams got a shot of espresso. ☕️ Bitcoin leaped past $111K faster than a kid chasing an ice cream truck, up 2.27% before settling back to $110K. Because, you know, even rockets need a breather. 🚀

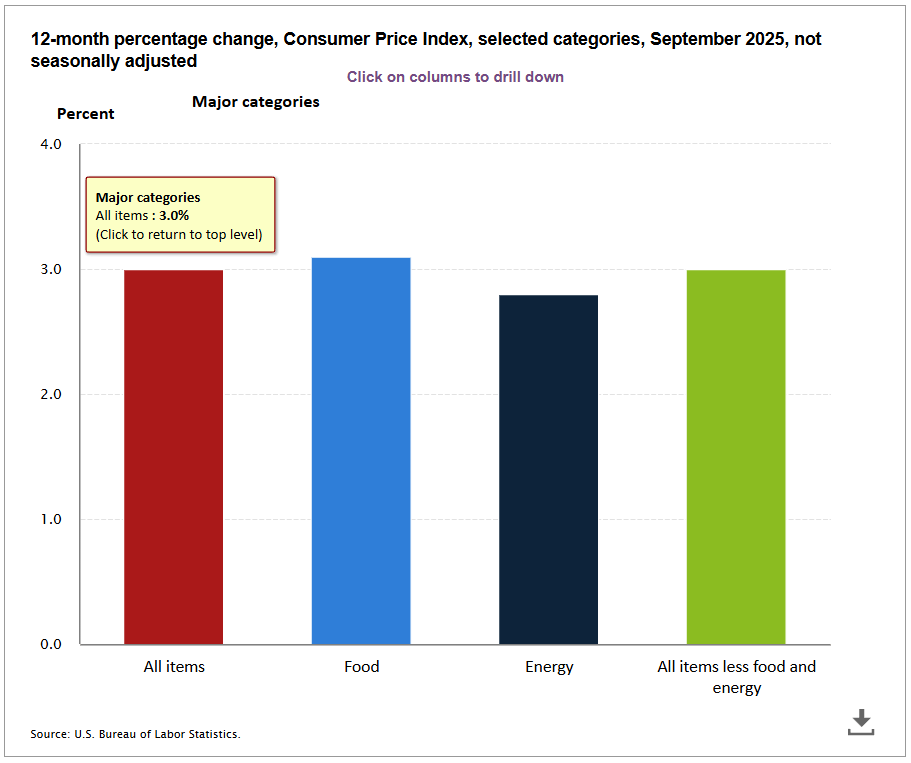

September’s CPI? A mere 0.3% increase, nudging the annual inflation rate to 3%. Experts were expecting a 0.4% jump, but nope! Inflation said, “Not today, Satan.” 😈 Core inflation, the snooty cousin that ignores food and energy, also played nice at 0.2%, landing at 3% annually. Economists’ predictions? Slightly higher, of course. Because who doesn’t love being wrong? 🤷♂️

Meanwhile, the U.S. government shutdown is still going strong, entering its 24th day. 🎉 But hey, the CPI got a special pass, originally scheduled for October 15. The Fed’s got its eyes glued to this report for next week’s rate decision. Spoiler alert: they’re probably cutting rates. The CME Fed Tool says there’s a 96.7% chance. 🧙♂️ Crypto and stocks are partying like it’s 1999, with crypto up 1.74% and all major indices in the green. 🤑

But wait! Not everyone’s sipping the Kool-Aid. Some are side-eyeing the CPI data like it’s a dodgy magician. 🪄 Gold investor Peter Schiff, the eternal skeptic, writes, “Even the CPI, which downplays inflation like a politician on a campaign trail, shows a 3% YoY rise in Sept., 50% above the Fed’s 2% target. And yet, the Fed’s cutting rates? That’s like throwing gasoline on a barbecue you already lit.” 🔥

Market Metrics: The Numbers Don’t Lie (But They Do Giggle)

Bitcoin was strutting its stuff at $110,083, up 0.69% for the day and 4.57% for the week, according to Coinmarketcap. Its price swung from $108,802.83 to $111,842.53, because why not? 🎢

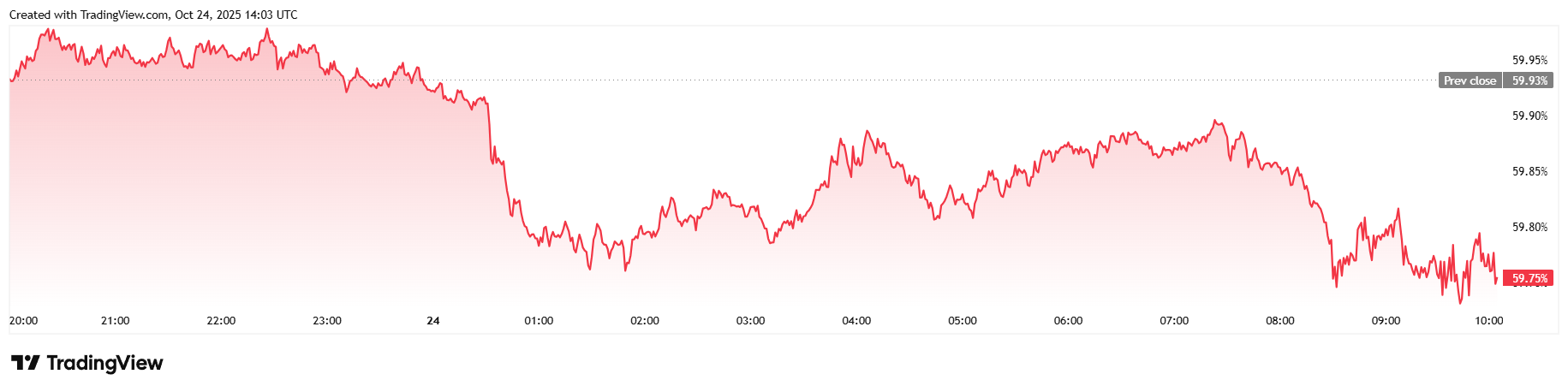

Trading volume took a nap, down 22.59% to $53.07 billion, but market cap said, “Not today!” and rose 1.07% to $2.2 trillion. Bitcoin dominance slipped 0.29% to 59.75%, because even kings need a day off. 👑

Futures contracts? Up 2.92% to $71.50 billion, thanks to Coinglass. Liquidations stayed steady at $66.05 million, with short sellers losing $49.81 million and long investors shedding $16.24 million. Ouch. 😬

FAQ ⚡

- Why did Bitcoin zoom past $111K?

Inflation took a chill pill, and the Fed’s rate-cut dreams got a green light. 🚦 - What’s the CPI report saying?

September CPI rose 0.3%, putting annual inflation at 3%, below the crystal ball predictions. 🔮 - How are markets reacting?

Crypto and stocks are throwing a party, with Bitcoin up over 2% and the crypto market gaining 2.16%. 🎈 - What’s next?

With a 96.7% chance of a rate cut, traders think Bitcoin’s gonna keep flexing as monetary policy loosens. 💪

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Dogecoin’s Wild Ride: Will It Bark or Bite? 🐶💰

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Bitcoin’s Bouncy Castle? 🚀

2025-10-24 18:49