Ah, the divine comedy of Bitcoin! 🌟 On-chain data, that most gossipy of narrators, whispers that the grandees who purchased near the celestial peak of Bitcoin’s price are, quite astonishingly, choosing to cling to their digital treasures even as the market takes a most ungraceful tumble. How utterly… *resolute* of them! 💎

The Cost Basis Distribution: A Ballet of Greed and Fear

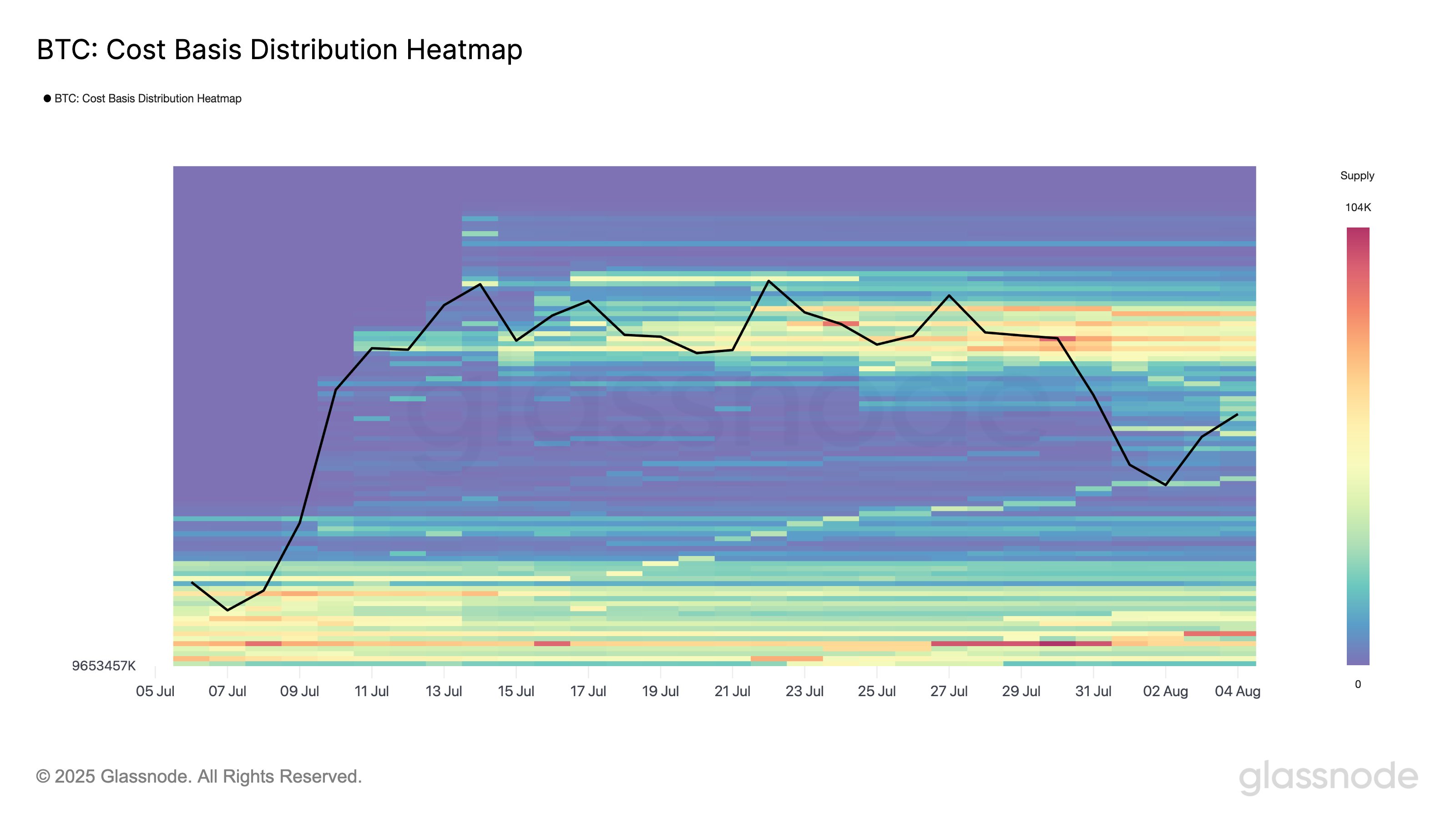

In a recent epistle on the ever-chattering platform X, the on-chain oracle Glassnode has deigned to enlighten us about the latest pas de deux in Bitcoin’s Cost Basis Distribution Heatmap. This, my dear reader, is a map of financial folly, revealing at which price points the hoi polloi acquired their precious coins. In the arcane world of on-chain analysis, this is considered a matter of grave importance, for investor behavior, like a melodramatic actor, becomes most pronounced when the cryptocurrency dares to flirt with its acquisition price. 🎭

When the market is in a state of bullish delirium, those in profit view price declines toward their cost basis as *opportunities*-a chance to “buy the dip,” as the plebeians so quaintly put it. This creates a sort of financial fortress, a support boundary that even the most bearish of bears might hesitate to breach. Conversely, those poor souls in the red eagerly await a retest of their acquisition price, desperate to exit the stage with their dignity (and capital) intact. Their selling, alas, provides resistance-a tragicomic obstacle to the asset’s ascent. 🛡️

Behold, the chart shared by Glassnode, a masterpiece of financial abstraction, illustrating the trend in Bitcoin’s Cost Basis Distribution Heatmap over the past month:

Observe, if you will, the “airgap” that has formed-a void born of Bitcoin’s frenzied sprint toward its new all-time high. Such gaps emerge when the cryptocurrency moves with such reckless abandon that supply cannot change hands, leaving behind a barren landscape devoid of dense cost basis centers. This airgap, my friends, is a “free for all,” a Wild West of investor behavior where no support or resistance dares to tread. Yet. 🌪️

From this chart, it is abundantly clear that as Bitcoin consolidated, supply gradually coalesced at levels above $116,000. Below this mark, however, the landscape remains as desolate as a Wildean drawing room, with supply thinning out up to $109,000. With the latest plunge, Bitcoin is at last venturing into this uncharted territory, and lo! Supply is being filled in. Could this be a sign that investors are seizing the moment to buy the dip, thereby constructing a support cluster in this range? One can only speculate. 🧐

Another morsel of intrigue from this graph is the stubborn persistence of supply with a cost basis between $118,000 and $120,000. While some have succumbed to panic selling-a most undignified display-many appear to be holding firm, their resolve as unyielding as a Victorian matron’s corset. Bravo, I suppose? 👏

The question now hangs in the air like a poorly timed witticism: How will this Bitcoin airgap evolve in the coming days? Will these top buyers continue to stand firm, or will they crumble like a house of cards in a tempest? Only time, that most merciless of critics, will tell. ⏳

BTC Price: A Tragic Hero in the Making?

At the time of this most erudite composition, Bitcoin is languishing around $114,200, down 4% in the last seven days. A tragic decline, to be sure, but one that only adds to its dramatic allure. 📉

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- AVAX Soars Again! Is the Crypto World Turning Tides? 🚀

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-08-06 00:06